-

The Federal Housing Administration’s changes seek to bring guidelines for specialized Title I programs in line with current borrower and market needs.

November 9 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The number of plans is less than one-fourth of what it was at its pandemic peak, and many are expiring, so the group will replace the weekly measure with a monthly one.

November 8 -

Rising debt-to-income ratios were behind almost a third of refinance rejections among those 65 and older, according to an analysis from the Urban Institute.

October 27 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25 -

Average incomes for this age group increased by 24% since 2012, but housing prices jumped 86%.

October 25 -

The industry is prioritizing Black and Hispanic consumers in the interest of social equity and to tap new markets amid declining refinance volume and rising rates.

October 22 -

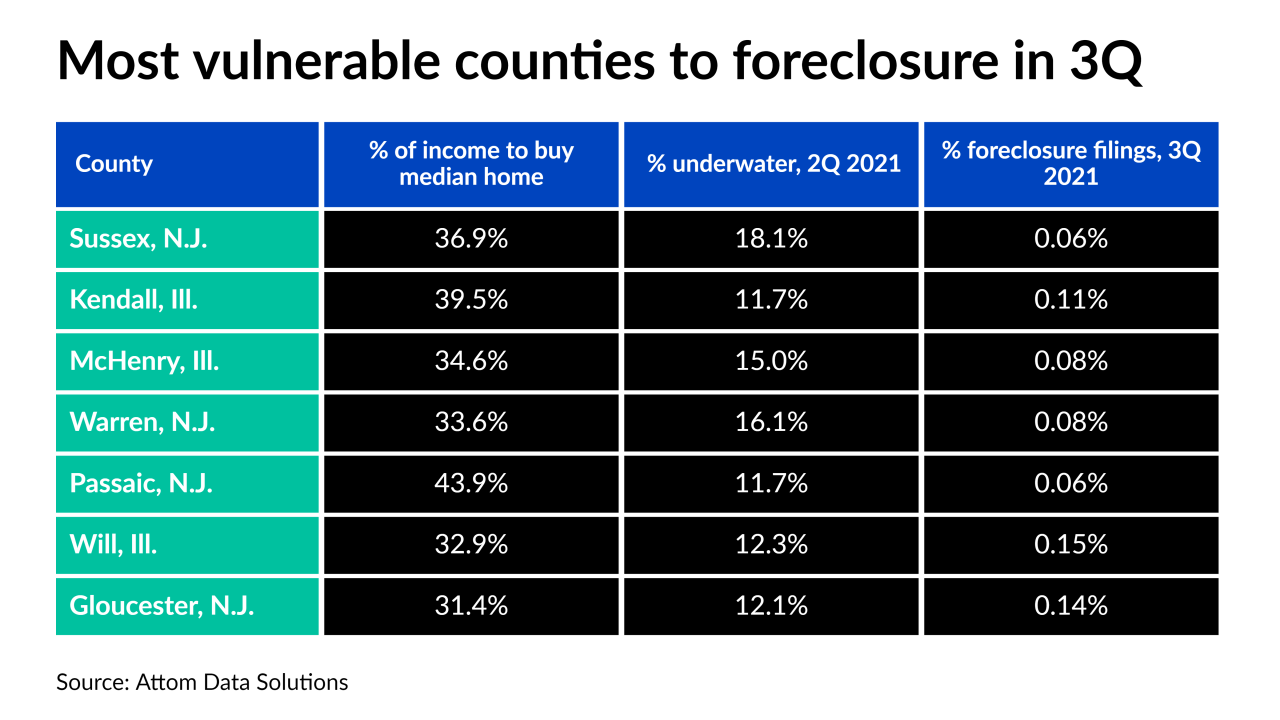

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

While September's single-family starts were unchanged from the prior month, multifamily activity fell 5%, according to government data.

October 19 -

Changes in the Fed, including the replacement of Jay Powell as chairman, might shift the board back to a dovish economic position.

