Declines in

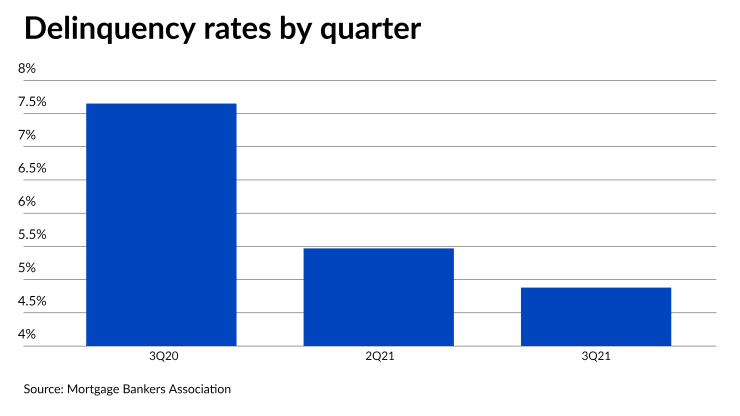

The overall seasonally adjusted delinquency rate dropped 58 basis points from the second quarter to 4.88%, and had a more pronounced decline from a year ago. This likely points to the fact that many people who leave forbearance with payment difficulties are working to resolve them by either adding missed payments to the end of their loan terms, or asking for modifications more in line with their current finances, according to the trade group’s latest report. Compared to the same quarter last year, when the pandemic was more of a concern, the seasonally adjusted delinquency rate was down by nearly 3% or 277 basis points.

The national survey asks mortgage companies to report loans as delinquent if the payment was not made according to the loan’s original terms, but the group indicated it did not expect the results of the recent survey to include mortgages on a path to deferral or modification to be included in that category.

“The improvement [in arrears] was driven entirely by a decline in later-stage delinquent loans — those loans that are 90 days [or more] past due, but not in foreclosure,” Marina Walsh, the MBA’s vice president of industry analysis, said in a press release. “By the end of the third quarter, many borrowers were approaching the 18-month expiration point for their forbearance terms and were being placed in permanent home retention solutions, such as modifications and loan deferrals.”

The sign many distressed borrowers appear to be successfully transitioning into alternatives that help resolve delinquencies and avoid foreclosures raises hope that many mortgage companies will bear up under the wave of tighter servicing-related enforcement coming from regulators.

A group of regulators on Nov. 10 warned that the slack they extended to mortgage servicers on compliance with CARES Act servicing rules to allow for operational adjustments last year

However, one of those regulators — the Consumer Financial Protection Bureau — reported a wide range of delinquency rates when it released a study of

The association on Nov. 8

Nearly 43% of forbearance exits were modifications and more than 23% were deferrals during the most recent week tracked by the MBA, which ended Oct. 31. Just 16% of loans remained delinquent. Cumulatively since June 1, 2020, more than 29% borrowers had deferrals, more than 20% continued to pay despite having forbearance plans, nearly 17% remained delinquent and exited without an alternative plan in place and 13.4% engaged in or applied for modifications.