-

Leverage is moderate in Saluda Grade's pool, yet the junior liens carry slightly more LTV and DTI risk, on a weighted average (WA) basis.

February 4 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

The lender, which reported over $200 million in home equity line of credit volume in the recent quarter, suggests the business can deliver massive scale.

October 21 -

Small-business owners will be given the option to tap into anywhere from $50,000 to $500,000 in financing.

April 24 -

ACHM 2025-HE1 will repay notes using a pro-rata, sequential pay structure that must satisfy an overcollateralization test, and cumulative loss and delinquency triggers.

March 29 -

Unlike previous FIGRE deals where overcollateralization provided credit support to the notes, FIGRE Trust 2025-HE1 has a class G composed of principal-only notes that provide the credit support.

February 3 -

Newrez's servicing arm approved an "obviously counterfeit" HELOC request from a bad actor totaling almost $500,000, a complaint claims.

December 31 -

Aside from the pool primarily made up of second and junior liens in the pool, 82.2% of the loans were underwritten with alternative documentation.

November 1 -

None of the loans registered a delinquency in the past 24 months, and none had received a modification prior to the May 31 cutoff date.

June 24 -

One of the subordinate tranches, the BX is exchangeable, while credit enhancement levels on the notes range from 35.70% on the A1 notes to 3.5% on the B3 tranche.

June 18 -

Notes A, B and C benefit from credit enhancement amounting to 33.3%, 16.2% and 7.0%, and the deal's capital structure will repay investors on a combined pro-rata and sequential basis.

May 7 -

Price growth is decelerating but still driving historic home equity gains for owners and widening the gap between the haves and have-nots in housing, ICE finds.

May 6 -

Overall, the loans also have a weighted average (WA) FICO score of 742, an original cumulative loan-to-value ratio of 77.9%, and debt-to-income ratio of 37.5%.

December 12 -

Originators funded 72.6% of the loans in 2023, while 16.7% of the loans were funded in 2022 and originators funded the rest between 2021 and 2018.

December 7 -

Though home mortgage issuance has slumped in line with originations, new potential bank capital rules and increased consumer debt consolidation could boost activity for these two subsets in the secondary market.

October 23 -

Notes will be repaid through a modified sequential structure, which calls for the A-1 and M-1 through M-3 classes to receive principal on a pro-rata basis.

June 22 -

Among the nonperforming assets 44.01% are either in foreclosure or referred for foreclosure; 19.32% are in default; 7.17% are liquidated and 1.75% are in bankruptcy.

June 15 -

While first-quarter profits were up considerably, CEO Michael Nierenberg said the company will offer more products to counter market conditions that are “only going to get worse.”

May 3 -

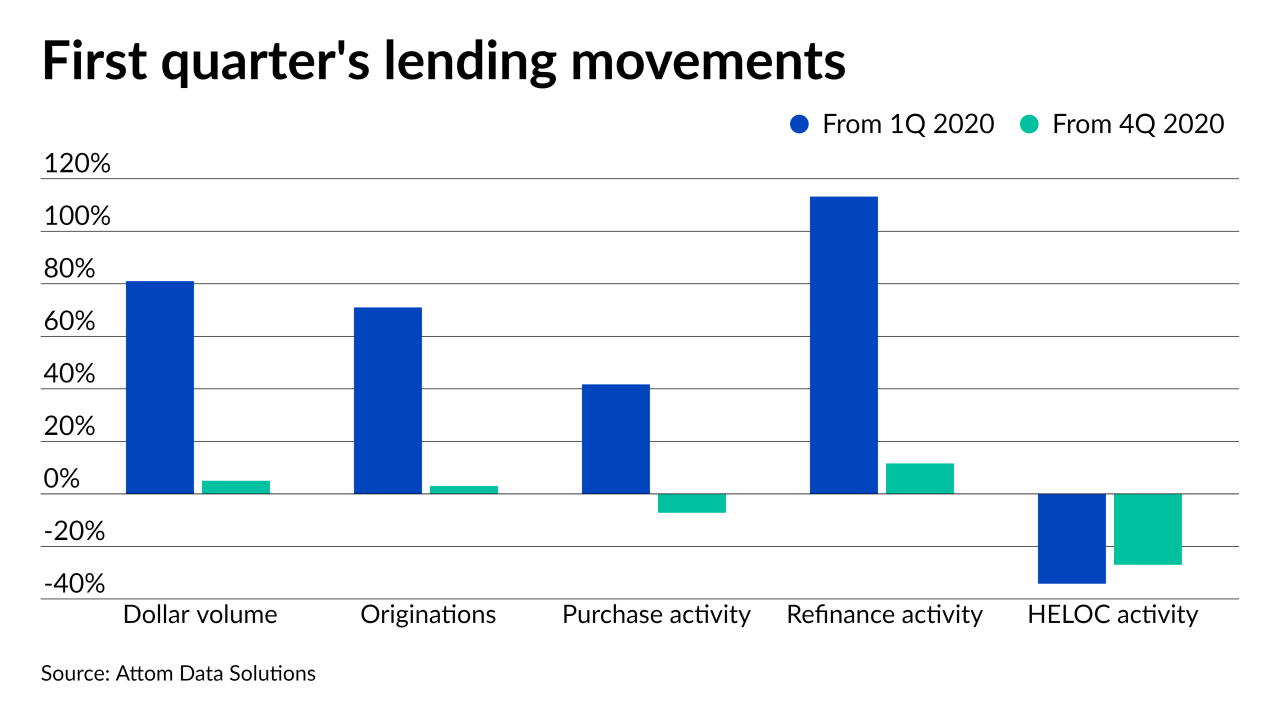

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

A majority of the loans are also junior-lien obligations, according to a presale report.

February 22