The railcar equipment notes are secured by a portfolio of 5,770 units which are almost all being utilized through full-service leases.

-

Investors were also reacting to the inauguration of Joe Biden and uncertainty over additional fiscal relief, Freddie Mac’s Chief Economist Sam Khater said.

January 28 -

DLJ and Nomura Corporate are sponsoring portfolios of mostly previously modified, well-seasoned mortgages that have at least two years of clean-current payment status.

January 27 -

According to a presale report from Moody’s Investors Service, Home Re 2021-1 is the fourth deal by the issuer that will sell floating-rate notes (pegged to one-month Libor) that are backed by a reference pool of mostly prime mortgages.

January 27 -

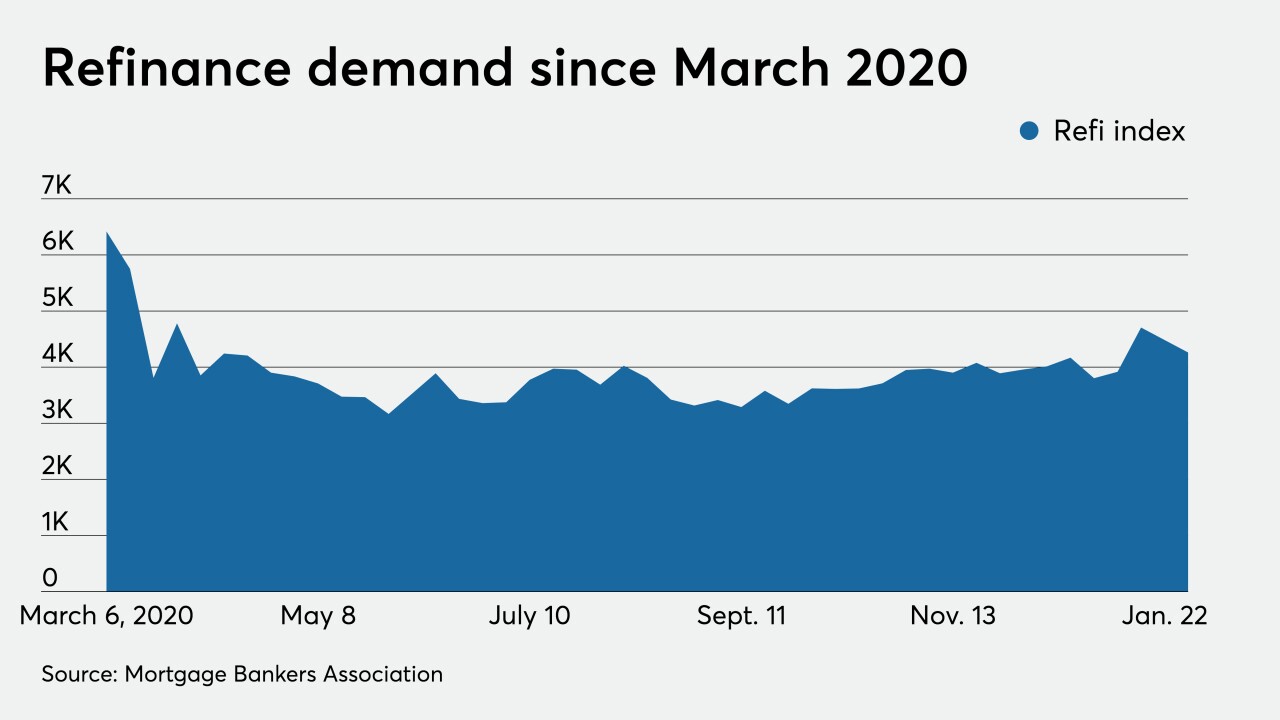

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Black Knight’s product is designed to assist mortgage lenders in performing due diligence while also preventing heightened risk of foreclosure losses.

January 26

-

About $16 billion across 43 deals in both new-issue and refinancing has prompted analysts into making early revisions to raise their initial volume forecasts.

January 26 -

The subsidiary of New Residential Investment produced nearly $400 million in non-QM volume in the first quarter of 2020 before putting a hold on the product offering in March.

January 25 -

The Financial Stability Oversight Council could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

January 25 -

The receivables will flow from payments on UK monoline credit-card accounts for nonprime borrowers.

January 25 -

The online lender is looking to price its second securitization deal of 2021, following last week's closing of a pass-through notes offering via its master trust.

January 25 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.15-21

January 22 -

The administration faces a slew of immediate financial policy tasks, such as passing a new round of small-business aid, charting a course for Fannie Mae and Freddie Mac and filling vacant agency leadership posts.

January 20