Macro factors point to a solid year in the securitization market but wild cards abound, many of them political.

-

The Ford Credit Auto Owner Trust 2020-REV1 transaction is Ford’s 12th under its platform that permits revolving assets during the pre-amortization period of the transaction.

February 10 -

According to presale reports on Flagship’s $355 million auto-loan securitization, the subprime auto lender is removing the 2% collateral pool limit on loans over six years (72 months) that can be added during a three-month prefunding period for Flagship Auto Credit Trust 2020-1.

February 6 -

Members of the House Financial Services Committee chastised Kathy Kraninger for not supervising student loan servicers and failing to examine firms for compliance with the Military Lending Act.

February 6 -

Think Finance, which had teamed with tribal lenders to offer high interest installment loans, could no longer make or collect on loans in states that have caps on interest rates, under terms of a proposed settlement with the Consumer Financial Protection Bureau.

February 6 -

The lease deal – Santander’s sixth ABS of Chrysler Capital leases since 2017 – has a higher proportion of leases with original terms longer than 36 months (44.5%) than prior deals through the platform.

February 5

-

In a letter to CFPB Director Kathy Kraninger, the Democratic senators argue that task force members cannot be trusted to protect consumers because they have represented payday lenders or Wall Street banks, or worked at law firms that did so.

February 5 -

Fitch Ratings has moved three of its managing directors into new roles leading the U.S. RMBS and structured credit teams, including a new global role in developing enhanced analytics across multiple asset classes.

February 5 -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

The 38.5% concentration of 'A' borrowers is the highest of any prior 11 LendingClub securitizations, according to Moody's.

February 5 -

The 34 narrowbody and widebody aircraft in the portfolio are older-vintage planes with a weighted average age of 13.8 years, but all but one of the planes remains an in-production model.

February 4 -

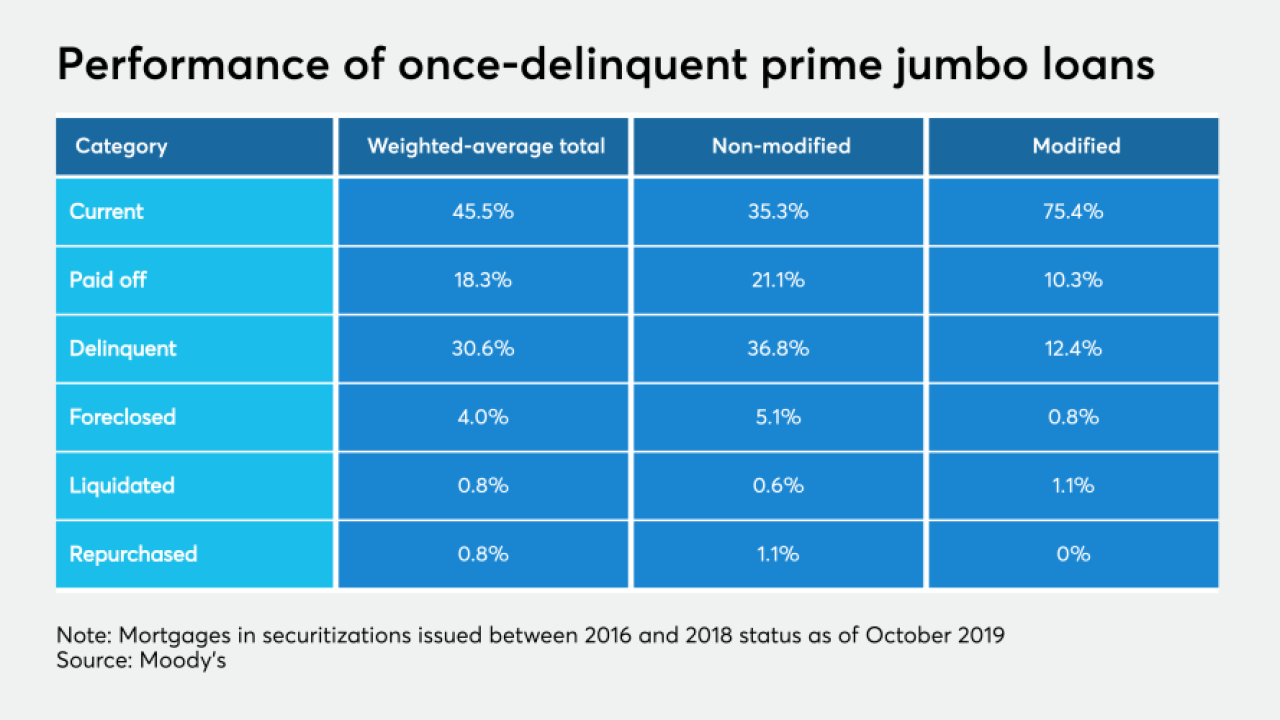

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 3