-

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23 -

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

March 23 -

Nonbanks hold a disproportionate percentage of the worst-rated loans, but banks hold a majority of the market, and risk management safeguards are largely untested, according to an interagency report on shared national credit.

January 31 -

The six bills championed by Democrats aim to reduce consumer burdens and provide opportunities for borrowers to rehabilitate their credit, but the legislation has garnered no Republican support.

January 28 -

The FHFA’s attempt to move some of its balance sheet into the private sector could leave investors with greater liabilities than they were initially told.

January 2 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

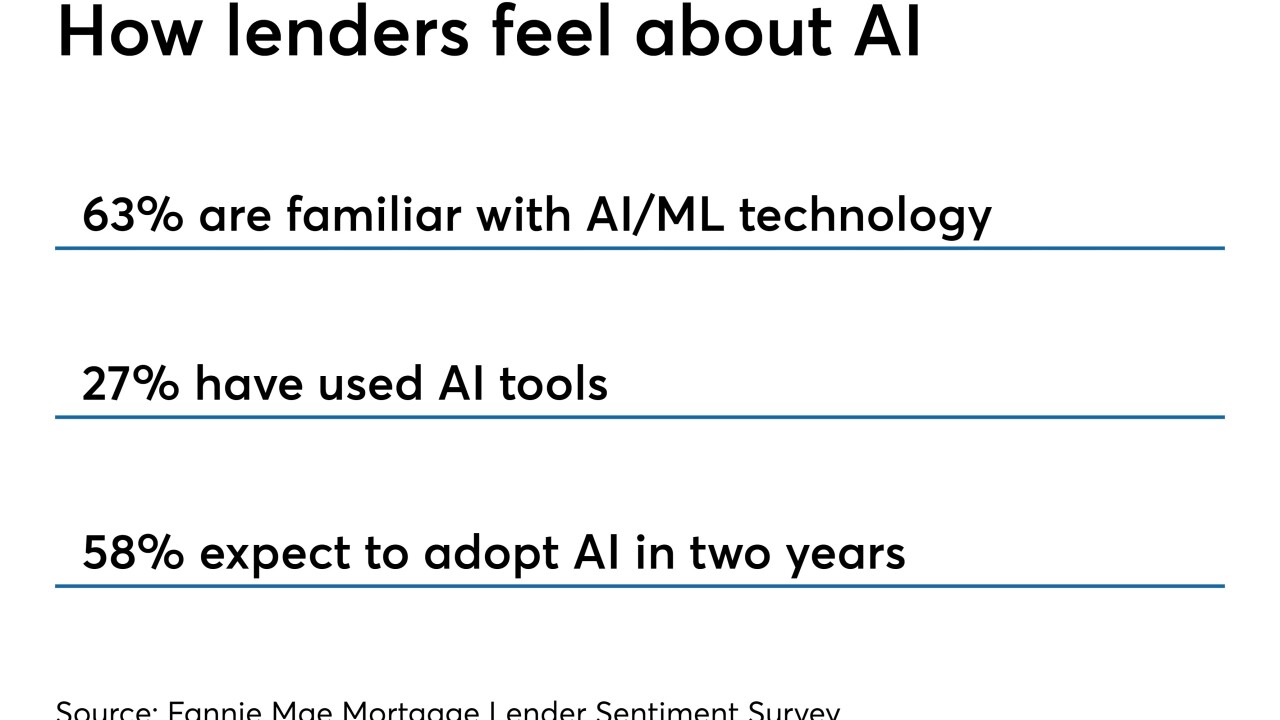

Financial regulators’ statement cautiously encouraging lenders to go beyond traditional underwriting in their lending decisions is a big step forward for the use of alternative data and artificial intelligence, bankers say.

December 16 -

Casting aside recession fears, the credit bureau predicts credit cards, mortgages, auto loans and unsecured personal loans should all perform well — including those extended by online lenders.

December 12 -

Many business customers are putting off expansion because they can’t find enough workers to fill available jobs.

December 11 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22 -

Mortgage activity fell at the start of the year, but lower mortgage rates are boosting refinance volume, and Generation Z is starting to creep into the housing market, according to TransUnion.

August 14 -

The regulator of the government-sponsored enterprises retreated from an earlier proposal that had barred VantageScore because of its ties to the credit bureaus.

August 13 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

Though the use of alternative data in lending is seen by some as untested, several fintechs say they couldn't function without it.

August 5 -

After rising between 2016 and 2018, the card issuer's charge-off rates are now steady. The trend reflects both the impact of tighter underwriting standards and the continued resilience of U.S. consumers.

July 19