-

La Quinta is spinning off a portfolio of 2014 hotels into a real estate investment trust called CorePoint; the REIT obtained a $1.035 billion mortgage from JPMorgan Chase that is being used as collateral for mortgage bonds.

June 25 -

The $470 million transaction has some features rarely seen now that the market for bridge loan securitization has been rehabilitated, including a "blind ramp" and a "blind reinvestment" period.

June 21 -

The real estate investment trust, along with co-borrower Stellar Management, obtained a $675 million mortgage from four banks; they are cashing out $113 million of equity in the process.

June 19 -

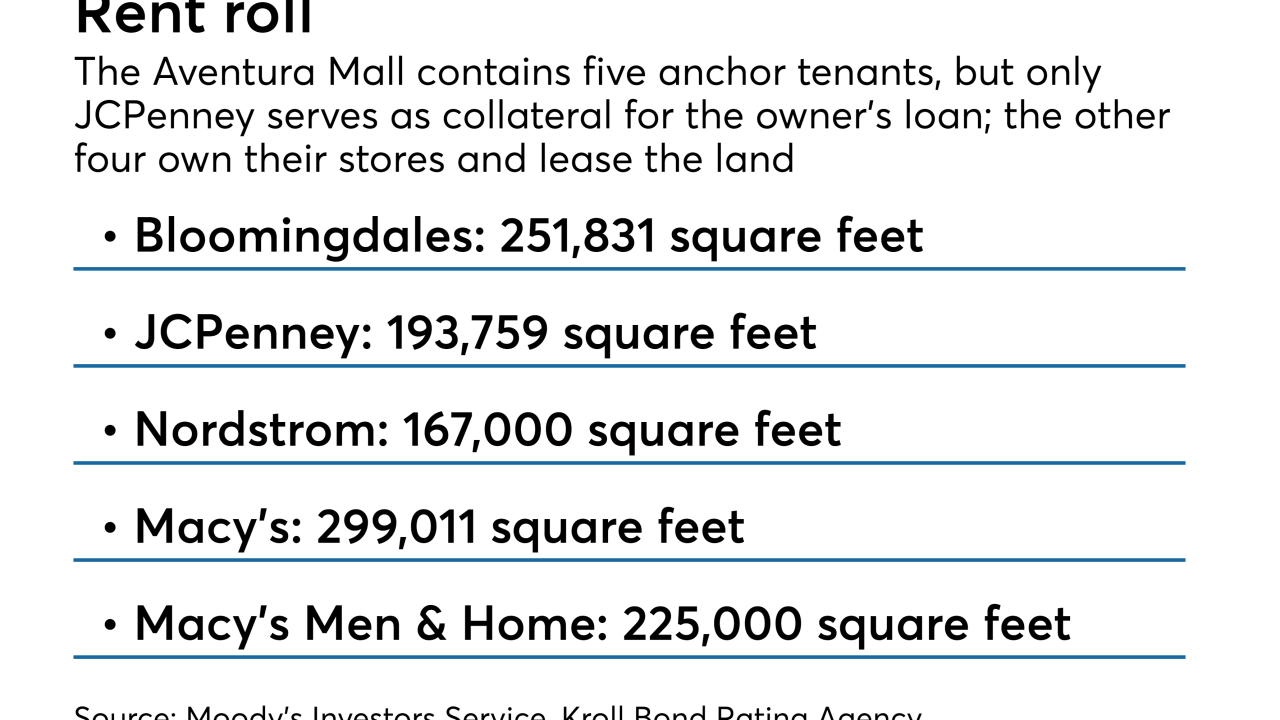

The 10-year, fixed-rate term of the $1.75 billion interest-only loan may raise some eyebrows, though the owners still have "implied equity" of $1.7 billion in the 2.2 million square foot property, per Moody's Investors Service.

