Commercial real estate companies are among those left out of the Federal Reserve’s middle-market relief program, but House members said they need government-backed financing to navigate the pandemic as much as anyone.

-

For investors seeking rich yields, mortgage-insurance provider Radian Guaranty is approaching the market with a $488 million transaction that is offering greater credit enhancement than a similarly structured deal earlier this year, pre-pandemic.

October 14 -

As the ongoing pandemic raises major questions over the fate of commercial real estate, the Benchmark 2020-B20 Mortgage Trust deal approaching the market has as a significantly higher concentration of office properties.

October 14 -

Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

October 14 -

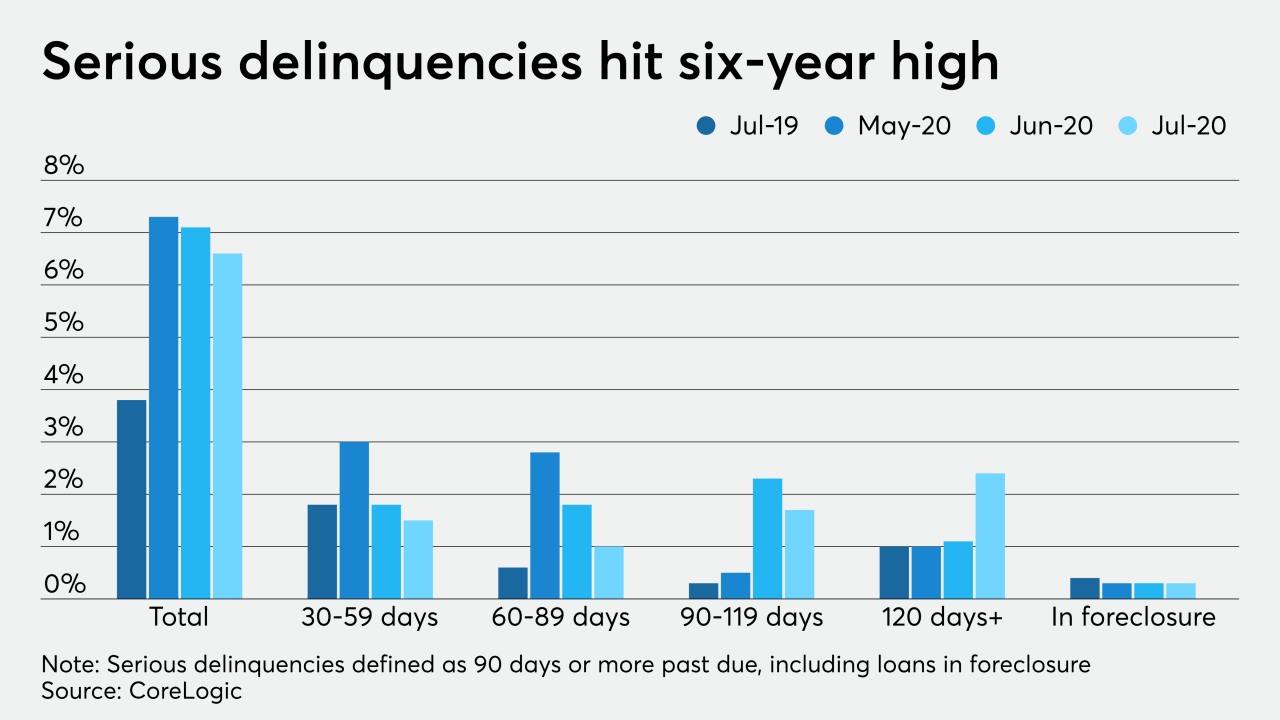

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

The performance of U.S. credit card securitizations is continuing to improve, according to Fitch Ratings, but the asset class's ongoing health will depend significantly on what emerges from political squabbles in Washington, D.C.

October 13

-

IPFS Corp. is approaching the asset-backed securities market with its seventh deal in 2020 backed by a revolving pool of insurance premium finance loans, an asset class posing relatively little risk to investors, at least for now.

October 13 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

Navient Solutions has approached the market with $780 million securitization of Federal Family Education Loan Program loans, following a similarly structured transaction completed in early August. In a report published Oct. 12, Moody's Investors Service highlighted the elevated risk to those assets during the current pandemic.

October 13 -

The recent decrease in the rate at which current loans became impaired could further encourage the cautious return of the non-QM market currently underway.

October 9 -

Investors continued to tap the COVID-19-driven emergency facility for SBA loan pool purchases, secondary CMBS notes, and private SLABS.

October 9 -

Deals, trends and research in structured finance and asset-backed securities for the week of Oct. 2-8

October 9 -

Prestige's new $377M securitization has a collateral pool in which over 44% of the loans are from borrowers with recent Chapter 7/13 discharges.

October 9

![Fed Chairman Jerome Powell said the central bank had previously concluded that asset-based borrowers were able to secure financing elsewhere. Treasury Secretary Steven Mnuchin said “small hotels do not fit into [the Main Street Lending Program] because they already have other indebtedness.”](https://arizent.brightspotcdn.com/dims4/default/78478d7/2147483647/strip/true/crop/1593x900+4+0/resize/430x243!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fb3%2F79%2F3b1db6264efa9eab86e05b296afc%2Fpowell-jerome-mnuchin-steven-bl-092220.png)