-

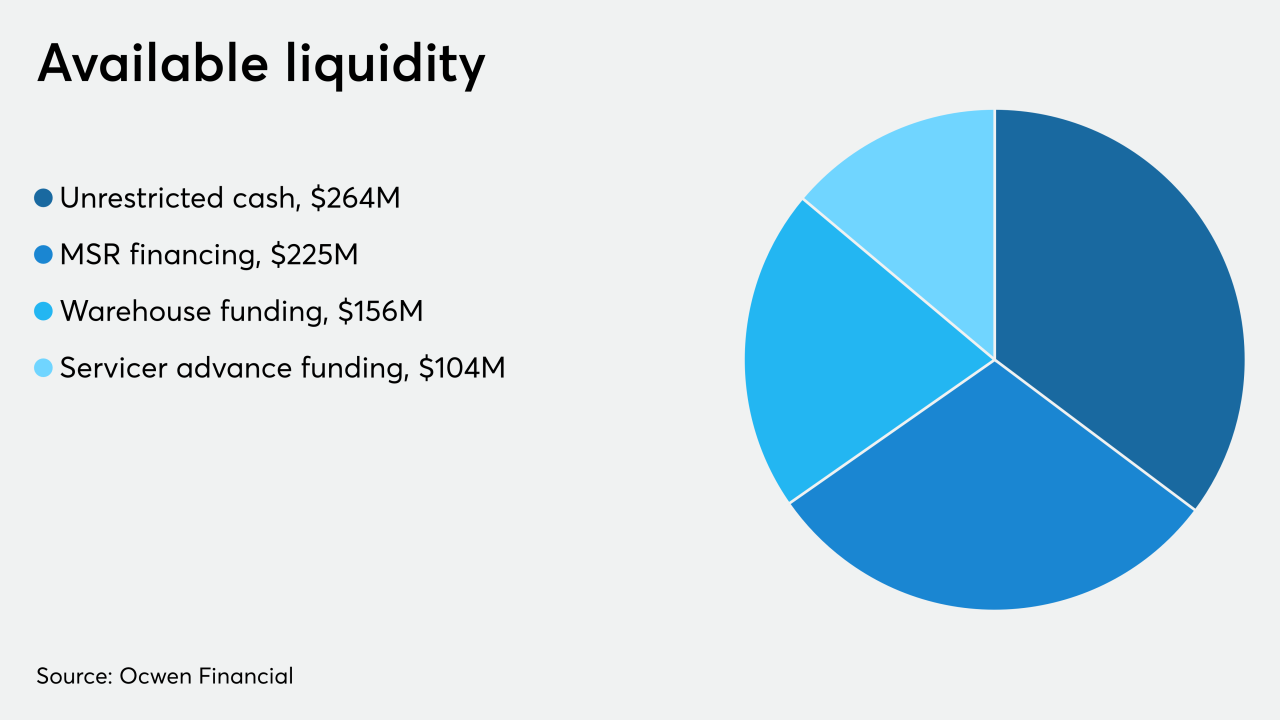

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

Real estate investor Tom Barrack said predicted a “domino effect” of catastrophic economic consequences if banks and government don’t take prompt action to keep commercial mortgage borrowers from defaulting.

