-

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.22-28

January 28 -

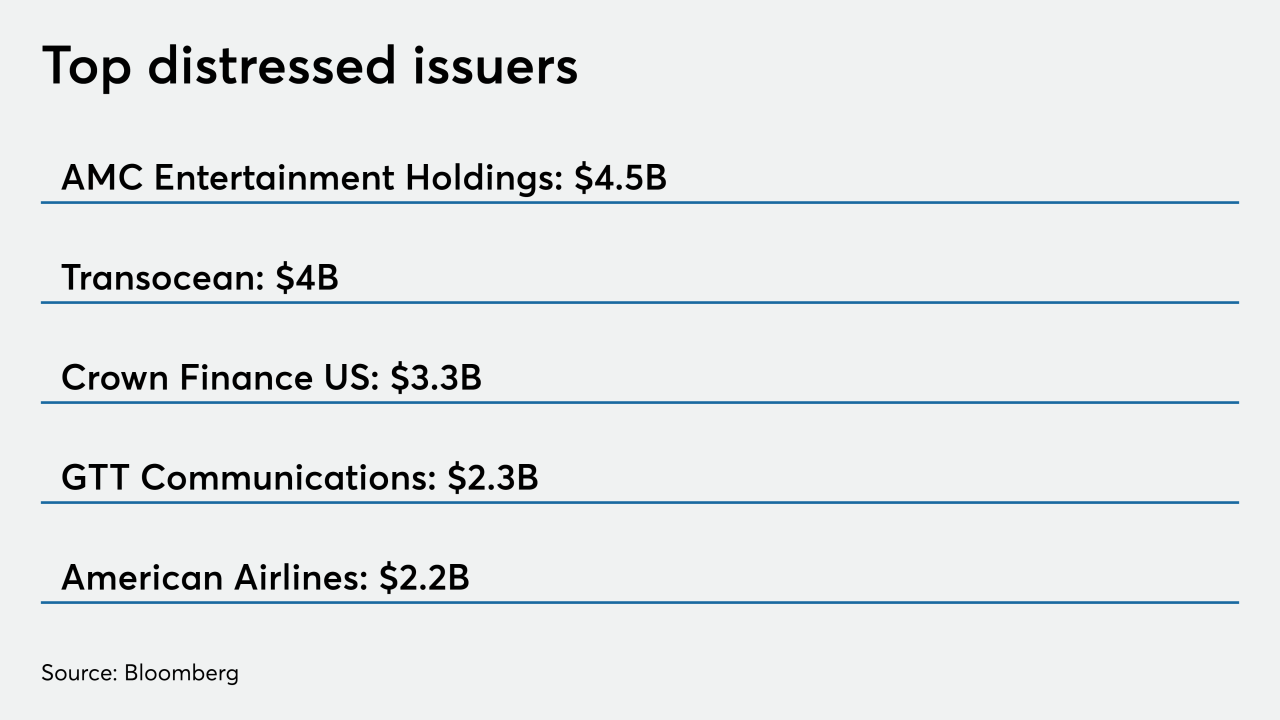

Cheap funding costs have extended a lifeline to many troubled companies, slowing the pace of U.S. bankruptcy filings, but shops, offices and hotels have been particularly vulnerable to the pandemic this month.

January 27 -

About $16 billion across 43 deals in both new-issue and refinancing has prompted analysts into making early revisions to raise their initial volume forecasts.

January 26 -

More may be on the horizon as lenders lose patience with defaulting property owners.

January 19 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

Distressed debt funds on average gained 11.4%, according to Hedge Fund Research Inc., compared to the riskiest corporate bonds rising 2.3%.

January 11 -

Although returns may be lower than in recent years, CLO securities (particularly the senior-rated tranches) remain very attractive compared to alternative investments.

January 8 -

The deal between San Francisco-based lender and Social Capital Hedosophia Holdings Corp. V is latest example of a closely held firm going public by merging with a special purpose acquisition company.

January 7 -

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

Bausch, formerly Valeant Pharmaceuticals, has paid down more than $24 billion of the $32 billion in leverage it owed five years ago from a debt-driven acquisition spree — which ended after a drug-pricing scandal.

January 4 -

The reference pools of mortgages supporting the credit-risk transfer notes sold by Fannie Mae and Freddie Mac were 'generally lower' in delinquencies per newly issued monthly reports, says DBRS Morningstar.

December 31 -

The buyout industry has about $3 trillion of unrealized value on its books, according to Preqin. And it’s tapping that to land loans for bolt-on deals, to refinance debt or bail out struggling companies in their portfolios.

December 31 -

Utilities earn a regulated return on investment in new stuff, so there are quantifiable gains to be made on greening their asset base.

December 30 -

The former property-assessed clean energy program administrator plans to sell off assets via Chapter 11, but PACE securitizations through its bankruptcy-remote trusts will continue to be backed by homeowner ad valorem assessments.

December 29 -

The three-year loan will boost the hotel-centered REIT's dwindling cash reserves battered by the COVID-19 global impact on travel.

December 28 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 18-23

December 23 - LIBOR

The likely extension of support of Libor until June 30, 2023 is a major plus for the securitization market, fending off potential market disruption the buying and trading of $1.8 trillion in outstanding asset-backed securities because of the planned cessation of the benchmark rate by the end of 2021.

December 22 -

The online lender, which raised $240 million, wants to take its artificial intelligence technology for evaluating borrowers to the next level and expand its partnerships with banks, its CEO says.

December 20 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 11-17

December 18