June 18 -

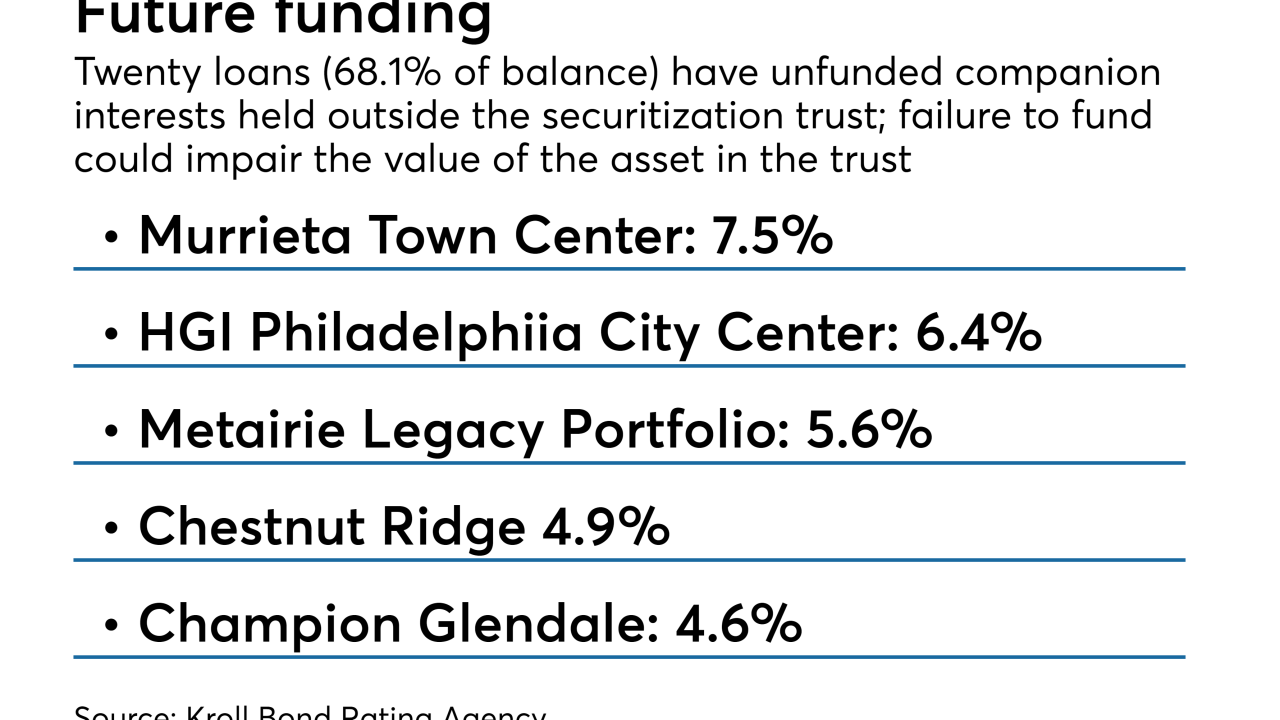

The $278.3 million RCMF 2018-FL2 also has unusually heavy exposure to apartment buildings, offices and industrial properties that are either vacant or have low occupancy levels, according to Kroll Bond Rating Agency.

June 14 -

QSuper Board, an Australian pension fund, is tapping the commercial mortgage bond market to help finance a portion of a 52-story office building on Manhattan’s Upper West Side.

June 13 -

All five – Plaza West Covina Mall (Calif.), Franklin Park Mall (Ohio), Parkway Plaza (Calif.), Capital Mall (Wash.), and Great Northern Mall (Ohio) – were built in the 1970s and have JCPenney or Sears as a major tenant.

June 7 -

Fitch Ratings, which has only rated two other CRE CLOs over the past three years, joins Moody's Investors Service and Kroll Bond Rating Agency on the $514.2 million transaction.

June 6 -

Blame the decline in the oil and gas industry; many 2014 vintage deals have exposure to a number of multifamily and hotel properties in North Dakota and Texas, according to Fitch.

June 5 -

The biggest decline was in the delinquency rates for offices and retail, but late payments on multifamily and industrial CMBS loans increased.

May 31