-

The executives were hired for their focus on loan origination, portfolio management and securitization.

June 17 -

Foursight's first deal of 2019 has a rising 36.6% share of subprime borrowers from its lower-tier loan programs.

June 13 -

The CFPB issued a final rule late Thursday to delay the compliance date for mandatory underwriting provisions of the 2017 payday lending rule.

June 7 -

The agency's vote Thursday threatens to block many of the industry's communications with customers, though banks did win one concession.

June 6 -

A decline in average FICO and recent loss levels in AmeriCredit's securitizations prompts Moody's to project slightly higher credit losses in the new transaction compared to previous rated deals.

May 31 -

The collateral will include $147.3 million in well-seasoned loans that were part of HESAA’s 2009 issuance, as well as up to $155 million in new loans that the trust will originate through an Oct. 31, 2020 prefunding and recycling period for the next academic calendar year.

May 28 -

S&P Global Ratings reports that cumulative loss levels on collateralized portfolios of subprime auto loans fell to 7.11% in March, compared to 8.67% in February. That figure was also down from 7.61% in March 2018, and the lowest since 2016.

May 28 -

Kathy Kraninger, the bureau's director, is in a standoff with Democrats about her claim that the agency cannot supervise institutions under the Military Lending Act.

May 27 -

A Davis & Gilbert poll of market participants showed more expect delinquencies over the next one to two years, likely requiring credit enhancement in future deals.

May 22 -

The AGs say the agency's plan to rescind ability-to-repay requirements for payday loans would undermine states' ability to enforce their own laws.

May 17 -

S&P Global Ratings forecasts lower losses in subprime lender American Credit Acceptance's next auto-loan securitization, citing the inclusion of performing loans transferred from a recently called deal.

May 16 -

Regions Financial said Thursday that it will not renew its contract with GreenSky — a move analysts say could prompt other banks to re-examine their lending arrangements with the fintech.

May 16 -

The official told lawmakers Thursday that the research underlying the bureau's 2017 payday rule proposal did not support strict underwriting requirements of small-dollar loans.

May 16 -

The portion of Americans with a car loan climbed to 35% last year from just 20% in 1999, the New York Fed said in a blog post. Auto loans first overtook mortgages in 2013 and have pulled further ahead every year since.

May 15 -

It’s no coincidence that with more than half of consumers ages 20 to 29 now holding credit cards — up from 41% in 2012 — 90-day delinquency rates are at a seven-year high, according to the New York Fed.

May 14 -

Santander Drive Auto Receivables Trust 2019-2 has a lower average FICO (600) and lighter seasoning (two months) compared to SDART 2019-1.

May 8 -

The Atlanta company reported a first-quarter revenue increase of 22%, and it has established a more aggressive target for the full year.

May 7 -

The long-awaited proposal includes safe harbors to protect collectors from getting sued, but would restrict phone collection attempts and allow borrowers to opt out of receiving other communications.

May 7 -

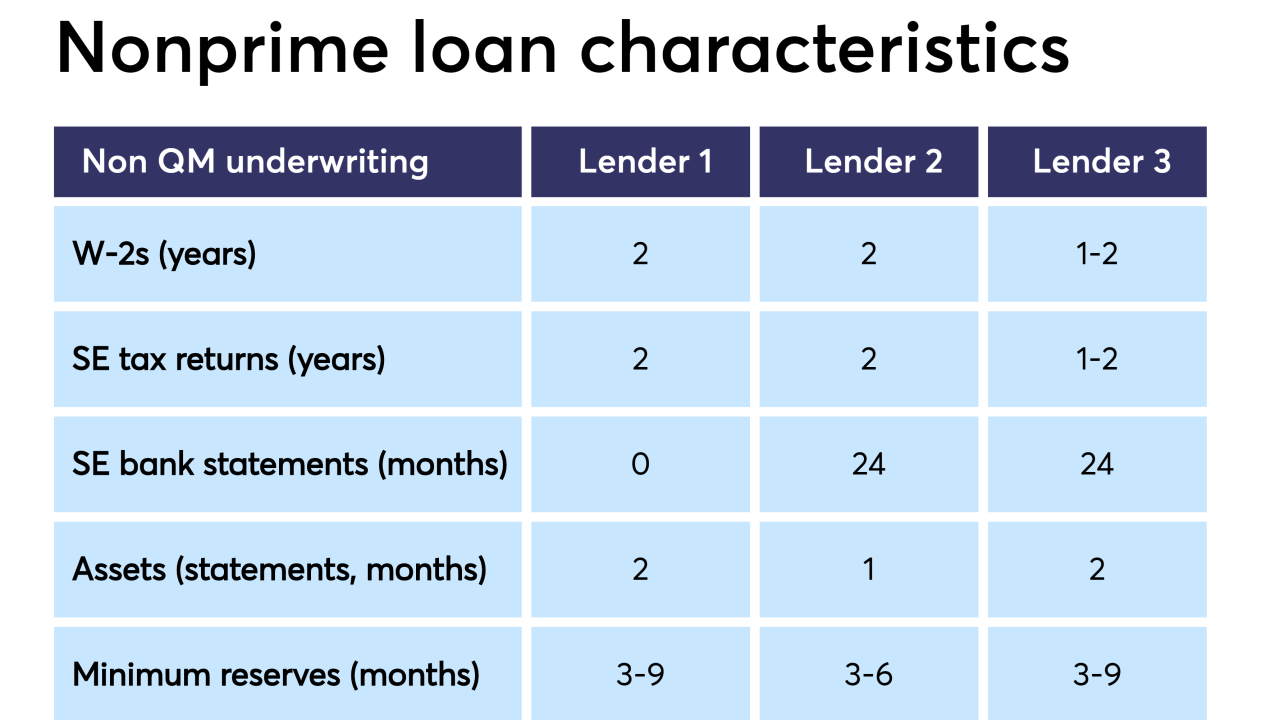

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

DT Auto Owner Trust 2019-2 will issue five classes of notes, collateralized by $550 million in auto loans issued through company-owned "buy here-pay here" dealerships.

May 2