-

After three consecutive weeks of increases, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23% this week, according to Freddie Mac.

November 26 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

A large majority of the pool assets, 86.2%, are second-lien home equity investment contracts that have a weighted average (WA) multiple share rate of 2.00x.

November 19 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

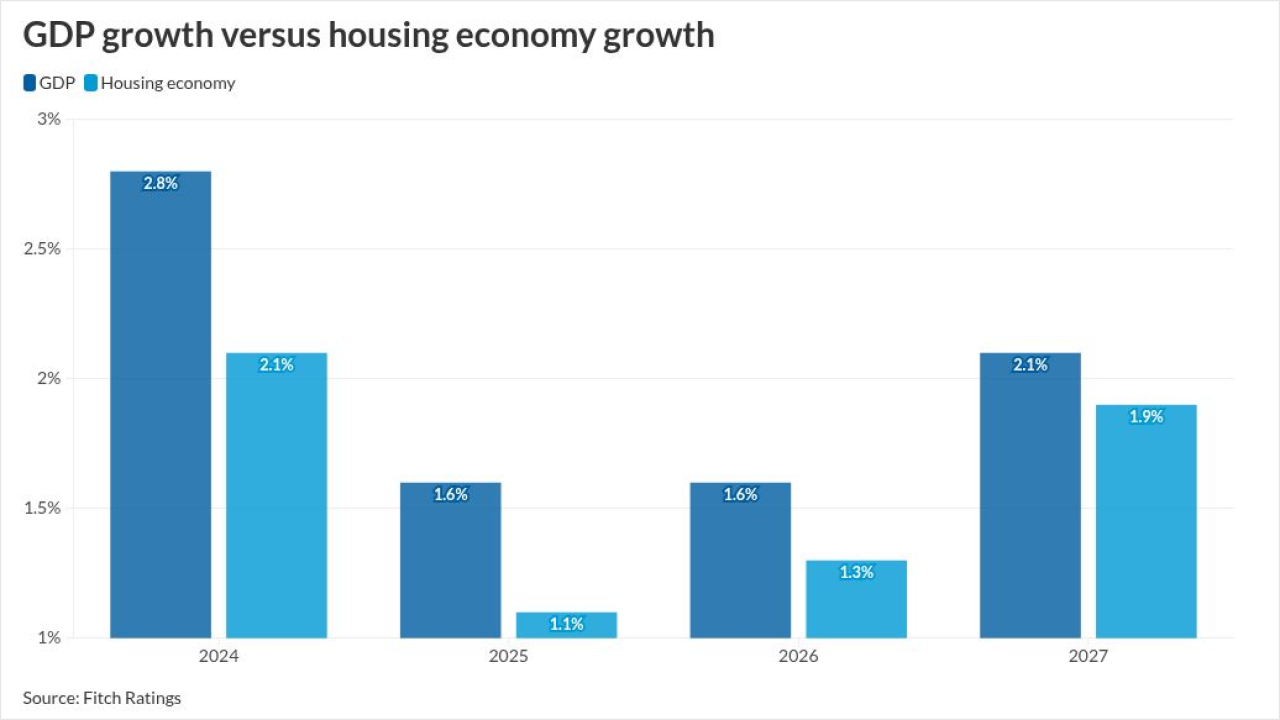

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

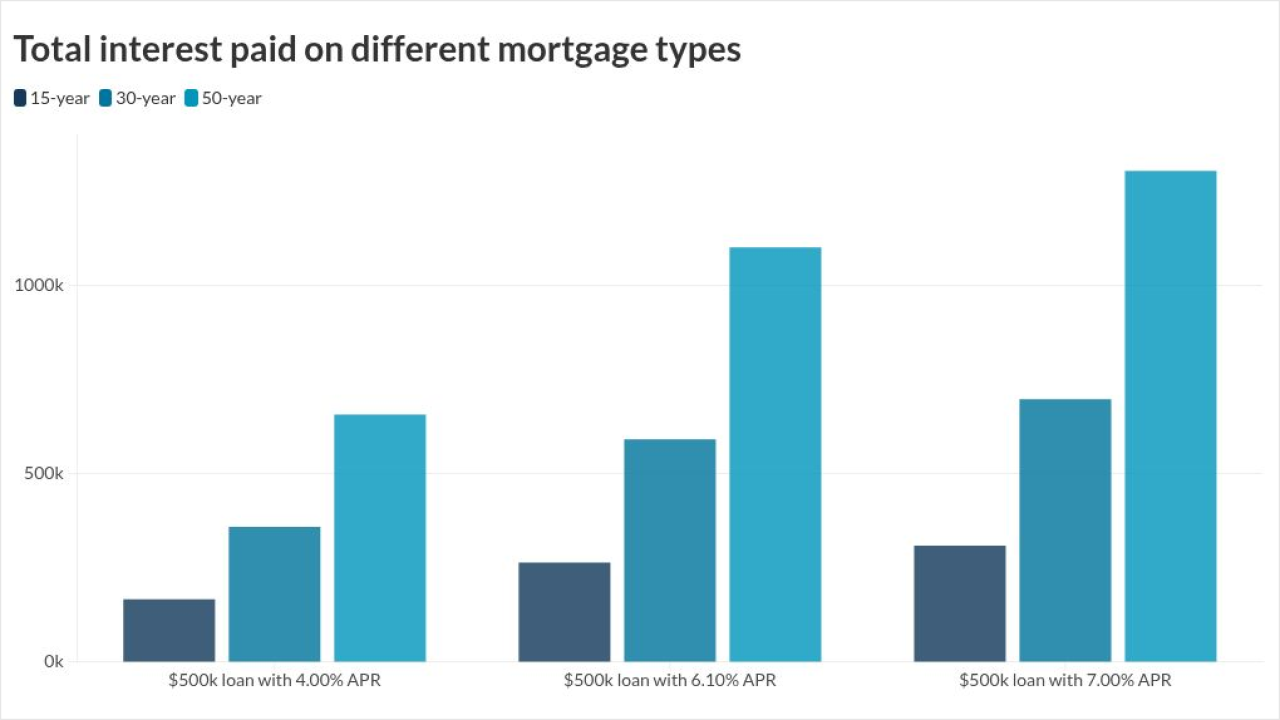

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

Rate-and-term refinances dropped 14% month over month in October, but were still up 143% from last year.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

Mortgage credit availability increased 2.3% to 106.8 last month, marking the fourth consecutive month of growth.

November 10 -

