The Federal Reserve Board finalized changes to its supervisory rating framework, allowing large bank holding companies to be considered "well managed," even with one deficient rating.

-

Previously, Kim was a managing director in J.P. Morgan Chase & Co.'s strategic investments group, where she managed a diverse portfolio of fintech investments.

November 5 -

Despite record loan applications, Upstart's AI pulled back, causing a revenue miss and raising "incremental uncertainty" about its core underwriting model.

November 5 -

The issuance can be expanded to $1.2 billion, with virtually the same capital structure characteristics.

November 5 -

LADAR 2025-3's loss levels are notably lower than the rating agency's assumptions on the LADAR 2025-1 because the sponsor excluded borrowers with credit scores lower than 701 from the collateral pool.

November 4 -

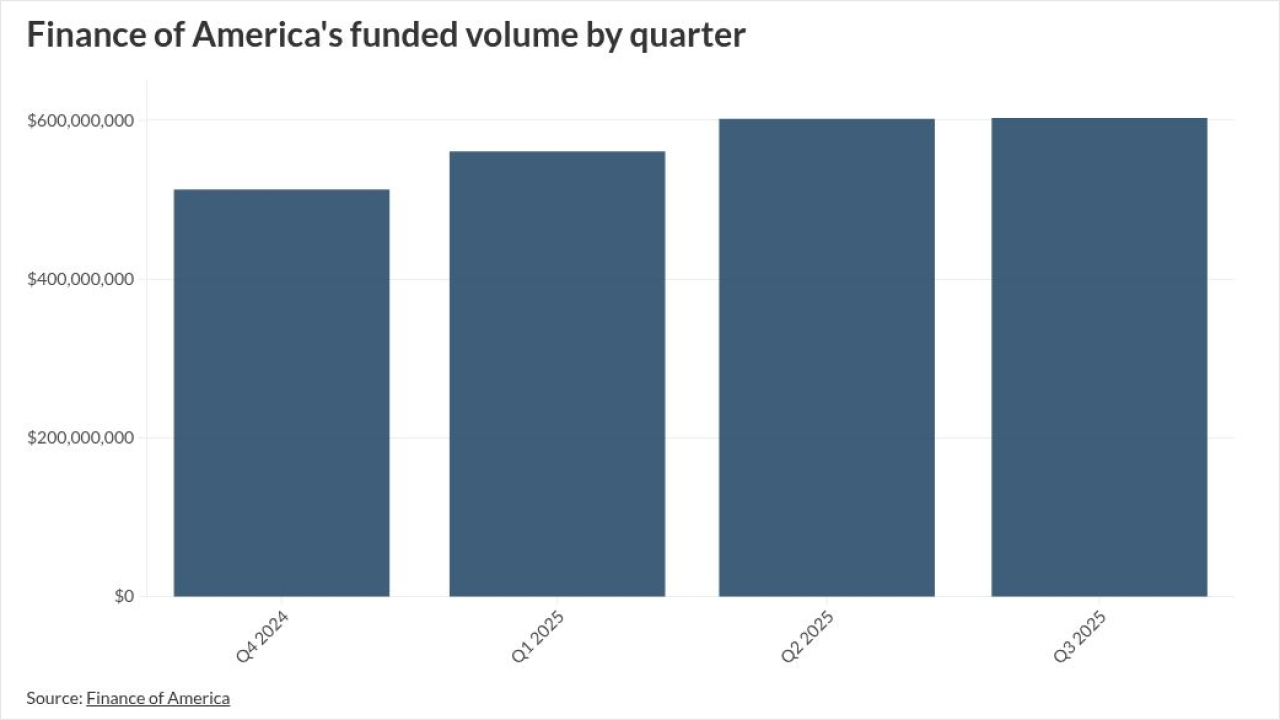

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4

-

WFLOOR 2025-1's annualized monthly yield, which averaged 20% since 2018, has been consistently higher than most other dealer floorplan trusts that Moody's rates.

November 4 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

The buy now/pay later firm, which reports earnings Thursday, has inked deals with Worldpay to expand potential borrowers and with New York Life to obtain more capital for future lending.

November 3 -

The partnership marks the first time that Canadian wealth managers and their accredited retail investor clients can access BlackRock's private credit fund, which includes securitized assets.

November 3 - ab regulation lead

A bottleneck at the Small Business Administration in clearing federal small business loans because of the ongoing federal government shutdown is becoming an increasingly urgent issue for small and even some midsized banks.

November 3 -

HINNT's sellers can repurchase defaulted loans, which increases the transaction's recovery rate, and enhances the credit to the notes.

November 1 -

The Tacoma, Washington-based bank, which has completed two mergers since 2023, said Thursday that it will buy back up to $700 million of its own shares over the next year.

October 31