BlackRock Financial Management is the ninth issuer this year to print a collateralized loan obligation at a favorable spread in an apparent exchange for limiting the deal’s shelf life.

According to a presale report from Fitch Ratings, the senior notes to be issued by the $500.25 million Magnetite XXI CLO pay 128 basis points over Libor; that's the second-tightest level of any open-market transaction in February.

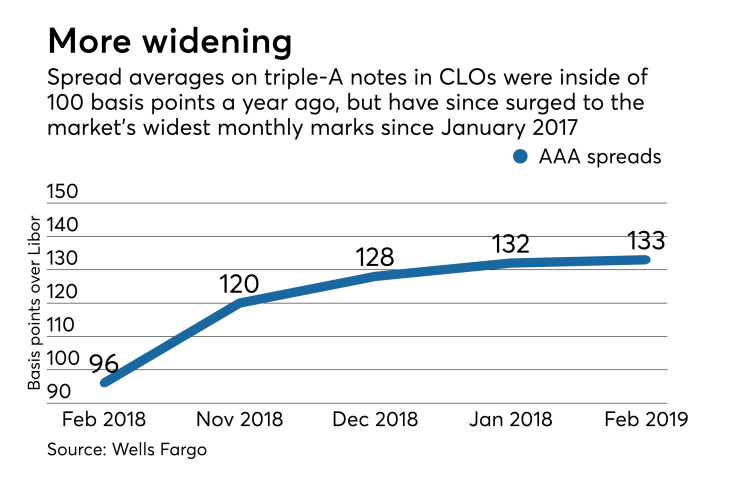

According to Wells Fargo, the average spread on the 26 deals totaling $13 billion that priced during the month was 133 basis points.

BlackRock's deal has a relatively short reinvestment period of three years and can be called after just one year - factors that likely made it more appealing to investors. CLO managers are permitted to sell and trade assets during reinvestment periods to improve the credit quality. In recent years, reinvestment periods have typically been stretched to five years under more issuer-friendly spread environments.

In addition, the weighted average life of loans held in the CLO cannot exceed seven years; by comparison the typical deal rated by Fitch since the third quarter of 2018 had maximum WAL of 8.5 years.

Offering shorter tenors is one way that CLO managers are seeking more favorable terms from investors now that floating-rate assets are no longer in such high demand. Another reason for shorter deals is that some managers, those with fewer CLOs under their belt or middling performance,

The triple-A and double-A tranches in CLOs are approximately 15 basis points wider, on average than last November; last year at this time, CLO triple-A tranches were pricing at 96 basis points over Libor.

Last month, six deals were priced with reinvestment periods of three years or shorter (including Magnetite XXI). Voya Asset Management achieved the lowest triple-A coupon at 117 basis points for a $399 million transaction via Jefferies that had only a one-year allowance for reinvestment, according to Deutsche Bank.

Other issuers with shorter deals last month had wider coupons, but were either infrequent or newer managers or broadly syndicated loan CLOs (TCW Asset Management Co., Elmwood Asset Management and middle-market specialist Golub Capital). Ellington Management Group's new deal with a two-year reinvestment period had a large 184 basis point spread, but the firm was marketing a niche distressed-asset CLO.

In January, three issuers – PGIM, CBAM Partners and Assurant CLO Management – went to market with deals with reinvestment periods of three or fewer years.

Wells Fargo thinks the market is on pace for $110 billion issuance, short of last year’s record $128 billion of new-deal volume in CLOs (excluding refinancings and resets).