-

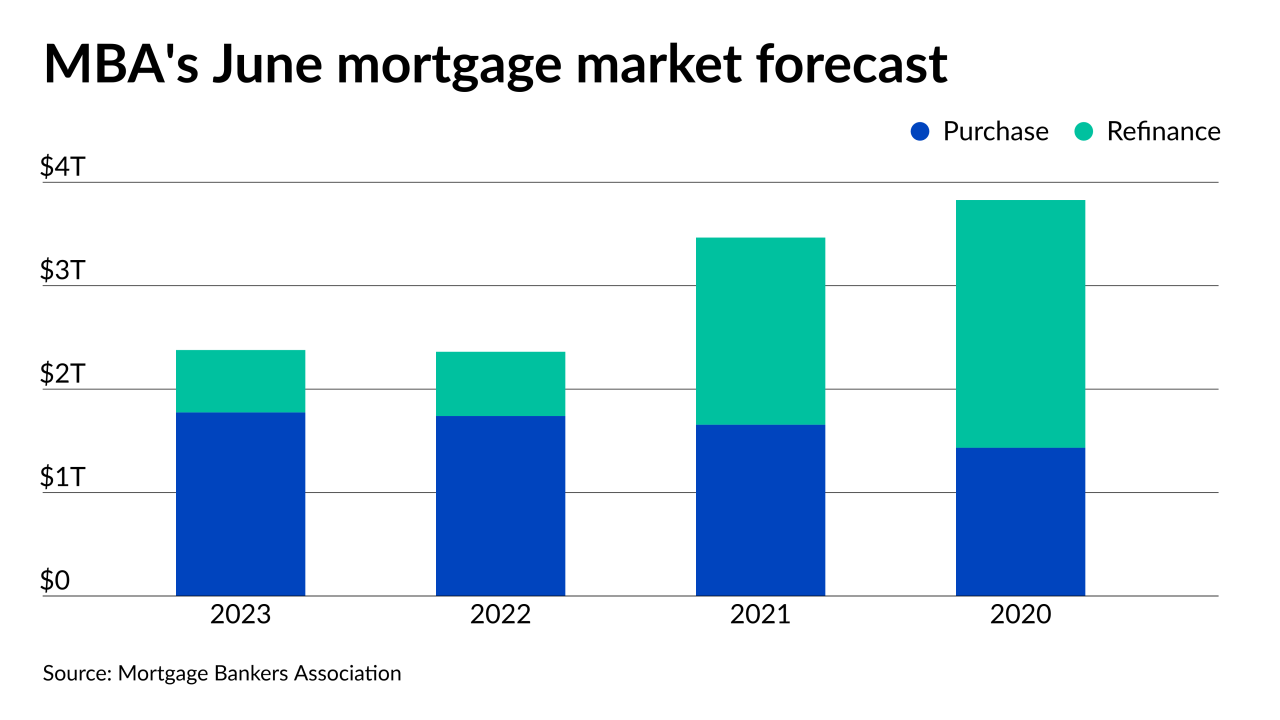

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

The agency’s new chief said eliminating the “adverse market fee” — in place since December — will make it easier for families to refinance while mortgage rates are still low.

July 16 -

“One” is the first in a series of non-agency mortgages the wholesaler plans to introduce this year.

July 15 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

Those handling loan modifications anticipate a growing secondary market for loans in forbearance as they budget cautiously for additional alterations of regulations down the road.

July 14 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

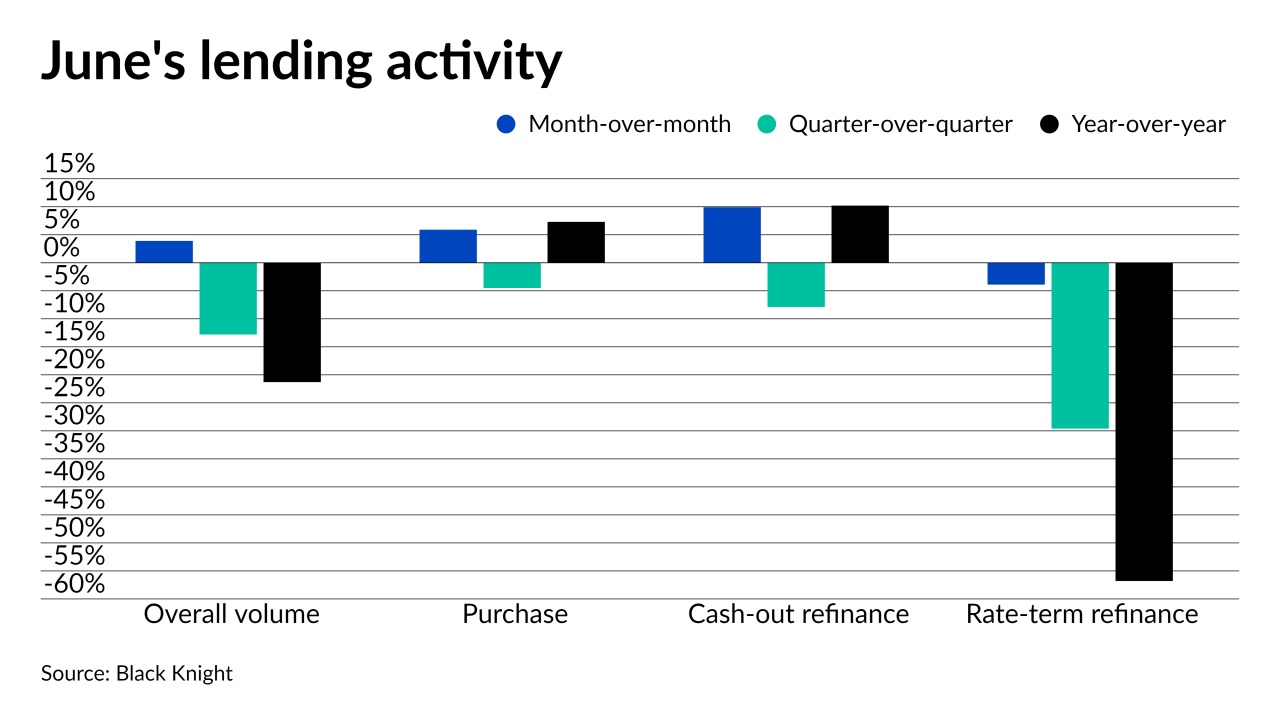

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

Consumer advocates and mortgage industry officials are urging Sandra Thompson, the new acting director of the Federal Housing Finance Agency, to undo many policies that her predecessor, Mark Calabria, put in place over the past year.

July 1 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28 -

The Consumer Financial Protection Bureau issued a temporary final rule that allows mortgage servicers to initiate foreclosures on abandoned properties and certain delinquent borrowers, but it also outlined additional measures that shield distressed homeowners.

June 28 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

The Supreme Court decision cleared the way for further revisions to the agreements between the Federal Housing Finance Agency and the Treasury, which could include dismissing the January changes.

June 25 -

The Community Home Lenders Association has called for suspension of federal limits on the loan volumes that Fannie Mae and Freddie Mac can purchase from individual lenders. The demand came on the same day that the Biden administration fired FHFA Director Mark Calabria and started the process of nominating his successor.

June 24 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

The data also showed that more purchase loans were made to low- and moderate-income borrowers last year, but fewer refinances.

June 18