Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

The sale consists of $363 million of seasoned first-lien whole loans in default within Freddie Mac's mortgage-related investments portfolio. The loans are being serviced by

The mortgages to be sold are being split into four pools. There are three standard pool offerings where the bids are due on May 7.

The fourth pool is being marketed as an extended timeline pool offering. Freddie Mac targets participation by smaller investors, including nonprofits along with minority, women, disabled, LGBT, veteran or service-disabled veteran-owned businesses, or MWDOB for short.

The deadline for the extended pool is May 21. The sales are expected to settle in July 2019.

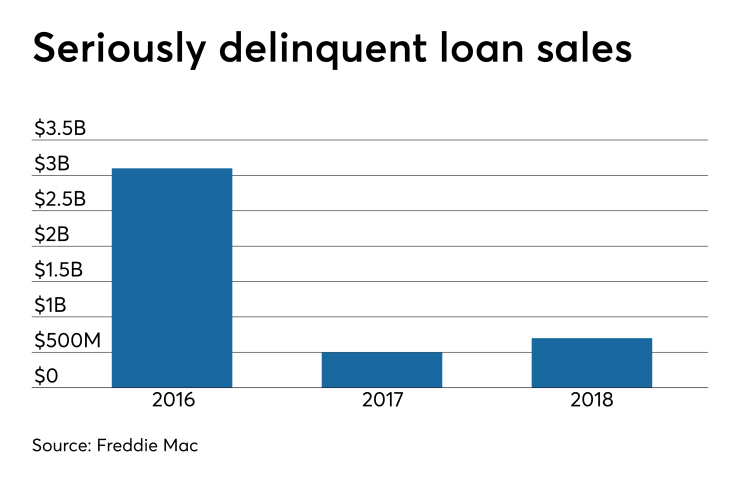

During 2018, Freddie Mac sold approximately $700 million of seriously delinquent mortgages from its portfolio, according to its year-end Securities and Exchange Commission filing.

Of the $20.9 billion of single-family mortgage held-for-sale on its balance sheet as of Dec. 31, 2018, $2.6 billion were considered to be seriously delinquent.

The previous year, it sold approximately $500 million. The held-for-sale portfolio on Dec. 31, 2017 was $17 billion, with $2.1 billion deemed seriously delinquent.

Freddie Mac had

Its legacy and relief refinance single-family loan portfolio had a seriously delinquent rate of 1.93%, down from 2.59% at Dec. 31, 2017, while the core single-family portfolio it was 0.22%, down from 0.35%.