-

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

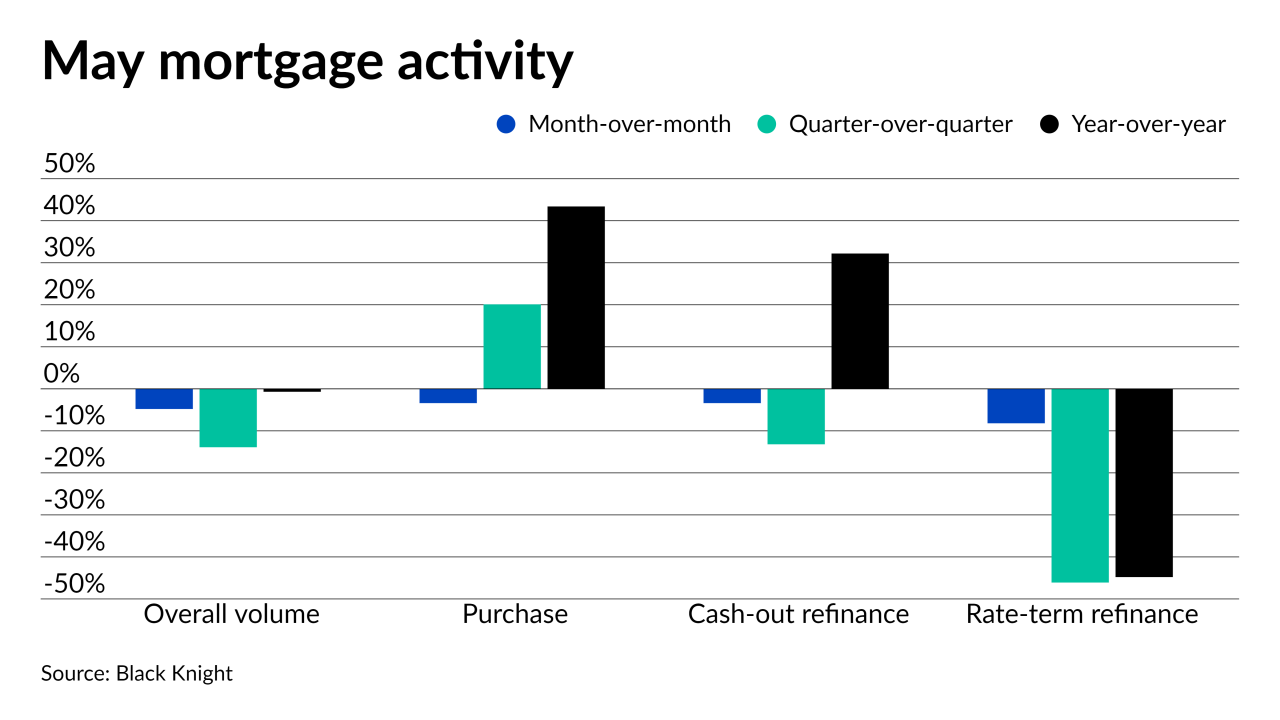

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

The race enters a complicated phase that could impact financial markets.

