Mortgage applications decreased 0.7% from one week earlier, but lending activity should continue strong for the remainder of the year as rates stay low, according to the Mortgage Bankers Association.

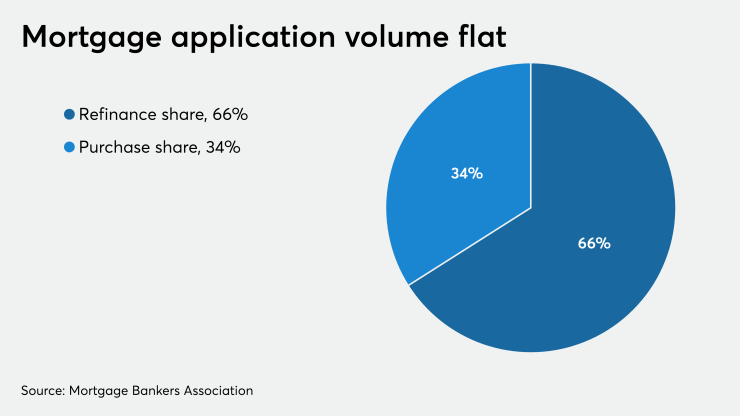

The MBA's Weekly Mortgage Applications Survey for the week ending Oct. 9 found that the refinance index decreased 0.3%

"Mortgage applications for refinances and home purchases both decreased slightly last week, despite the 30-year fixed mortgage rate declining to a new MBA survey low of 3%," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Applications for government mortgages offset some of the overall decline by increasing 3%, driven by a solid gain in government purchase applications and an 11% jump in VA refinance applications."

The seasonally adjusted purchase index decreased 2% from one week earlier, while the unadjusted purchase index decreased 1% compared with the previous week, although it was 24% higher than the same week one year ago.

"Refinance and purchase activity continue to run well ahead of last year's pace, fueled by record-low rates and strong homebuyer demand. Housing supply is a challenge for many aspiring buyers, but activity should continue to stay strong the rest of the year," Kan added.

Adjustable-rate mortgage activity decreased to 2% from 2.2% of total applications, while the share of Federal Housing Administration-insured loan applications decreased to 10.7% from 11% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 13.4% from 12.2% and the U.S. Department of Agriculture/Rural Development share increased to 0.6% from 0.5% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased a basis point to 3%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate decreased a basis point to 3.3%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA remained unchanged at 3.12%. For 15-year fixed-rate mortgages, the average remained unchanged at 2.59%. The average contract interest rate for 5/1 ARMs decreased to 2.63% from 2.8%.