-

While the balance of newly delinquent loans fell by 50% from November, the ratings agency warned that many borrowers will likely struggle to bring loans current under ongoing pandemic conditions.

January 5 -

Reports indicate distressed owners would rather surrender their hotel or retail properties instead of negotiate workouts on delinquent loans as the pandemic spread carries on.

January 4 -

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The more-than-$550 billion market for bonds backed by U.S. commercial mortgages may face losses even after promising Covid-19 vaccines become widespread, as key parts of the real estate market may not return to full strength anytime soon.

December 8 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

Mortgage delinquencies dropped to the lowest level since March but, particularly at the seriously delinquent level, they're still much higher than pre-coronavirus rates, according to Black Knight.

November 23 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

While the overall rate fell in October, S&P noted a sharp rise in the proportion of loans overdue 60 days as many roll out of COVID-19 forbearance.

November 9 -

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

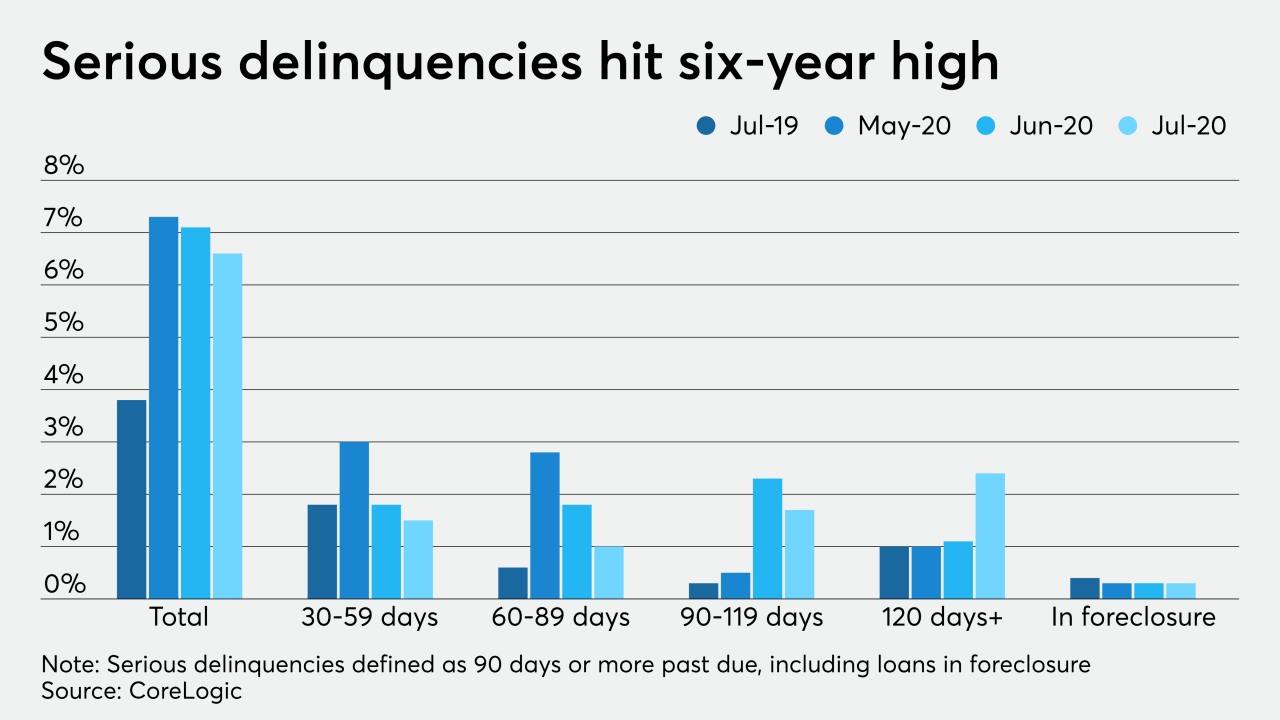

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

The Consumer Financial Protection Bureau's overhaul of its Qualified Mortgage standard is alarming free-market advocates who say it will precipitate a return to easy credit and higher defaults and could disproportionately harm minorities.

October 8 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

Deals, trends and research in structured finance and asset-backed securities for the week of Sept. 25-Oct. 1

October 1 -

Deals, trends and research in structured finance and asset-backed securities for the week of Sept. 18-24

September 24 -

“The Fed has made it clear that they don’t want a liquidity problem in the Treasury market or the higher-grade corporate market,” Fuss said. “They cannot, unfortunately, underwrite lending in the private markets.”

September 23 -

A new report on bank-held commercial real estate and C&I loans indicates troubled borrowers may be skipping payments on loans they won't be able to refinance or extend over the next year, leading to a potential wave of defaults over the next four to six quarters.

September 15