November 4 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1 -

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

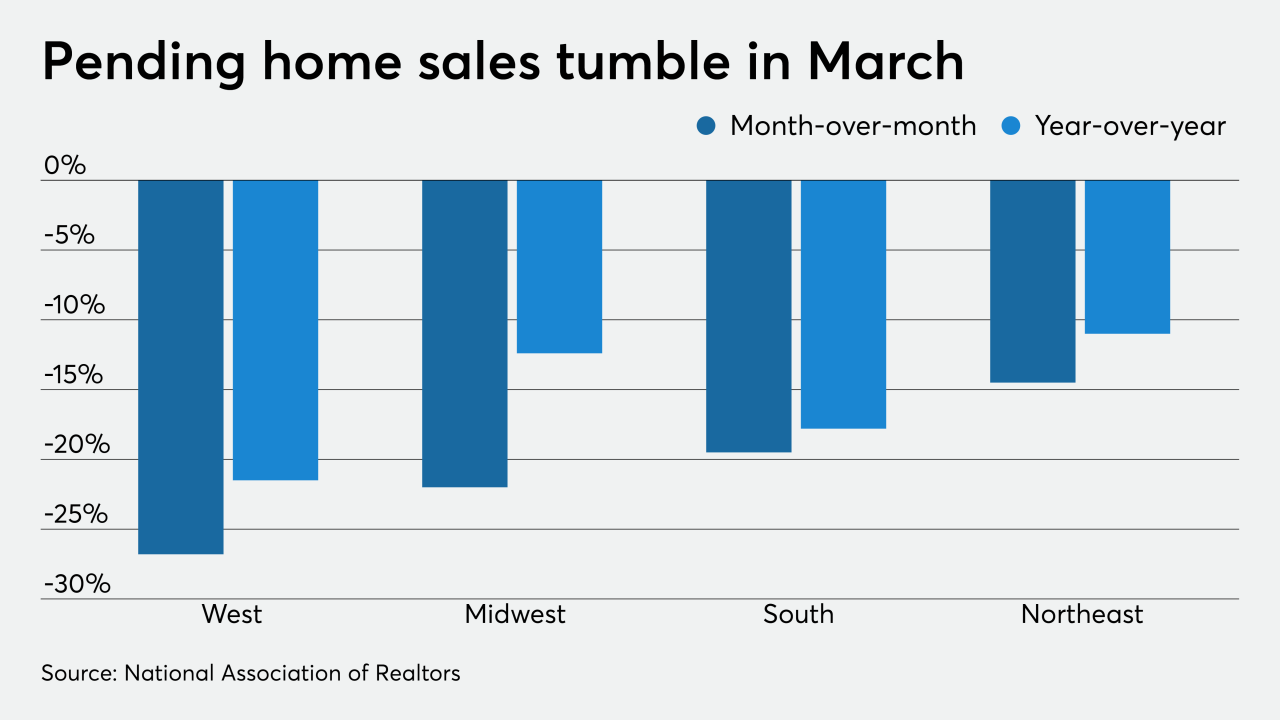

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

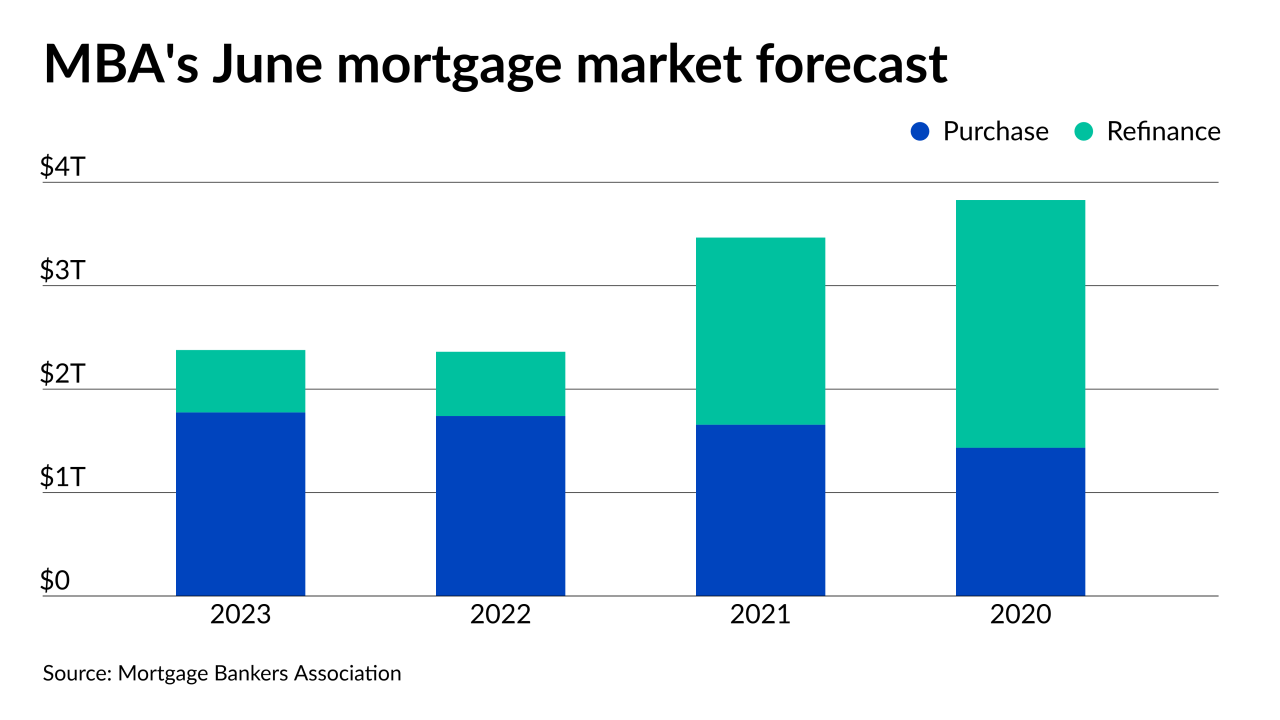

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

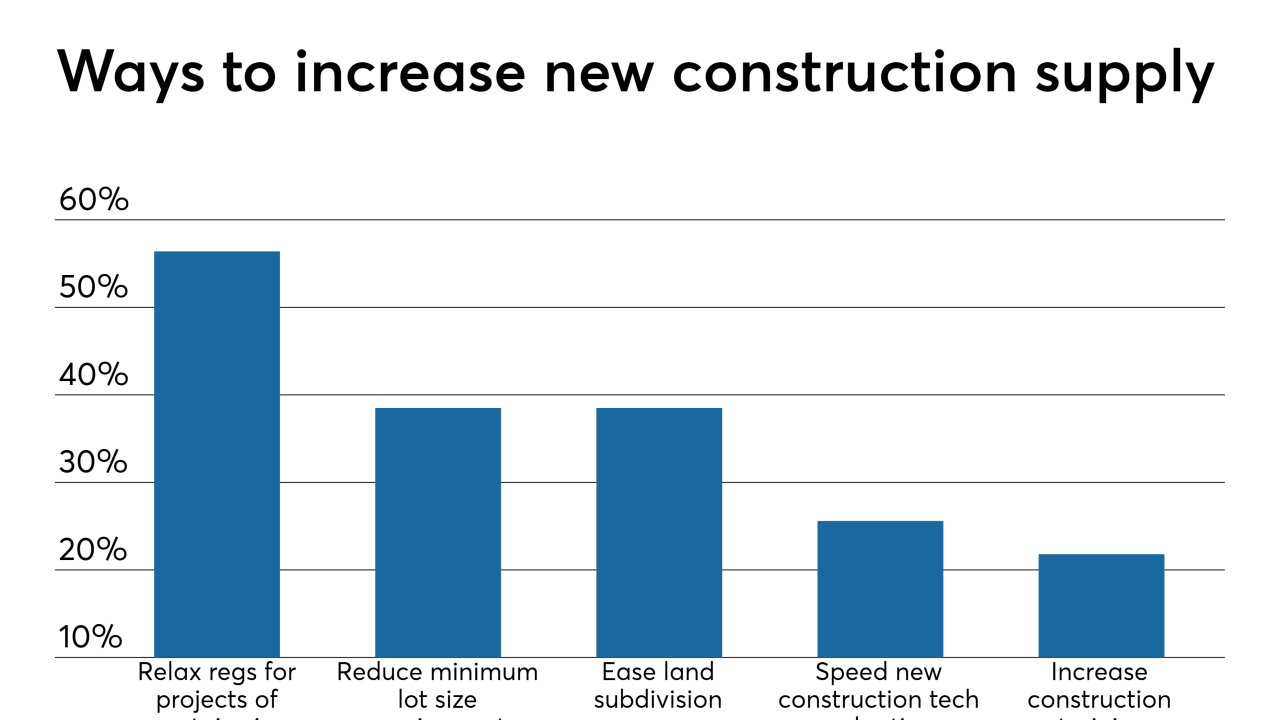

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

While talks of an impending recession pick up steam, the housing market remains fairly stalwart and won't be to blame this time around, according to Zillow.

August 16 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

Freddie Mac is now offering to buy a new form of manufactured housing loan with terms similar to that of conventional mortgages from all eligible lenders, following a test run last year.

May 2