October 18 -

The drop over the 30-day period was in line with a large number of plan expiration dates, and occurred despite the extension of an initial filing deadline for government loans.

October 15 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

Increased purchase activity countered a slowdown in refinance applications, which were impacted by rising rates.

October 13 -

Two Wall Street firms and a single-family rental investor have purchased portions of the government-sponsored enterprise's latest nonperforming loan package.

October 12 -

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12 -

The entire pool is comprised of fixed-rate, fully amortizing mortgages, with an average balance of $901,373. They are also first-lien loans.

October 8 -

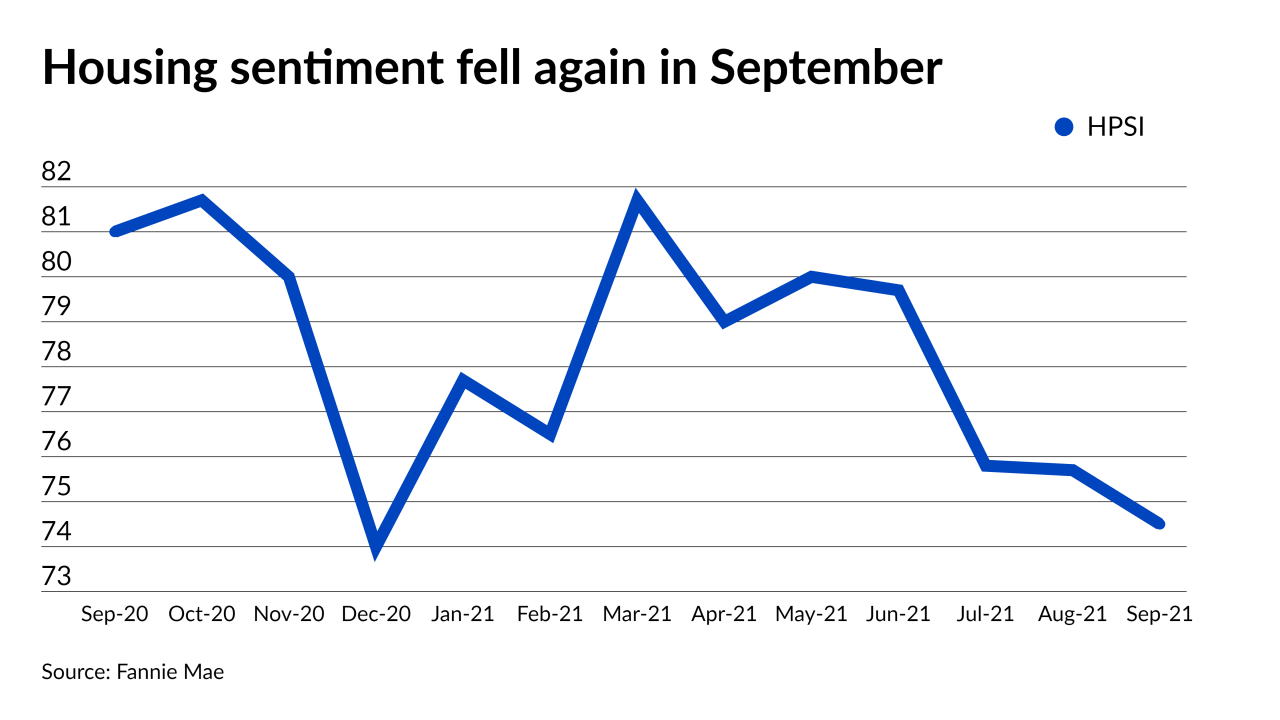

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

Those leaving forbearance or other relief plans generally had higher credit utilization rates, were more likely to have mortgages, and experienced lower levels of bank card delinquencies, according to TransUnion.

October 7 -

However, economic data points to likely future increases, with investors awaiting numbers from upcoming jobs report.

October 7