-

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

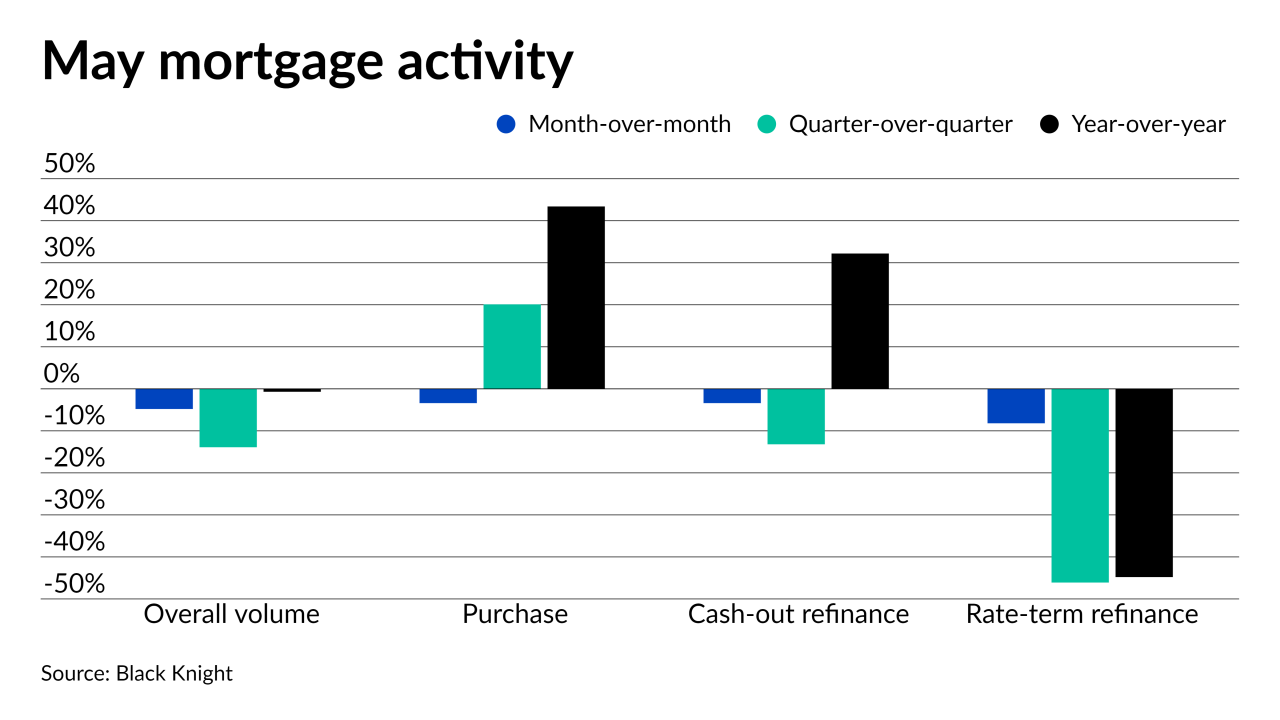

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

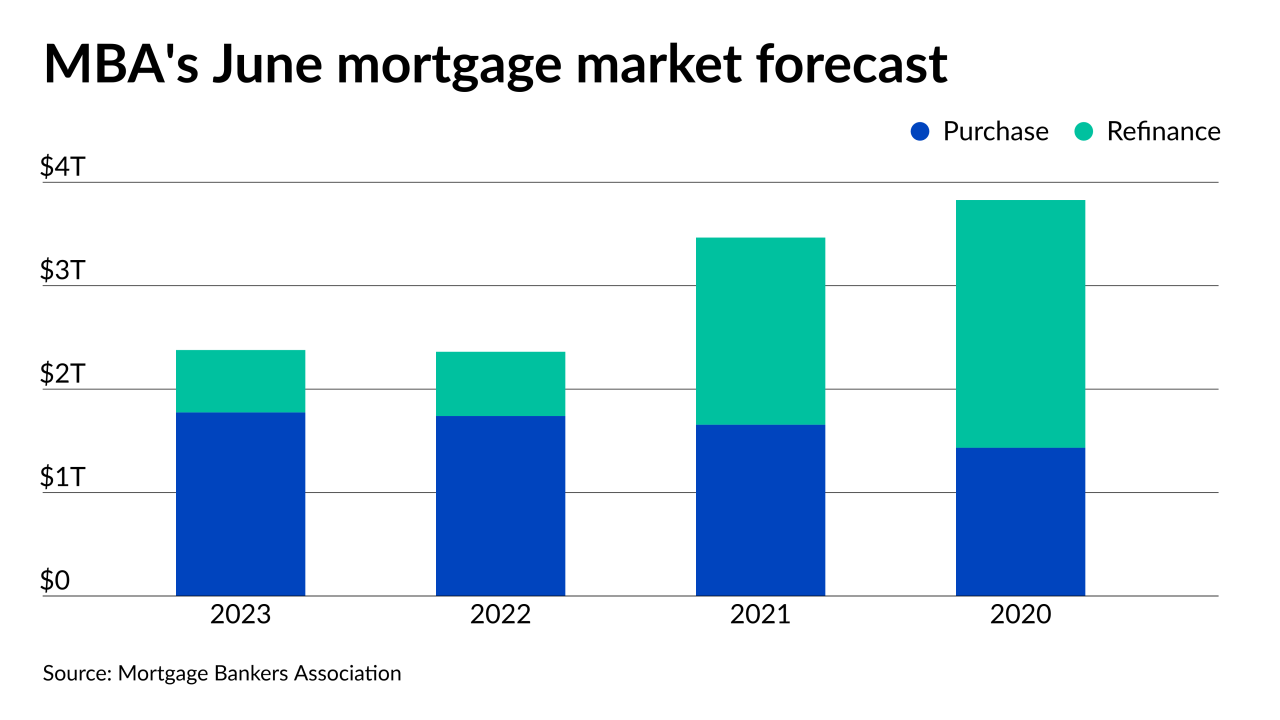

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

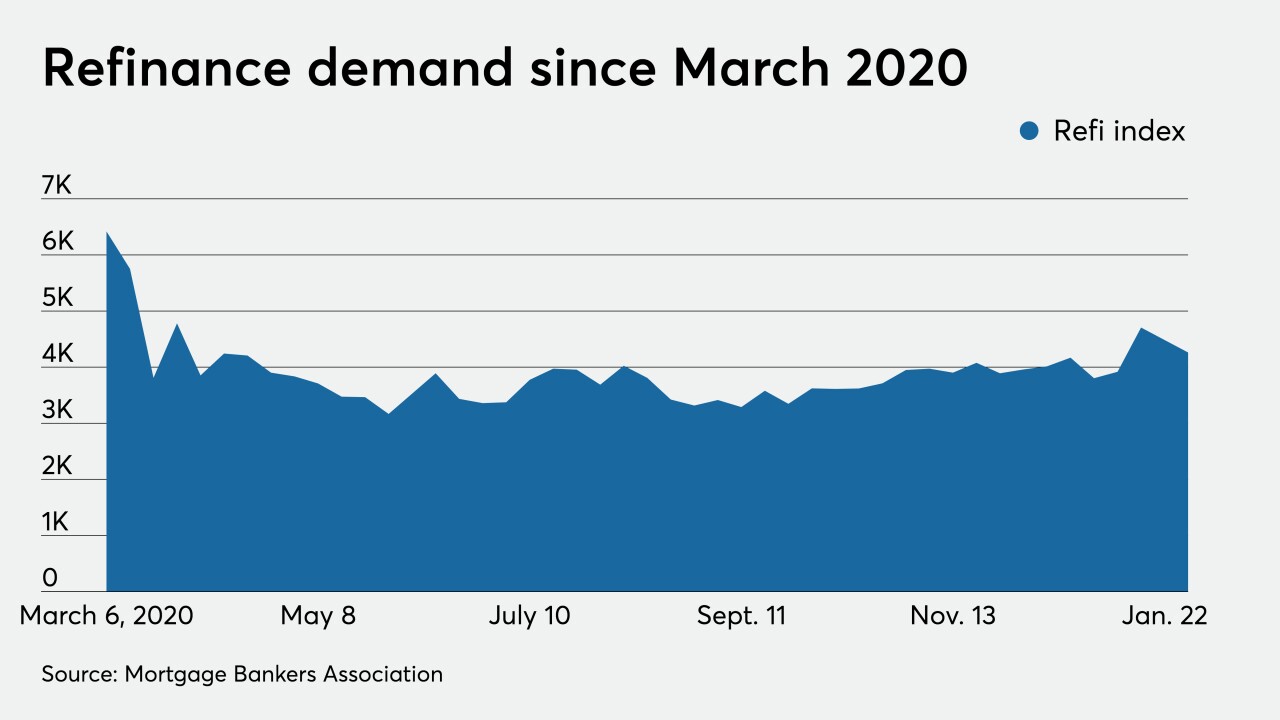

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

Mortgage rates, whose movements until now had not reflected gains in the benchmark 10-year Treasury yield, rose 14 basis points this week, according to Freddie Mac.

January 14 -

Industry watchers make their wildest guesses (more or less) about developments in real estate finance that could rock the industry in the upcoming months.

December 29 -

Falling interest rates more than canceled out median home listing prices, reaching an all-time time high during the month, Redfin said.

December 24 -

With coronavirus inoculations underway and government stimulus likely to come, the outlook for next year’s housing market and lending environment grew more optimistic in December.

December 15