-

Investors are reacting skeptically to the auto lender's deal to acquire CardWorks for $2.65 billion.

February 19 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 23 -

The agency’s semiannual report warned institutions to be mindful of operational risks from the innovation in core banking systems, and detailed supervisory steps to monitor the adoption of a new reference rate.

December 9 -

The Federal Housing Finance Agency is scrapping a capital proposal it released last year and will seek comments on a new plan in 2020.

November 19 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

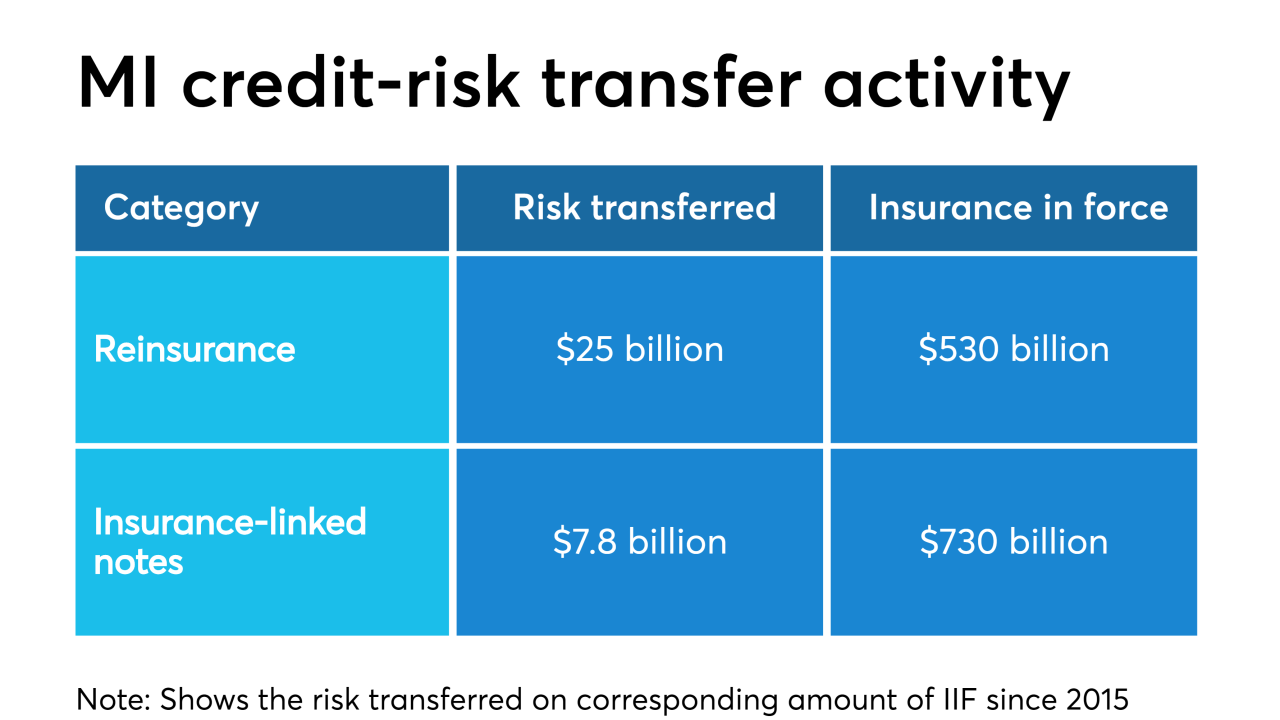

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

The bank started buying more Treasurys and mortgage-backeds over a year ago, long before talk about rate cuts. What did it know that its rivals didn't?

August 25 -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

The potential for negative long-term mortgage rates is surfacing around the world, and with global tensions building in the U.S. market, there's a small but growing chance it could happen here, too.

August 8 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24