Investors have turned to private readings such as the Challenger, Gray & Christmas Inc. report showing companies announced the most job cuts for any October in over 20 years.

November 6 -

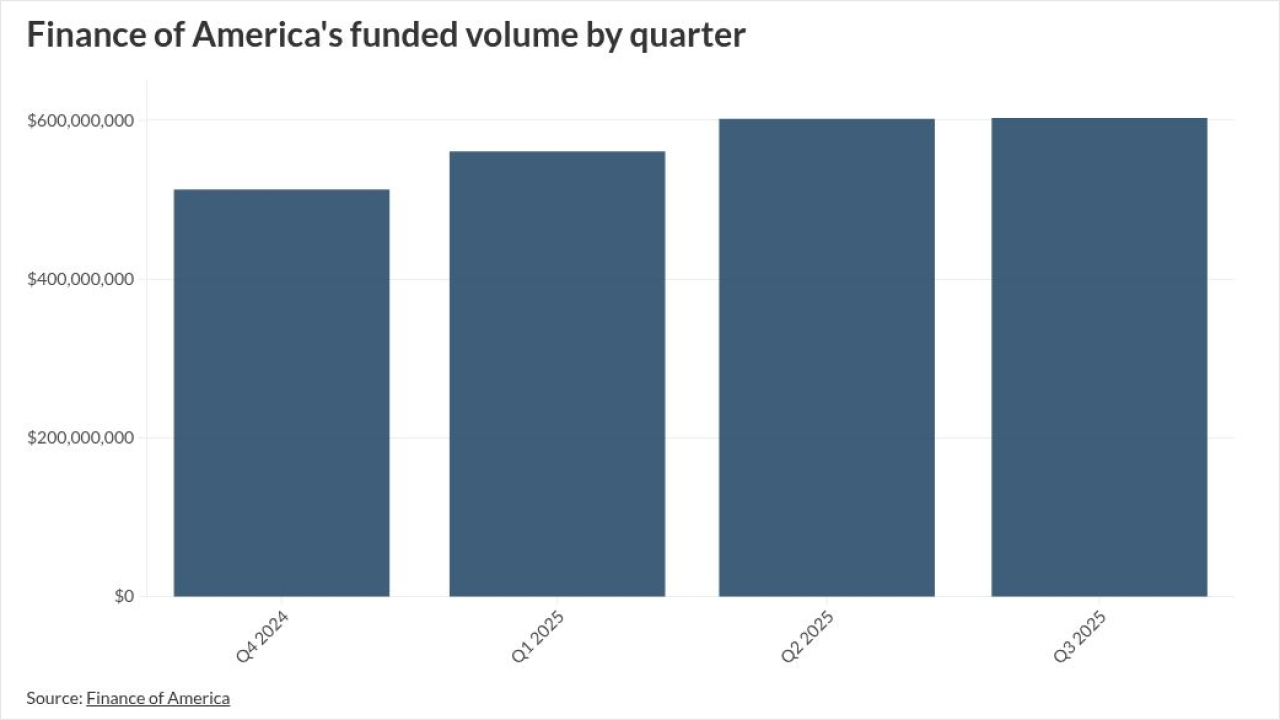

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

The 30-year rate dropped just 0.2 percentage points, as Federal Reserve Chair Jerome Powell's recent comments caused Treasury yields to rise.

October 30 -

An index of contract signings held at 74.8 after climbing a revised 4.2% a month earlier to the highest level since March, according to National Association of Realtors data released Wednesday.

October 29 -

Late-stage mortgage delinquencies hit the highest level since January 2020 in September, a new report from VantageScore found.

October 28 -

Bill Pulte's X post has the industry excited that loan level price adjustments could change, but the impact would not be as beneficial as some think, KBW said.

October 27