-

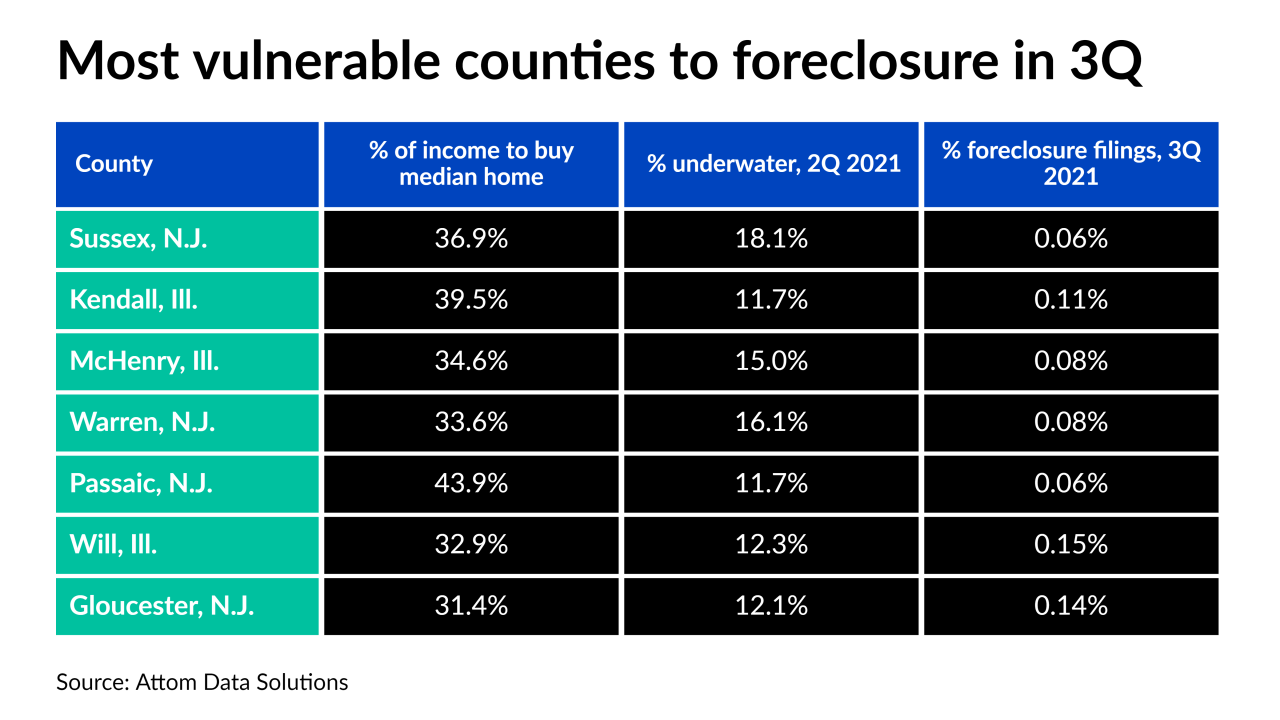

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The agency developed measures taking effect Aug. 31 that, among other things, will allow lenders to prioritize foreclosures of the most impaired loans and then focus on modifying salvageable ones.

August 11 -

The number of people exiting pandemic-related payment suspensions starting in September will be daunting to process, according to a Black Knight report published Monday.

August 2 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

The Consumer Financial Protection Bureau issued a temporary final rule that allows mortgage servicers to initiate foreclosures on abandoned properties and certain delinquent borrowers, but it also outlined additional measures that shield distressed homeowners.

June 28 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8