March 23 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

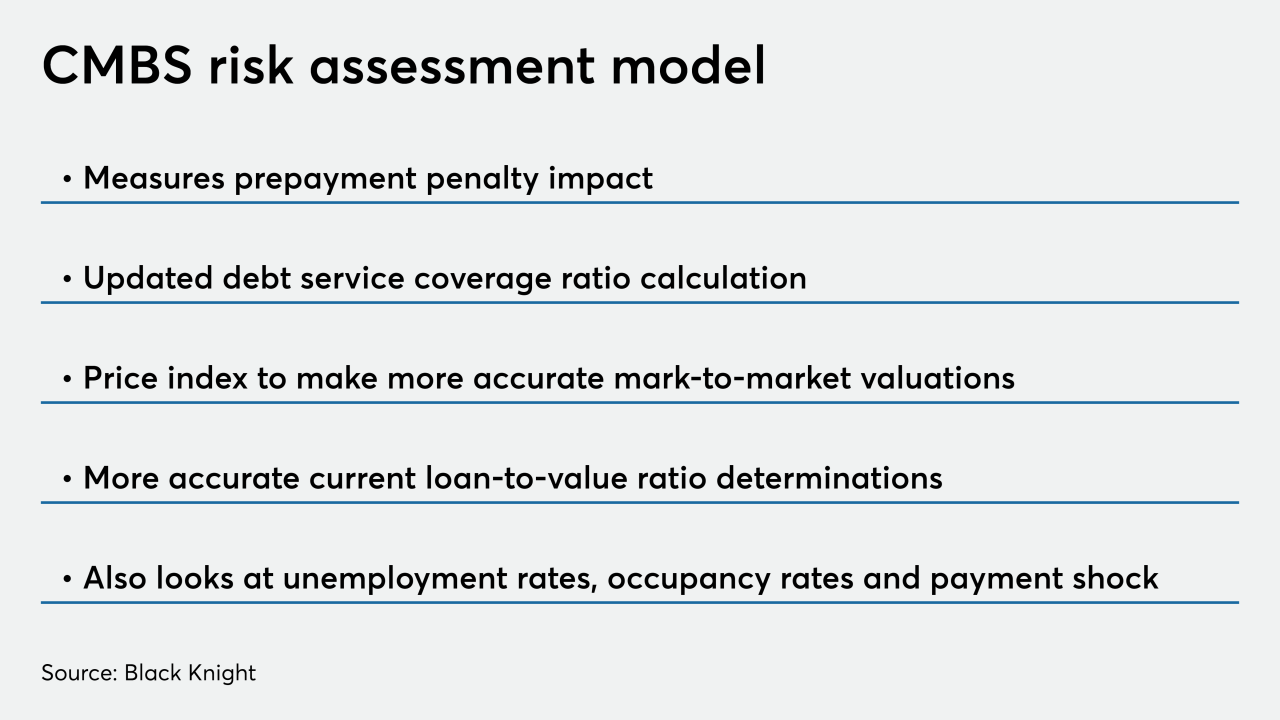

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

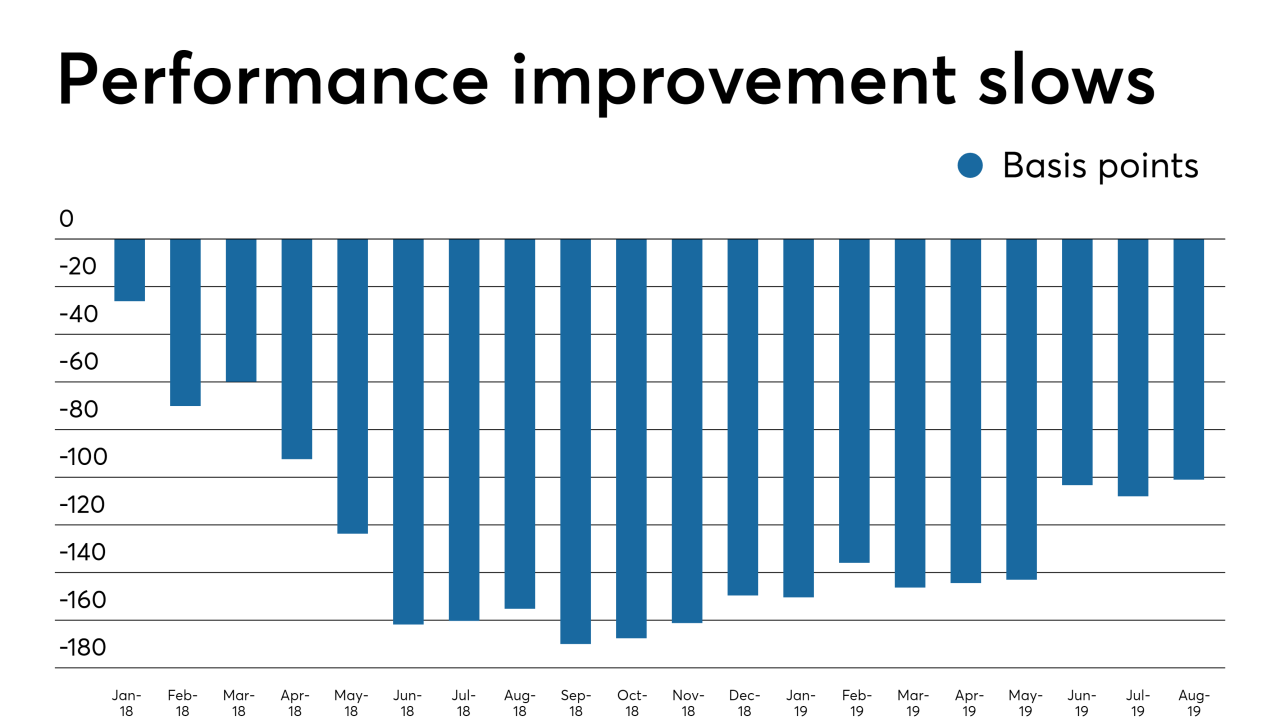

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The share of severely underwater mortgages shrunk by over two percentage points compared with a year ago, as these borrowers benefited from the rise in equity levels, Attom Data Solutions said.

November 7 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

Foreclosure activity fell 21% in July compared to a year ago and rose 6% from June after twelve consecutive months of declines, according to Attom Data Solutions.

August 26 -

The industry has long worried that the ability-to-repay rule gives borrowers an avenue to fight foreclosure, but one plaintiff’s experience may discourage others from trying.

August 15 -

Increased consumer debt and the threat of an economic downturn increase the default risk for government-sponsored enterprise mortgages during the first quarter, according to Milliman.

August 7 -

While seasonal factors were attributed to the monthly rise in mortgage delinquencies for June, the jump was still much higher than last year's fairly steady increase, according to Black Knight.

July 23 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29