-

Home starts fell more than forecast in August, reflecting less construction of apartments and a decline in the tropical storm-hit South, representing a pause in momentum for a housing market that's been a key source of fuel for the economy.

September 17 -

Potential sales last month rose compared with April as homes became more affordable due to low mortgage rates.

June 18 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

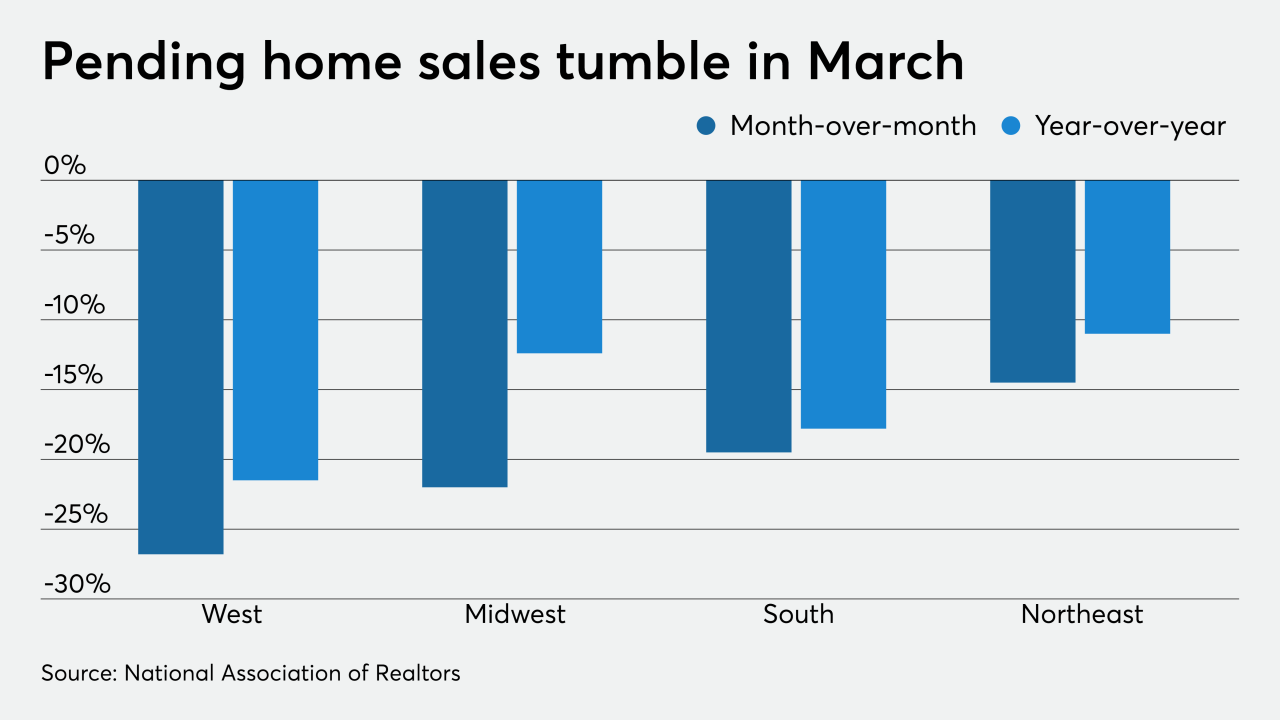

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

Consumer sentiment about purchasing a home nears its record high as almost half of those surveyed said mortgage rates will stay at the current low levels, according to Fannie Mae.

February 10 -

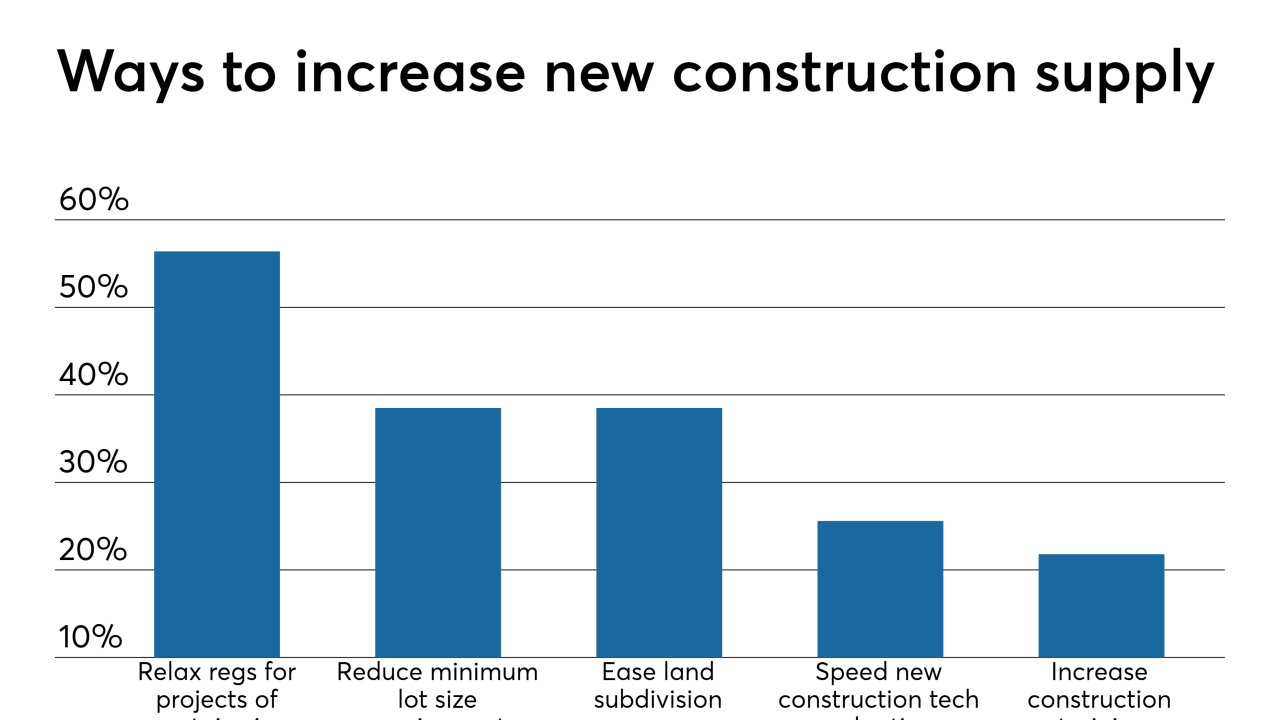

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

While talks of an impending recession pick up steam, the housing market remains fairly stalwart and won't be to blame this time around, according to Zillow.

August 16 -

Behind strong job markets, the shortage in housing supply and more millennials moving out, 2019 projects to be a record year for multifamily originations.

August 12 -

Freddie Mac is now offering to buy a new form of manufactured housing loan with terms similar to that of conventional mortgages from all eligible lenders, following a test run last year.

May 2