-

Navient Corp. is returning to all fixed-rate collateral for its next securitization of refinanced private student loans issued via its Earnest affiliate to high-earning college graduate professionals.

May 1 -

The surge in originations during the first quarter more than offset a decline in demand for new leases.

April 30 -

Kroll has again downgraded the subordinate note classes for Honor Automobile Trust Securitization 2016-1, with total losses expected to build to $7 million to $8 million.

April 29 -

The $350 million GLS Auto Receivables Trust 2019-2 transaction is being issued on the heels of the lender's record $453.2M 1Q volume in originations.

April 24 -

A panel of federal judges determined that Think Finance and an online tribal payday lender must comply with state interest rate and licensing laws.

April 24 -

For the first time, the marketplace lender d/b/a Best Egg is securitizing loans from High Yield Prime borrowers who don't qualify for its prime loan products.

April 22 -

Democratic presidential candidate Elizabeth Warren proposed eliminating student-loan debt for an estimated 42 million Americans with a wealth tax

April 22 -

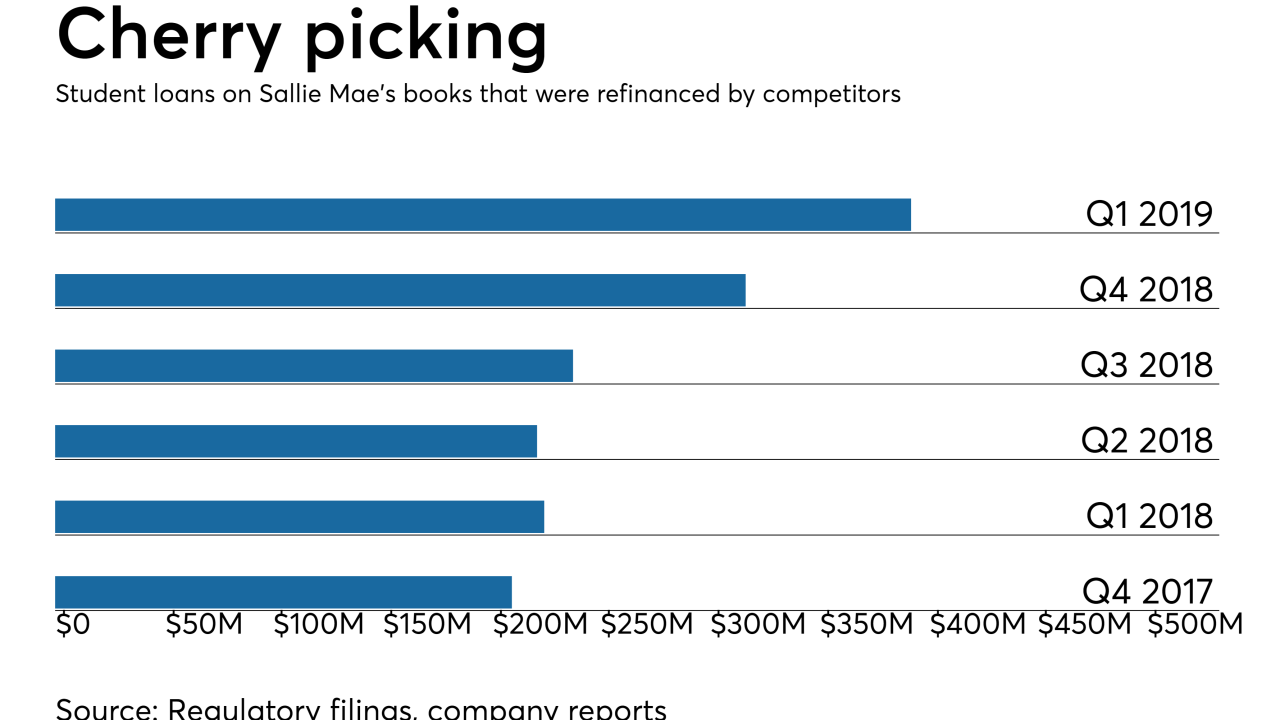

SLM Corp. wants to "target the people our competitors are targeting and bring on their federal balances" CFO Steven McGarry said during an earnings call.

April 18 -

Measures of loan performance were generally better than expected at Ally, American Express, Synchrony and Sallie Mae. Their 1Q reports suggest that consumers remain able to meet their obligations despite a long run-up in debt.

April 18 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

The Federal Trade Commission accused the online lender of numerous violations in connection with its loan servicing practices. In one example, Avant allegedly informed customers that they could make payments by credit card or debit card but then refused to accept such payments.

April 15 -

Two deals Exeter completed in 2018 are performing worse than Moody's expected so its looking for additional losses on this deal; S&P sees losses in the same range as four prior deals.

April 12 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

More consumers were late in paying two major types of loans in the latest figures from the American Bankers Association, but it appears to be a relatively isolated problem.

April 11 -

Losses on Conn’s consumer loans are stabilizing, and the electronics and appliance store chain sees an opportunity to reduce the level of credit enhancement for its latest securitization.

April 11 -

The San Francisco fintech, which uses artificial intelligence to make consumer credit decisions, has raised an additional $50 million. It also announced new partnerships with lenders and plans for a credit card.

April 8 -

The regional direct lender caters to very risky and highly leveraged borrowers (507 FICO, 163.95% LTV), but is offering relatively little credit enhancement compared to its peers.

April 5 -

The lawmakers are questioning the agency about its oversight of student loan servicers involved in a federal loan forgiveness program.

April 5 -

The proposed rollback of underwriting requirements for small-dollar lenders could redefine a legal doctrine that governs rules affecting other companies as well.

March 29 -

Assemblywoman Monique Limon is in the “early stages” of exploring how to create a state-level Consumer Financial Protection Bureau as part of a broader push for more consumer protection for state residents.

March 27