With the Financial Stability Oversight Council likely to resume

The FSOC, which was established in 2010 to monitor systemic risk after the housing crash, could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

“One cannot assume that, going forward, the FSOC will only be considering designations of the largest firms,” Olmem said during a recent teleconference. Experts “contend that the FSOC should consider designating even midtier-sized firms on the grounds that collectively they can present the same systemic risks,” he noted.

The concern reflects a broader fear among less-regulated nonbanks that they could be subject to more restrictions because a Democratic administration with

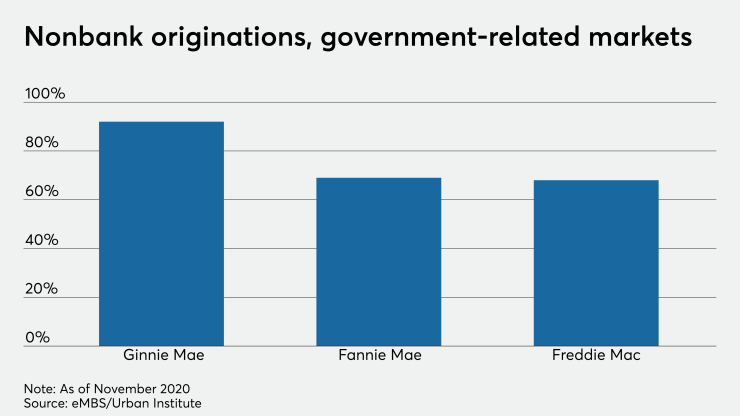

Nonbanks dominate government-related secondary mortgage markets. In November 2020, they represented 92% of securitized originations guaranteed by Ginnie Mae, 69% of loans purchased by Fannie Mae and 68% of those bought by Freddie Mac, according to data from eMBS and the Urban Institute.

Fannie and Freddie’s ability to identify systemic risks through the FSOC was among the topics Treasury Secretary Nominee Janet Yellen confirmed an interest in focusing on in

However, while nonbanks’ growing role in the financial system is clearly

“It’s … unclear whether mortgage companies will be the initial focus,” he said, noting that among the other types of nonbanks singled out in recent regulatory reports are broker-dealers, certain investment companies and money market funds.

That said, it’s clear that the ground has been laid for the FSOC to undertake the examination of the regulation of nonbank mortgage companies and servicers, and regulators could soon begin the process by making informational requests, Olmem said.

“For companies that believe they could find themselves considered for designation, it is appropriate to begin an internal assessment of their operations to understand if they satisfy FSOC’s standards,” he said.

Companies will have due process rights, said Olmem. They can present a case for why designation may be inappropriate in a hearing, and may have the opportunity to introduce reforms to reduce their systemic risk.

Under