Hunt Mortgage Group’s second offering of bonds backed by bridge loans on commercial property comes roughly a year after its debuted in the CRE CLO market.

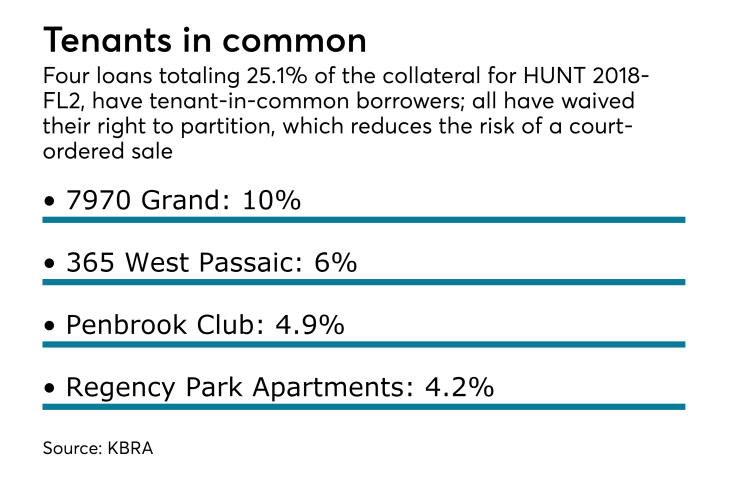

Like the first deal, the $285 million HUNT 2018-FL2 is backed primarily by multifamily properties which account for 80.1% of the initial pool balance (up from 77.8% of the previous deal).

Also like its previous deal, HUNT 0218-FL2 will not be fully ramped at closing red at closing; the sponsor has an additional180 days to put $44.7 million of proceeds to work in additional loans, subject to certain criteria. Another $15 million of proceeds will be set aside to acquire companion “participations” in loans already held in the trust during the initial 36 months of the deal.

Hunt can also acquire whole loans and other participations during the reinvestment period using principal proceeds received on the collateral assets, provided such reinvestment assets satisfy the reinvestment and eligibility criteria.

These active management features have not been included in most of the deals completed over the past year, most of which were from first-time issuers. What’s more, the eligibility criteria for new loans in Hunt’s latest deal are “more liberal” than recent deals rated by Kroll. They are also more liberal than those of Hunt’s initial CRE CLO.

Furthermore, Hunt is allowing itself to repurchase defaulted and ”credit risk assets” throughout the life of the deal. It can also exchange defaulted or credit risk assets for assets owned by itself or its affiliates, provided the exchange asset satisfies the eligibility criteria. Unlike other transactions rated by Kroll, there is no cap on the aggregate amount of credit risk assets that can be exchanged or sold for cash to the collateral manager or its affiliates during the life of the transaction.

Among other changes, Hunt has chosen a different lead placement agent for the deal, J.P. Morgan Securities instead of Wells Fargo Securities; and a different rating agency, Kroll Bond Rating Agency instead of DBRS.

The initial assets consist of 17 participations (82.4%) and three whole loans (17.6%), all of them originated by Hunt. All of the pari passu participations have a related unfunded companion participation that represents an unfunded future advance obligation under the related loan. The future advance obligations have an aggregate balance of $56.6 million as of the cutoff date and are held outside the trust by Hunt.

All of the multifamily properties that have recently undergone or are undergoing relatively “repositioning efforts” that involve either the use of loan proceeds to renovate and improve the asset in an effort to obtain higher rents (11 loans, 66%), improvements to property management/operations (one loan, 10%), or the stabilization of a recently completed student housing development (one loan, 4%).

Of the seven remaining properties (19.9%), three (14.4%) consist of office buildings with most recent occupancies ranging from 44.6% to 74.9%, which is well below their respective submarkets. “In each case, the [borrowers] are seeking to lease up the asset and obtain higher rents,” the presale report states.

The initial mortgage collateral is “highly leveraged.” According to Kroll, which puts the weighted average loan-to-value ratio at 132.5%. That’s above the average of 124.1% for of the 17 prior CRE CLOs it has rated over the past 12 months.

In its presale report, Kroll noted that Hunt’s initial transaction has yet to experience any delinquencies or losses, though this is because the sponsor identified “at least one credit risk asset” that it purchased out of the transaction at par, or face value.

Kroll expects to assign an AAA to two senior tranches of notes to be issued in the new deal; there are also five subordinate tranches with ratings ranging from AA- to B-.