-

The $155.7 million secured combo note offering is backed by the full face value of three classes of mezzanine notes plus a majority portion of the residual notes from Oaktree's first CLO of 2019.

By Glen FestMarch 21 -

The $503.3 million Madison Park XXXIV has a 133-basis-point spread for its $294.5 million Class A-1 loan tranche.

By Glen FestMarch 21 -

The boutique investment bank will retain a 45% minority stake in its former credit advisors unit, which was renamed and infused with additional capital by its new parent.

By Glen FestMarch 20 -

The refinancing also extends the reinvestment period of the $410 million Garrison BSL CLO 2016-1 by two years; the deal is non-callable for two years as well.

By Glen FestMarch 19 -

Gleysteen's return builds on a recent trend of old-school issuers revving up new CLO platforms

By Glen FestMarch 19 -

The JFSA published a final rule outlining the hoops U.S. CLO managers will have to jump through if Japanese banks are to avoid a higher risk weighting on their holdings; it remains to be seen how much of a burden this will be.

By Glen FestMarch 19 -

Approximately 68.4% of the collateral balance in Ford Credit Auto Owner Trust 2019-A derives from contracts that benefit from subsidized rates to well-qualified borrowers.

By Glen FestMarch 14 -

Dunkin' Brands plans to use note proceeds to pay down $985 million of outstanding notes from its debut deal four years ago.

By Glen FestMarch 13 -

Five EETCs totaling $3.9 billion have exposure to the type of jet involved in Sunday's crash; but there are none in lease ABS, which could benefit from higher valuations of replacement aircraft.

By Glen FestMarch 13 -

There are six tranches of AAA rated notes, including fixed-rate, some variable rate, and even a rare tranche of AAA rated loans.

By Glen FestMarch 13 -

With an expected March 20 closing, BMW's next lease securitization brings first-quarter deal volume to $6.5 billion, the highest three-month total in four years.

By Glen FestMarch 11 -

While S&P expects higher net losses to over a five-year span, Kroll believes stricter reinvestment criteria for the extended revolving period can reduce them.

By Glen FestMarch 11 -

The $1 billion DRIVE 2019-2 is backed by loans with slightly weaker credit metrics than the lender's prior deal, forcing it to increase credit enhancement.

By Glen FestMarch 7 -

Oil and gas firms have represented the largest sector concentration for Enterprise Fleet Management since 2012, but had declined slightly in the sponsor's previous transaction.

By Glen FestMarch 7 -

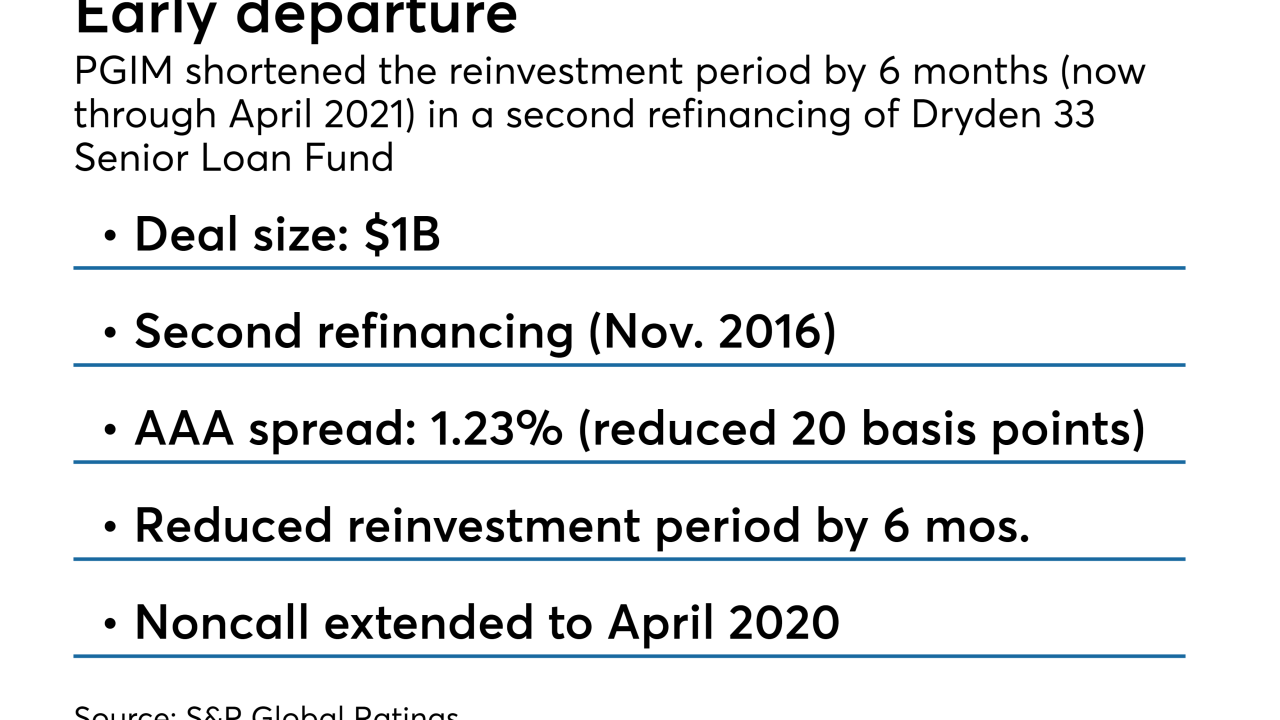

PGIM gains a 20 basis-point reduction in the AAA note coupon as it reduces the reinvestment period by six months

By Glen FestMarch 6 -

Investors appear to be willing to accept lower spreads in exchange for tying their money up for less time; CLO managers may be hoping to refinance when market conditions improve.

By Glen FestMarch 6 -

The majority of the collateral for Finsbury 2019-1 was originated over the past year, but it includes some loans from a 2016 deal that has been called; some of these older loans are delinquent.

By Glen FestMarch 6 -

After waiting a decade to return to the CLO market, AIG now has taken less than three months to issue a second deal through its new "CLO 2.0" platform.

By Glen FestMarch 5 -

Of the $300 million in proceeds, $90 million will be set aside to fund future acquisitions; the rest will repay an outstanding tranche of variable funding notes and pay a dividend to Roark Capital.

By Glen FestMarch 5 -

The $500.25 million Magnetite XXI has a three-year reinvestment period and can be called after just one year; it also priced inside most other deals that came to market in February.

By Glen FestMarch 4