JPMorgan Chase broke ranks with much of the banking industry and aggressively bulked up its securities portfolio over the past 12 months.

It’s a strategy that many bankers probably now wish they had adopted, especially as recession fears have grown in recent weeks and speculation about how far the Federal Reserve might go on rate cuts dominates the headlines.

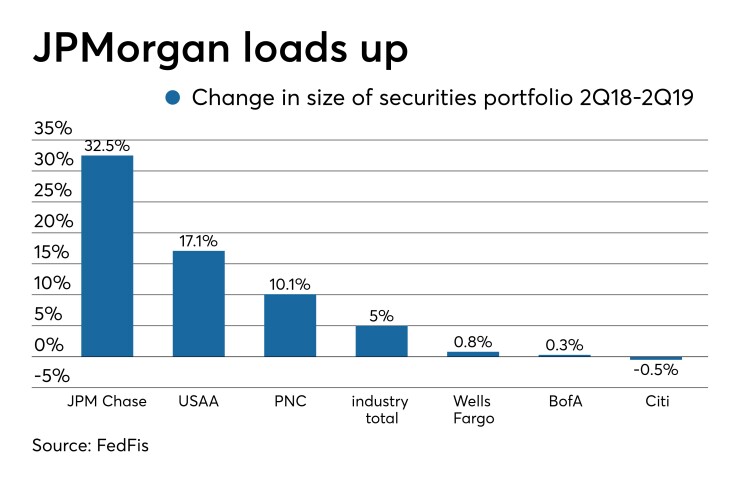

Over the 12-month period that ended June 30, JPMorgan’s securities book grew 32.5% to $306 billion, according to Federal Deposit Insurance Corp. data compiled by FedFis. That was faster than the industrywide growth rate of 5% and much faster than other large banks. Securities increased less than 1% at both Bank of America and Wells Fargo and fell slightly at Citigroup.

Many banks limit holdings of securities, since they typically generate lower yields than loans. But JPMorgan made the right decision to load up on securities more than a year ago, before the Fed signaled it would cut rates, said Matthew Pieniazek, president of Darling Consulting Group, which manages investment portfolios for banks.

JPMorgan’s addition of mortgage-backed securities and Treasurys will help protect it against falling interest rates, he said. Other banks, in his opinion, should have done the same thing.

“The horse is out of the barn. Banks should have been doing this two years ago,” Pieniazek said. “The industry’s worst exposure is not rising rates but falling rates.”

Falling rates hurt banks in multiple ways. Floating-rate loans already on banks’ books will reprice to lower rates. New loans will be originated at lower rates. And when a bank replaces securities that have matured, the

Many analysts expect margins to tighten this year as a result of falling rates. Mike Mayo, an analyst at Wells Fargo Securities, said in an Aug. 15 research note that he estimates the average net interest margin for all banks to narrow 35 basis points, to 3.05%, from the beginning of 2019 to the end of 2021. He had previously forecast a 10-basis-point expansion.

JPMorgan declined to comment for this story, but it had not kept its approach a secret. Then-Chief Financial Officer Marianne Lake said back in February at the New York company’s investor day that the bank had been restructuring its balance sheet in advance of a possible recession.

JPMorgan was not predicting a recession, but it was preparing for the possibility, Lake said.

“Recent declines in business sentiment have driven recessionary indicators higher,” she said. “They’re not flashing red, but they are off the floor.”

JPMorgan purposely slowed loan growth

Some securities had become a better fit for the company’s balance sheet than loans, even if the yields were comparable, Lake said. A residential mortgage loan, for example, carries a higher capital weighting and is less liquid than a mortgage-backed security.

“Many loans … would not produce returns above our cost of equity,” she said. “And, in many cases, securities may look more favorable.”

To be sure, JPMorgan still trails its peers in terms of securities as a percentage of total assets. JPMorgan’s loans now make up 40% of total assets, and securities 13%. Bank of America’s loans are 52% of assets, and securities 24%. At Citigroup, loans are 44% and securities 21%. And Wells Fargo’s loans are 53% and securities 23%.

That said, JPMorgan’s shift toward securities paid off in the second quarter as it reported an average yield of 3.28% on investment securities, compared with 3.16% at Wells Fargo and 2.72% at Bank of America.

During a July 16 conference call, JPMorgan’s new chief financial officer, Jennifer Piepszak, was asked about the continued additions to the securities book, specifically the addition of mortgage-backed securities and the subtraction of individual mortgage loans.

“Should we think about this as part of the overall … optimizing of capital and liquidity?” asked Erika Najarian, an analyst at Bank of America Merrill Lynch.

“Yes, that is precisely why we’re doing it,” Piepszak said. “Securities … are more efficient from a capital perspective as well as a liquidities perspective.”

Other banks that rapidly increased their securities holdings over the past year include the $20.1 billion-asset MidFirst Bank in Oklahoma City, whose portfolio rose 53.2% to $2.3 billion; and the $86.6 billion-asset USAA in San Antonio, where securities increased 17.1% to $27.5 billion.

Some banks reduced securities holdings to improve margins. The $9.4 billion-asset Banc of California in Santa Ana cut its securities book 49.2% to $1.2 billion “to enhance the value of our franchise by moving more of the lower-margin products off our balance sheet,” CEO Jared Wolff said during a July 25 conference call. That helped its net interest margin in the second quarter improve by 5 basis points from the first quarter to 2.86%.

But those types of moves can be shortsighted, Pieniazek said. In the quest for higher yields, many banks neglected to hedge their bets against the possibility of falling rates.

“When everyone thinks rates are rising, that’s the best time to buy insurance,” Pieniazek said. “You can still buy insurance now, but you may not like the cost of it.”

Banks that missed the boat earlier can play catch-up now, said Brant Houston, senior portfolio manager at CIBC Private Wealth Management. One way is to purchase longer-term securities, because “as rates fall, longer-dated securities will increase in value more than shorter-dated securities,” Houston said.

Lenders can also implement rate floors on newly originated floating-rate loans to protect the bank against falling rates, Pieniazek said.

Banks can have other reasons, unrelated to profit margins or rate sensitivity, to trim their securities holdings. The $4.3 billion-asset First American Bank in Elk Grove Village, Ill., reduced its securities book 12% to $2.2 billion to improve its leverage ratio, said Gene Coots, executive vice president of investments. That was needed to grease the wheels for an acquisition.

“We wanted to reduce the leverage ratio to gain a more efficient regulatory approval of the acquisition,” Coots said in an interview.

First American in May

But for the banks that had a chance in the past two years to load up on securities to protect against falling rates, there is no excuse for having not taken JPMorgan’s approach, said Marty Mosby, an analyst at Vining Sparks. JPMorgan knew there was a chance rates could go down instead of up, he said.

“When many of the other banks were waiting on rates to go up, I was screaming that they could lock in securities now” before rates fell, Mosby said. “JPMorgan is the best example of a bank that didn’t miss an opportunity.”