-

Industry leaders suggested they’ve "never felt so worried at a time when everything feels so good otherwise," said Chris Herbert, managing director of the Joint Center for Housing Studies of Harvard University.

June 23 -

Sales of previously owned homes unexpectedly increased to a one-year high as buyers rushed in ahead of a surge in mortgage rates, further depleting tight inventories to a record low.

February 18 -

An increase in the number of completed homes over the last two months and prospects of higher interest rates this year as the Federal Reserve tightens monetary policy may have encouraged a pickup in contract signings.

January 26 -

A measure of home prices in 20 U.S. cities jumped 18.3%, down from 18.5% in October, the S&P CoreLogic Case-Shiller index showed Tuesday. It marked the fourth straight month that home-price appreciation has cooled off ever so slightly.

January 25 -

While September's single-family starts were unchanged from the prior month, multifamily activity fell 5%, according to government data.

October 19 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

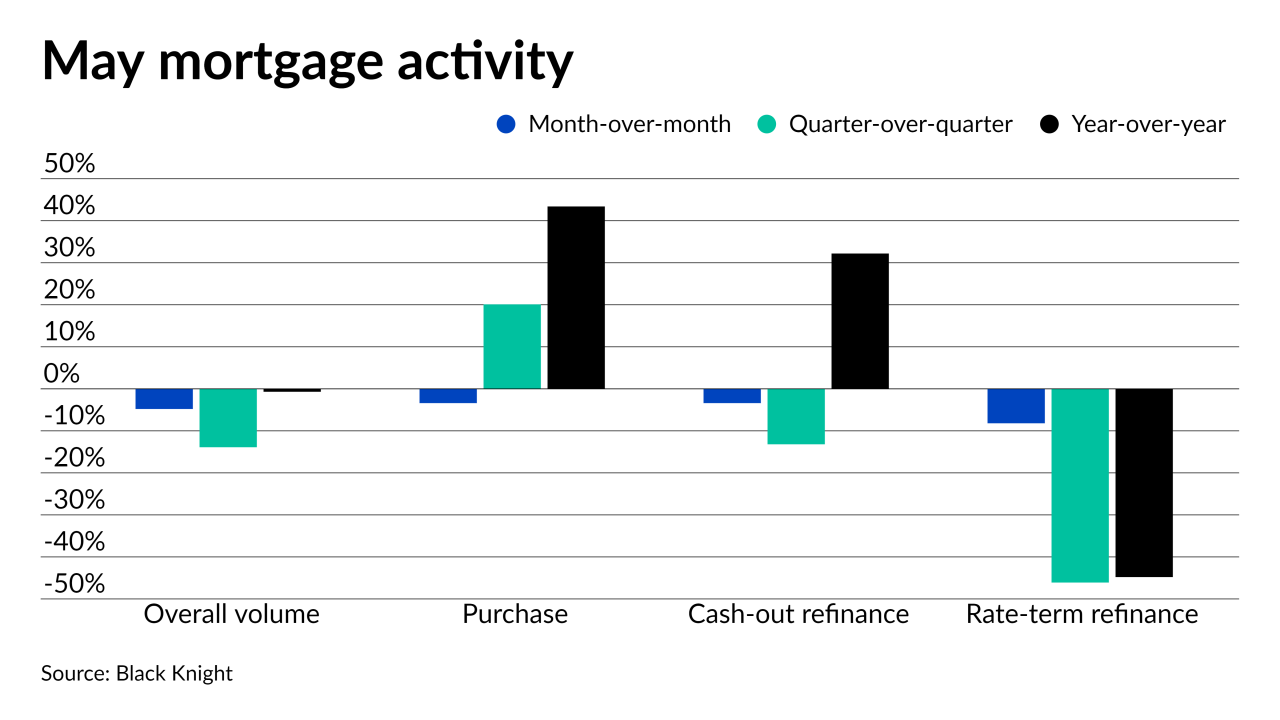

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

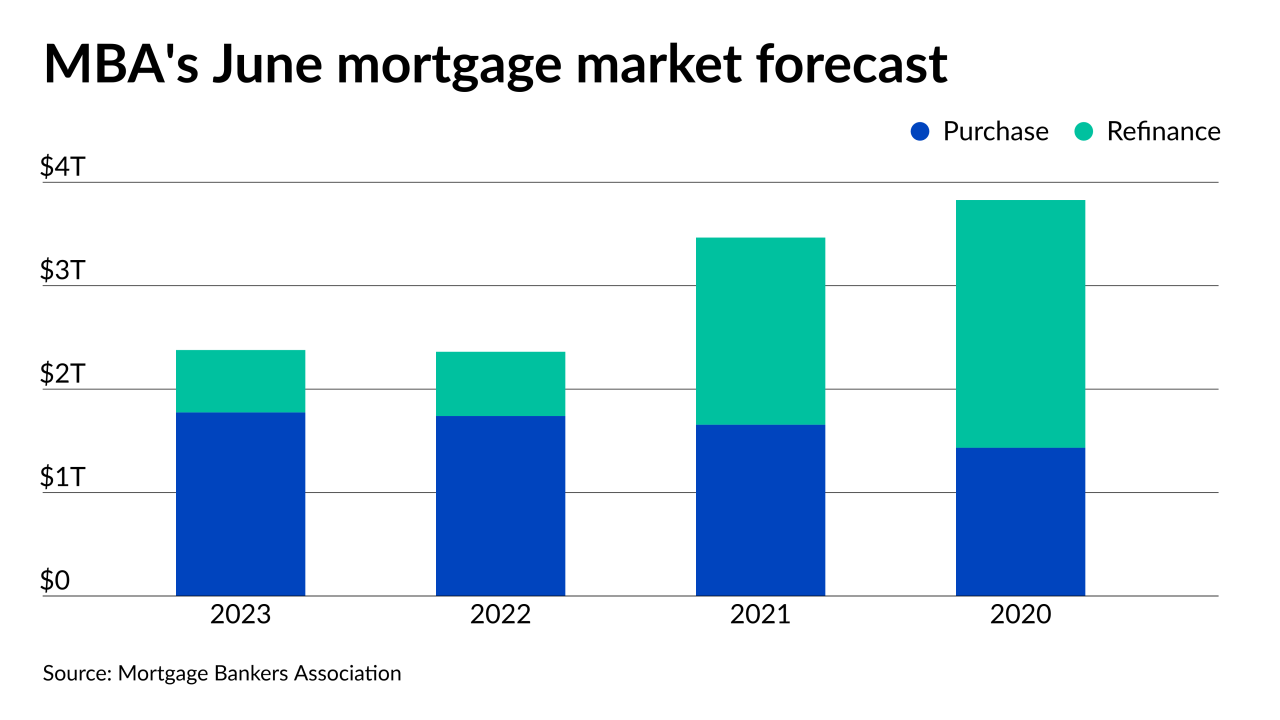

June 14 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

The race enters a complicated phase that could impact financial markets.

November 4 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

Mortgage rates fell back toward their all-time low this week, increasing purchasing power for homebuyers. But the lack of homes for sale drives up prices and reduces affordability, according to Freddie Mac.

October 1