The FHFA and Treasury will allow Fannie Mae and Freddie Mac to hold more capital as part of the Trump administration's plans to release the companies from conservatorship. But it is unclear whether the incoming Biden administration will keep the mortgage giants on the same reform path.

-

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.22-28

January 28 -

Dave Uejio, acting director of the Consumer Financial Protection Bureau, promised to protect veterans from predatory loans and to crack down on companies that improperly garnish stimulus checks or mistreat struggling borrowers.

January 28 -

The Chicago real estate private equity firm will issue $416.8M in notes financing its acquisition of retail, industrial and office properties leased by California-based Save Mart.

January 28 -

Investors were also reacting to the inauguration of Joe Biden and uncertainty over additional fiscal relief, Freddie Mac’s Chief Economist Sam Khater said.

January 28 -

DLJ and Nomura Corporate are sponsoring portfolios of mostly previously modified, well-seasoned mortgages that have at least two years of clean-current payment status.

January 27

-

According to a presale report from Moody’s Investors Service, Home Re 2021-1 is the fourth deal by the issuer that will sell floating-rate notes (pegged to one-month Libor) that are backed by a reference pool of mostly prime mortgages.

January 27 -

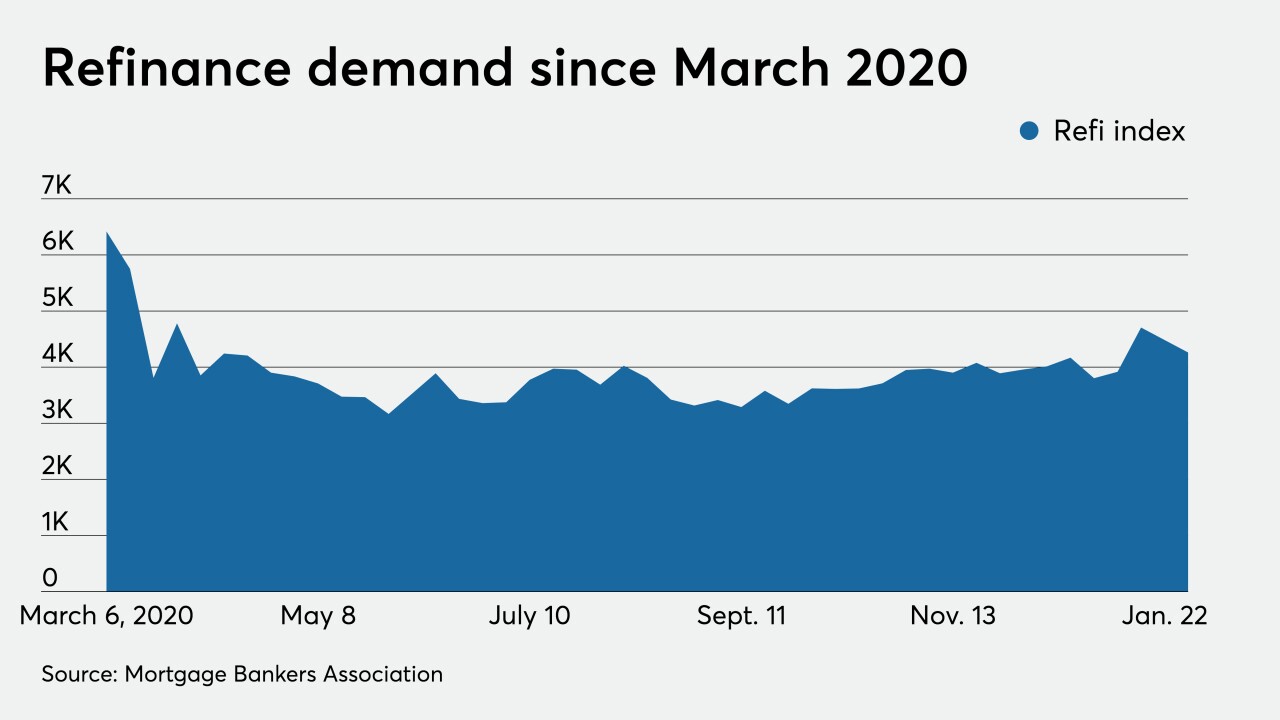

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Black Knight’s product is designed to assist mortgage lenders in performing due diligence while also preventing heightened risk of foreclosure losses.

January 26 -

About $16 billion across 43 deals in both new-issue and refinancing has prompted analysts into making early revisions to raise their initial volume forecasts.

January 26 -

The subsidiary of New Residential Investment produced nearly $400 million in non-QM volume in the first quarter of 2020 before putting a hold on the product offering in March.

January 25 -

The Financial Stability Oversight Council could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

January 25 -

The receivables will flow from payments on UK monoline credit-card accounts for nonprime borrowers.

January 25