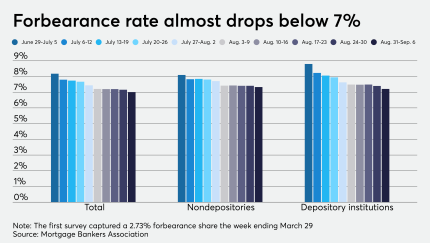

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

-

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

Three nonprofits look to create or preserve 10,000 units, vowing to fight off firms like Blackstone and Colony Capital, which bought up foreclosed homes after Great Recession.

October 6 -

HSBC, Bank of the West and Fannie Mae are among those offering green mortgage bonds, financing commercial clients’ efforts to rein in carbon emissions and developing other novel products that help customers tackle environmental challenges.

October 6 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

The notes are backed by $456.9 million in high-balance loans that meet qualified mortgage standards, according to ratings agency presale reports.

October 5

-

Kathy Kraninger’s job status would be in question if Joe Biden wins the White House. If the president is reelected, she may continue balancing a deregulatory agenda with her unexpectedly tough stance on enforcement.

October 2 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

The quarterly numbers were boosted by $11.3 billion in new deals last month, the most active month for CLOs since April 2019.

October 2 -

Credit research analysts cite a "significant" drop in defaults since the 2Q and improving macroeconomic indicators.

October 2 -

Deals, trends and research in structured finance and asset-backed securities for the week of Sept. 25-Oct. 1

October 1 -

Overall debt outstanding for delinquent commercial and multifamily mortgages cut down in September as more of the economy opens further with lodging and retail far behind, according to the Mortgage Bankers Association.

October 1 -

The bureau released a five-year review of the so-called TRID regulation that found consumers benefited from being able to compare mortgage terms and costs, but the price tag for the industry was roughly $146 per loan.

October 1