Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

Higher home prices play a double-edged sword, reducing affordability and contributing to lenders' deciding to ease underwriting. However, they can also help delinquent borrowers become current or pay off their mortgage.

"Originators' underwriting standards loosened after a period of negligible defaults, fueled by the strengthening macroeconomic environment and typical competitive pressures that occur late in the credit cycle," said the Moody's report from Siddharth Lal, Karandeep Bains and Joseph DiMiceli. "The debt-to-income ratio for mortgages in prime jumbo residential mortgage-backed securities that we rate has been on the rise since 2015 signaling decreasing affordability."

The weighted average DTI rose to 36% last year from approximately 31% in 2015. Meanwhile, weighted average credit scores fell to 762 from 774 in 2016.

While the 60 day or more late payment rate for older loans (issuances between 2012 and 2105) remained relatively flat at 0.05%, "in more recent vintages the delinquency rates have steadily climbed higher since issuance, inching up to 0.2% as of December 2019," Moody's said.

"The sharp slope is even more pronounced for 2019 vintage originations, with the weighted average 60-day plus delinquency rate at 0.16%, twice as high as any other vintage at the same stage."

But the good news for mortgage servicers and investors is "economic growth will shield most prime jumbo RMBS collateral from default. House price appreciation, rising wages and low unemployment will support borrowers' financial strength and, in turn, collateral performance."

Moody's forecast gross domestic product growth of 1.7% this year and 1.9% next year. That will help home prices to continue to increase, along with borrower's equity and keeping them motivated to make their mortgage loan payments.

Annual home price growth will slow to 4.3% in the fourth quarter of 2020 and 3% for the same period the following year, compared with 4.8% during last year's fourth quarter.

"The low unemployment rate, which we forecast will remain below 4% over the next two years, and rising wages will support collateral performance in new and existing deals by boosting borrowers' ability to make timely payments," the ratings agency said.

It is how delinquent loans from recent vintages performed after the initial missed payment that drove Moody's support for its conclusion.

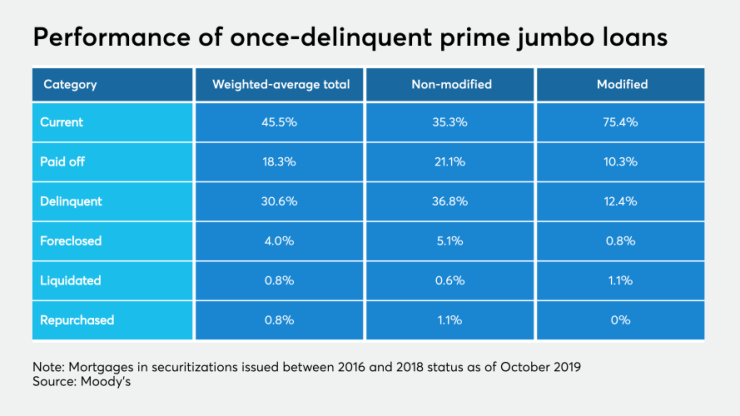

In October 2019, Moody's looked at 258 prime jumbo mortgages from issuances between 2016 and 2018 — this included 70 loans that servicers modified — that at one point became delinquent.

In approximately 63% of the cases, the borrowers either restarted making payments or paid off the loan in full. Less than one-third remained delinquent, with an additional 4% going into foreclosure.

Cures were more likely if the servicer modified the loan. Over 75% of the modified mortgages became current on their payment, compared with over 35% of the loans that weren't.

Only 12.4% of the modified mortgages remained delinquent, versus nearly 37% of those that did not received a modification. Less than 1% of the modified loans were foreclosed upon, compared with 5% of the non-modified ones.

"Once a servicer modifies a delinquent loan through principal deferral, an interest rate reduction or a loan extension, among other options, it undergoes a trial modification period. This period provides borrowers with the means to cure their delinquency and resume timely payments," Moody's explained.