-

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

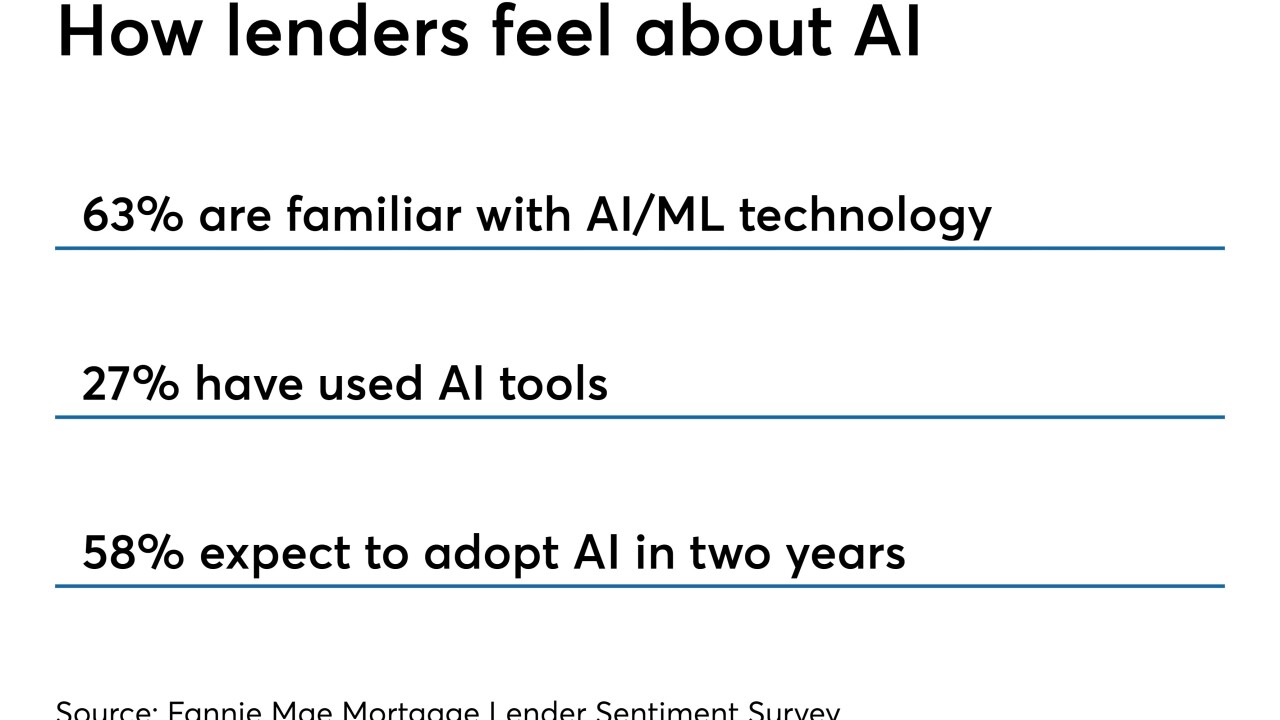

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22 -

Mortgage activity fell at the start of the year, but lower mortgage rates are boosting refinance volume, and Generation Z is starting to creep into the housing market, according to TransUnion.

August 14 -

The regulator of the government-sponsored enterprises retreated from an earlier proposal that had barred VantageScore because of its ties to the credit bureaus.

August 13 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

Though the use of alternative data in lending is seen by some as untested, several fintechs say they couldn't function without it.

August 5 -

After rising between 2016 and 2018, the card issuer's charge-off rates are now steady. The trend reflects both the impact of tighter underwriting standards and the continued resilience of U.S. consumers.

July 19 -

A bill by Rep. Patrick McHenry, R-N.C., would give the CFPB authority to oversee cybersecurity efforts at the credit bureaus.

July 19 -

In a downturn, some fintechs, such as independent lenders, will be more vulnerable to economic forces than those working to service banks' regulatory needs.

June 28 -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 25 Kabbage Inc.

Kabbage Inc. -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

Lawmakers waded into a growing debate about the threat posed by corporate credit risk.

June 4 -

The Consumer Financial Protection Bureau received over a quarter-million complaints in 2018, according to analysis by an advocacy group that urged the agency to maintain public access to its database.

May 12 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

A quarterly IACPM survey shows far fewer credit managers planning for widening spreads this spring, staving off concerns for now of deteriorating credit conditions and macroeconomic troubles.

April 18 -

More consumers were late in paying two major types of loans in the latest figures from the American Bankers Association, but it appears to be a relatively isolated problem.

April 11 -

Rep. Gregory Meeks of New York signaled which legislative provisions Democratic leaders would accept in a bipartisan housing finance package.

April 2