No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

-

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

The transaction is the first in two years for MidCap, which provides startup and expansion financing for biosciences/healthcare and technology firms backed by VC and private equity.

August 24 -

Stack Infrastructure has raised nearly $1.4B in the ABS market since last year to construct and manage build-to-suit "hyperscale" data centers, reportedly for tech giants like Amazon, Apple, Google and Microsoft.

August 23 -

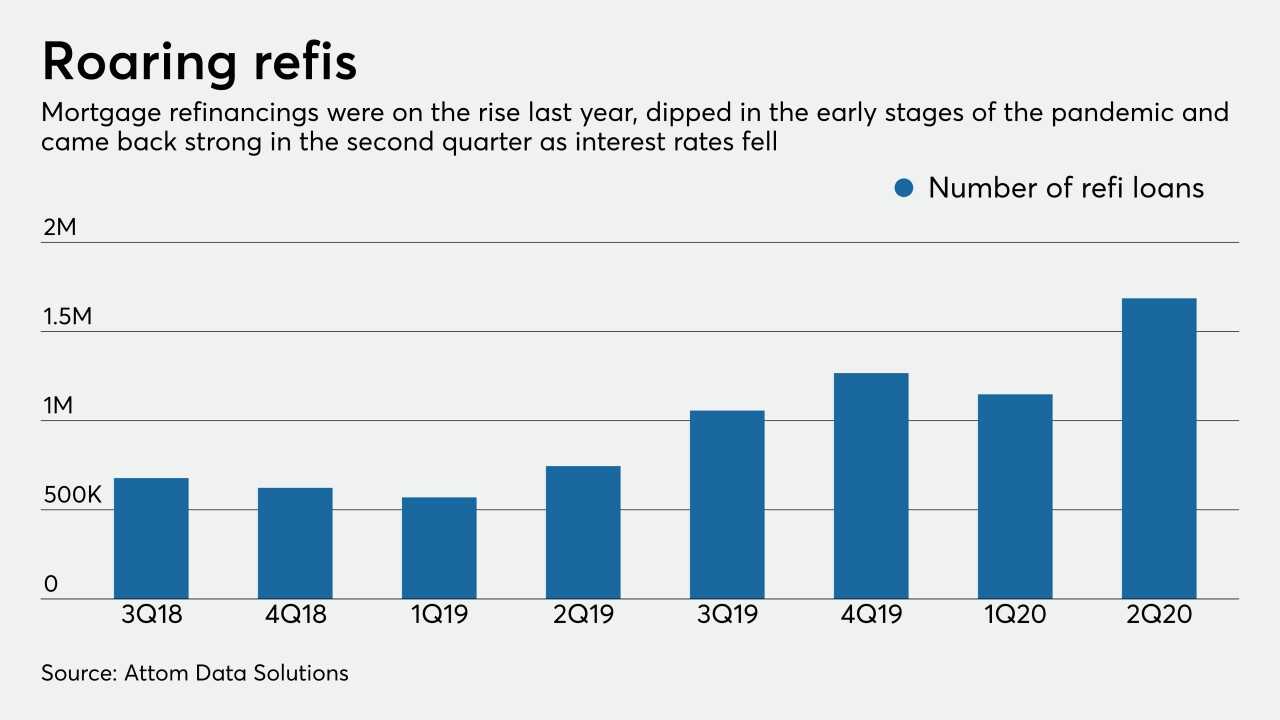

As interest rates tumbled throughout July, prepayments climbed to the highest monthly rate since 2004, but 90-days-or-more delinquencies were on the rise from June, according to Black Knight.

August 21 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21

-

JPMorgan Chase, which has an $18.4B prime auto-loan portfolio, has not ventured into the securitization market with publicly rated auto-loan collateral since 2006, according to ratings agency reports.

August 20 -

Positive payment behaviors in conjunction with CARES Act measures kept mortgage delinquencies from rising, but the number of borrowers facing hardship grew exponentially from last year, according to TransUnion.

August 20 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

The 30 loans secured by 146 properties in DBJPM 2020-C9 have lower-than-average loan-to-value ratios than recent bond offerings backed by commercial-mortgage securitizations of multiple properties.

August 18 -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

American Express isn't acquiring any loans in its deal for the online small-business lender. Here's what it is getting.

August 18