Exantas Capital Corp., a real estate investment trust formerly known as Resource Capital Corp., is returning to the mortgage bond market to finance a portfolio of commercial property being rehabbed or converted to a new use.

The $514.2 million Exantas Capital Corp. 2018-RSO6 looks much like the REIT’s prior commercial real estate collateralized loan obligation (CRE CLO), completed a year ago, with one exception: It carries ratings from three credit rating agencies, including two of the Big Three: Fitch Ratings and Moody’s Investors Service.

There are also six tranches of subordinate notes that will be rated by Kroll Bond Rating Agency alone and $69.4 million tranche of unrated preferred shares.

Wells Fargo Securities, Morgan Stanley and Barclays Capital are the placement agents.

Though Fitch and Moody’s are only rating the $290.6 million senior tranche of notes to be issued, having a third rating could increase demand for the deal significantly. That’s because many institutional investors are unable to purchase securities not rated by at least one, or sometimes two, of the Big Three.

To date, Fitch has only rated two other CRE CLOs, one in 2017 and one in 2015.

In most other respects, the transaction is similar to that of Exantas’ prior deals (under the Resource Capital brand). In general, the pool is secured by properties that have not completely stabilized, meaning there are risks that renovation may not be completed or that the properties may not be fully leased.

The biggest exposure is to multifamily properties (65.2%), followed by hospitality (11%) and retail (9.6%).

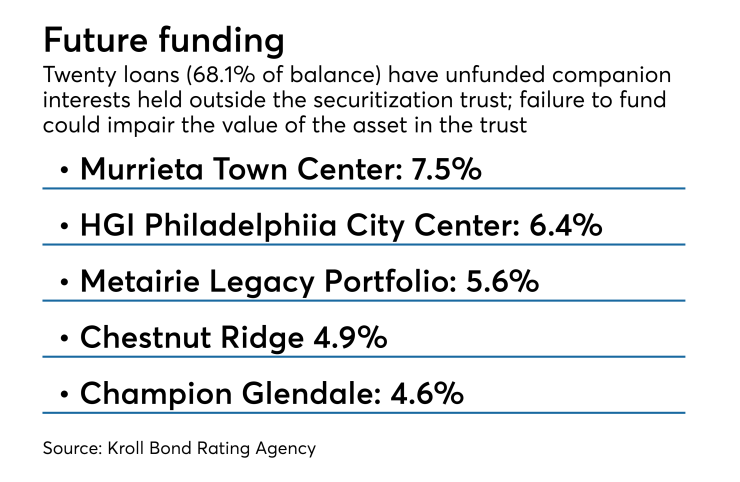

The trust has the limited ability, post closing, to acquire funded companion participations related to the initial mortgage assets up until December 2020 if the acquisition criteria are satisfied, and to sell defaulted and impaired assets to the preferred shareholder at par.

Moody’s notes in its presale report that some 7.3% of the initial balance will be held as cash for acquisition of two loans that have yet to close. However, If these assets are not acquired into the transaction within 90 days, the principal amount will be used to amortize the transaction in a modified pro rata manner, to maintain the targeted credit enhancement levels for each class.

All three rating agencies note that the deal is highly leveraged. Fitch puts the debt service coverage ratio of the collateral pool at 0.86x, which it says is is worse than the year-to-date average of 1.25x. It also puts the weighted average loan-to-value ratio (LTV) at 143.3%, which is worse than the year-to-date 2018 average of 103.8%.

Kroll puts the LTV even higher, at 129.3%, which it says is the second highest of the 14 CRE CLO transactions it has rated over the past year, which had an average of 121.7% and ranged from 112.0% to 135.0%.

Moody’s reckons the LTV is higher still, at 130.9%, though it does not compare this with recent CRE CLOs it has rated.

Among other ratings considerations, Kroll notes that there is one group of loans (5.4% of the initial balance) with affiliated borrowers that are not cross-collateralized or cross-defaulted. The three garden-style multifamily properties are within 12 miles of one another in the Phoenix area.

The associated loans are presented in the table below. The non-crossed affiliated borrower exposure in this pool compares favorably to the average (14.2%) of the comparable set, which ranged from 0.0% to 38.7%.

The risk is that if one of the loans defaults, the related borrower may be less inclined to contribute capital in order to cure the default than it might otherwise be if the loans were cross-collateralized and cross-defaulted, the presale report states. However, this type of exposure is lower than the average for deals Kroll has rated over the past year (14.2%).