After waiting a decade to return to the CLO market in the wake of the financial crisis, AIG now has taken less than three months to issue a second deal through its new "CLO 2.0" platform.

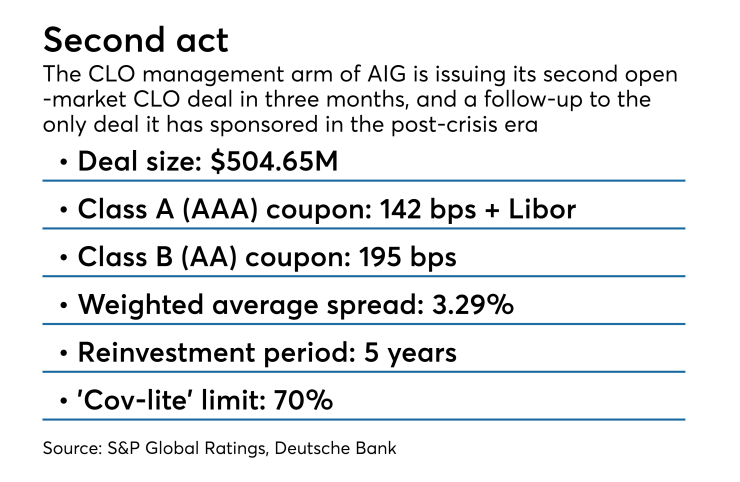

The $504.65 million AIG CLO 2019-1 is arranged by Wells Fargo. The senior tranche of Class A notes, which is rated AAA by S&P Global Ratings, has a coupon of 142 basis points over Libor; that's well wide of the 132 basis point coupon on the comparable tranche of AIG's December’s deal.

But market spreads have widened across the industry amid a slow start in CLO issuance market in January, and persistent investor reticence that has lowered demand and driven up average coupon rates on CLO note tranches.

Investors are demanding additional spreads from newly established managers like AIG, compared with what they will accept from more established managers such as Oak Hill Advisors, the Carlyle Group, BlueMountain Capital Management and Octagon Credit Investors.

AIG had the latest deal nearly 88% ramped at the time of S&P’s analysis of the deal, which had 258 corporate obligors making up $439.77 million of the identified portfolio.

The 2019-1 will have five classes of debt notes. In addition the Class A notes, there is a double-A rated Class B tranche totaling $67.5 million that has a coupon of 195 basis points over Libor. Three subordinate note tranches (Class C, D and E) all have deferrable-interest features.

The portfolio will have a 70% ceiling on “covenant-lite” assets, or loans that lack ongoing lender oversight of maintenance or financial requirements of the corporate borrower.

AIG’s CLO in December (arranged by Credit Suisse) was the first for the insurer in over a decade. The firm was a frequent issuer in the pre-crisis CLO 1.0 era, but sold off its investment advisory and asset management business – AIG Investments – in 2010 to Pacific Century Group. The company was renamed PineBridge Investments as a majority-owned affiliate of Pacific.

Last May, AIG purchase CLO management firm Covenant Credit Partners in Charlotte, N.C., in order to enter the broadly syndicated CLO market. Covenant managed three CLOs at the time, dating issuance back to 2014.