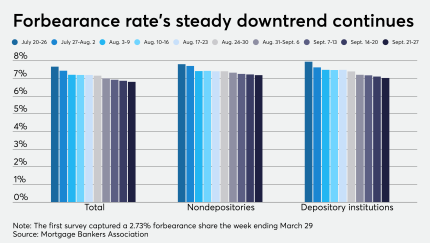

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

-

Mortgage applications decreased 0.6% from one week earlier, although a slight drop in purchase volume belied the fact that consumers are taking advantage of the current rate environment, according to the Mortgage Bankers Association.

October 21 -

The agency confirmed that loans backed by Fannie Mae and Freddie Mac can continue avoiding debt-to-income limits as the bureau completes a revamp of the Qualified Mortgage standard.

October 20 -

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20 -

Blackstone Group is sponsoring a $1 billion commercial real estate CLO transaction, backed by a portfolio of pari passu participations in commercial mortgages for primarily lower-grade office, mixed-use and hotel properties.

October 20 -

Moody’s Investors Service sees improved recovery prospects for the U.S. restaurant industry next year, buoyed by projected revenue growth of 15% despite ongoing concerns of the length and impact of the coronavirus pandemic.

October 20

-

A total of 34 states have offered coronavirus-related rental or mortgage assistance, much of which is funded by the CARES Act, according to the National Council of State Housing Agencies.

October 19 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

Pretium, by taking over Front Yard's 14,000-plus rental properties, will become the second-largest operator of cash-flowing single-family rental housing in the U.S.

October 19 -

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

The ratings agency reports that asset-backed securities backed by small-ticket equipment leases and loans is subject to greater volatility from small-business payment deferrals.

October 19 -

The CEO of SWBC Mortgage discusses her top priorities for the Mortgage Bankers Association, the election, the CFPB's seasoned QM proposal and what to expect at this week's conference.

October 19 -

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 18