The Federal Home Loan Banks will no longer have their housing goals judged by Home Mortgage Disclosure Act data, but rather by a percentage of what loans they purchase, the Federal Housing Finance Agency said.

"By creating housing goal targets that are achievable for the Federal Home Loan Banks, the final rule helps ensure they make meaningful contributions to affordable homeownership," FHFA Director Mark Calabria said in a press release. "This rule will expand responsible homeownership opportunities for underserved communities across the country."

The FHFA's final rule issued on Wednesday envisions a three-year phase-in period for the new goals. It replaces a final rule issued in December 2010.

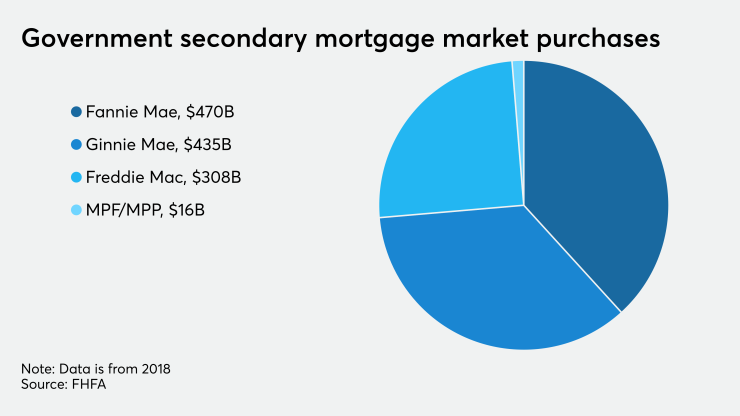

There are two mechanisms through which the Home Loan banks purchase whole loans on the secondary market: the

The target level of MPP and MPF purchases is 20% of acquired member assets, measured by number of loans. The goal includes purchase and refinance mortgages for low-income and very low-income families, as well as mortgages in low-income areas, regardless of income.

The final rule limits the extent to which a Federal Home Loan Bank can rely on mortgages for higher-income families in meeting the goal, the FHFA said. No more than 25% of the mortgages a Home Loan bank uses to qualify for the goal may be to borrowers earning above 80% of area The median income.

The FHFA's proposal aims to make it easier for smaller financial institutions to sell mortgages to a Home Loan bank. The small member participation housing goal's target level of 50%, is designed to encourage use of the Acquired Member Asset program by community-based institutions that often lack other connections to the secondary mortgage market and that are statistically more likely to serve low-income borrowers and families in low-income areas.

The new rule also allows mortgages