Progressive floats notes collateralized by single-family rentals, while GS Mortgage-Backed Securities Trust is secured by prime-jumbo and agency conforming loans.

-

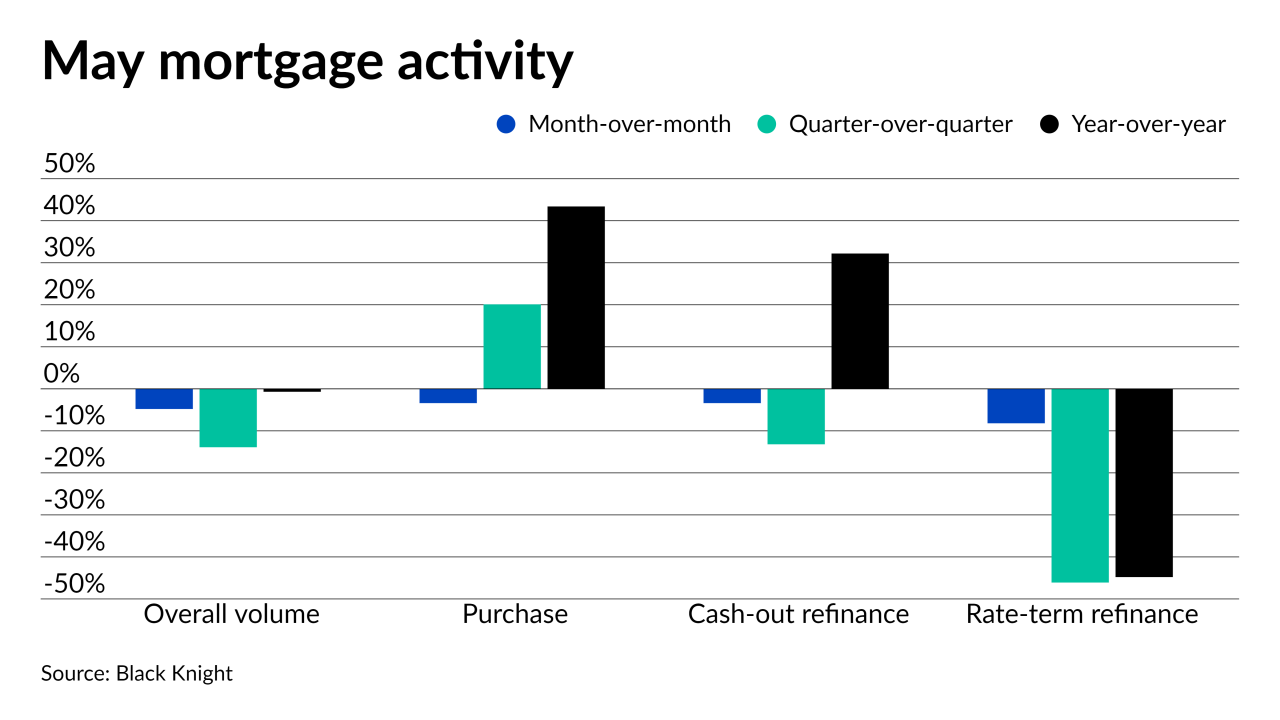

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Pre-permission to operate (PTO) loans will comprise 10 percent of the Mosaic 2021-2’s underlying collateral, a dramatic increase from the Mosaic 2021-1 deal.

June 14 -

More than 97% of venture backing goes go white-owned startups. Firms like Mendoza Ventures, Chingona Ventures and MaC Venture Capital are stepping in to support underserved entrepreneurs.

June 14 -

Fears of widespread credit losses have largely subsided, but demand for new commercial real estate loans remains lackluster because many companies are sitting on so much cash they don’t need to borrow. Meanwhile, competition from private equity groups and other nonbank lenders is escalating.

June 14 -

A portfolio of mixed-quality mortgage loans secures the deal, some of which adhere to ATR underwriting mandates from the CFPB.

June 11

-

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

ACC Trust 2021-1 is the issuer’s fifth transaction, and is backed by subprime auto leases extended directly to borrowers through its 68 owned dealerships

June 11 -

Progressive floats notes collateralized by single-family rentals, while GS Mortgage-Backed Securities Trust is secured by prime-jumbo and agency conforming loans.

June 10 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

Fitch says it will be weighing failures of management standards and practices at banks more heavily when considering possible downgrades. ESG advocates are cheering the development.

June 10 -

The current deal is the eighth retail auto lease securitization from the registered lease securitization platform, which was established in 2013.

June 9 -

Financial institutions spent nearly $214 billion last year — an 18% jump from 2019 — to meet regulatory requirements for fighting financial crimes, a new study says. The spending included more staffing to manage risks posed by customer growth.

June 9