-

Neuberger Berman Loan Advisors CLO 26 builds the Dallas-based manager's assets under management to $5.5 billion.

October 25 -

Four new CLOs have been priced in the last week inside of 120 basis points over Libor, a rarely breached floor for most of 2017.

October 20 -

A wave of corporate loan refinancings is putting collateralized loan obligations afoul of a covenant designed to safeguard their own investors.

October 11 -

HPS Investment Partners is adding a new name to one of its legacy Highbridge CLOs, as well as piling on extensive changes to note structure, deal terms and restrictions on some higher-risk assets.

October 10 -

Just $7.6 billion of deals were refinanced or reset in September, bringing the total for the third quarter to $27.2 billion, far short of the pace of the first half, when approximately $138 billion was reworked.

October 9 -

A report released Friday calls risk retention "an imprecise mechanism" for encouraging the alignment of interest between sponsors and investors. It recommends creating loan-specific requirements under which managers would receive relief.

October 6 -

The $456.9 million LCCM 2017-FLI is secured by 19 commercial mortgages, the largest of them an amended and restated loan on Two Gateway, an office building in downtown Newark, New Jersey.

October 3 -

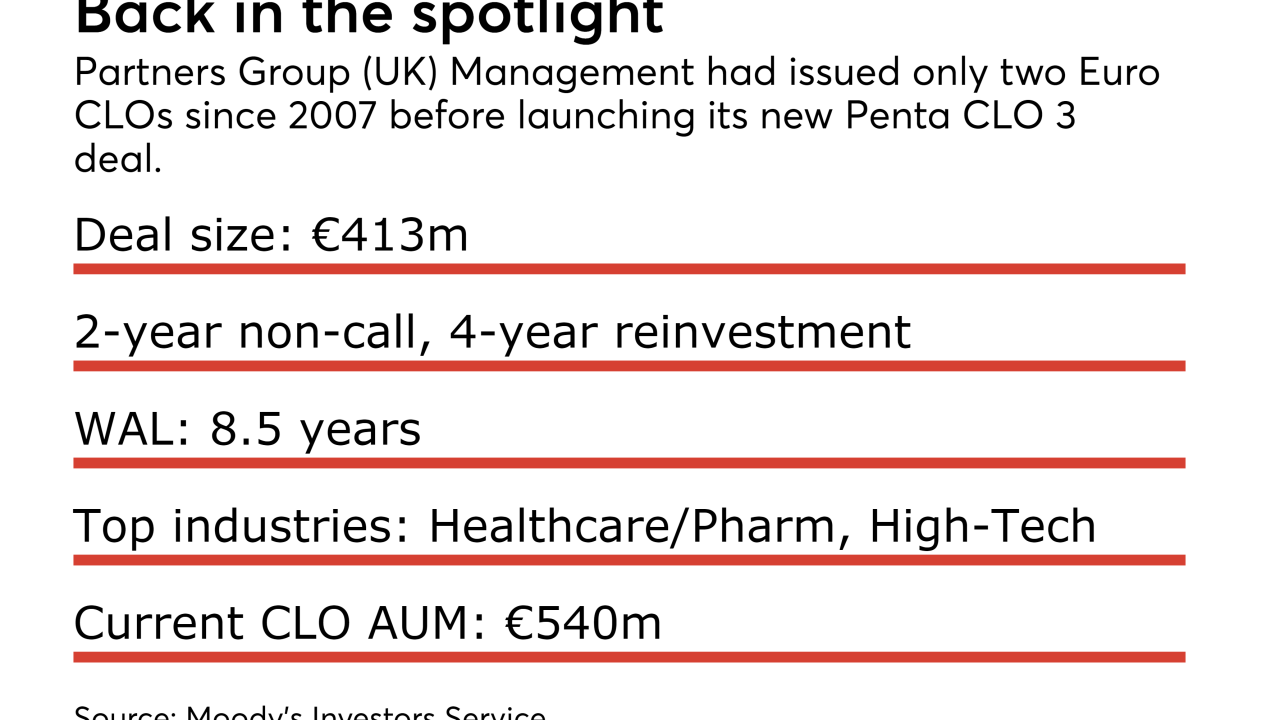

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2 -

Unlike the sponsor's previous transaction, which recycled collateral issued pre-crisis, this one includes newly issued securities intended to help small banks and insurance companies raise capital.

September 29 -

The legislation, sponsored by Rep. Andy Barr (R-Ky.) and Rep. David Scott (D-Ga.), is modeled on an exemption that allows sponsors of residential mortgage bonds to avoid holding risk in their deals.

September 25 -

The total includes over $78 billion in new transactions; collateralized loan obligations issued post-crisis have lmited exposure to Toys R Us, which filed for bankruptcy last week.

September 25 -

Regulatory relief remains uncertain, but there's plenty to celebrate as some more esoteric asset classes, such as franchise fees and aircraft leases, move into the mainstream, while others, such as nonprime RMBS, are starting to revive.

September 21 -

CIFC once preferred investing in the equity of other managers' CLOs and selling stakes in its own deals. Risk retention has forced a change in this business model.

September 18 -

The upstart firm, owned by private equity firm Eldridge Industries, is issuing its third deal since June; the $1.3 billion offering brings its total issuance for the year to over $4 billion.

September 18 -

MJX CEO Hans Christensen thinks the $500 billion market lacks the heft to influence lawmakers or regulators; he says any relief from rules requiring "skin in the game" of deals will have to benefit other asset classes as well.

September 18 -

U.K. authorities are years away from phasing out the London Interbank Offered Rate, but Conning's Paul Norris is urging the industry to pick up the pace on alternative benchmarks now that it's a matter of "when," not "if."

September 14 -

RREEF America, the real estate investment unit of Deutsche Asset Management, is securitizing an unusual mix of speculative-grade project finance and corporate in a debut $431.3 million collateralized debt obligation.

September 14 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1 -

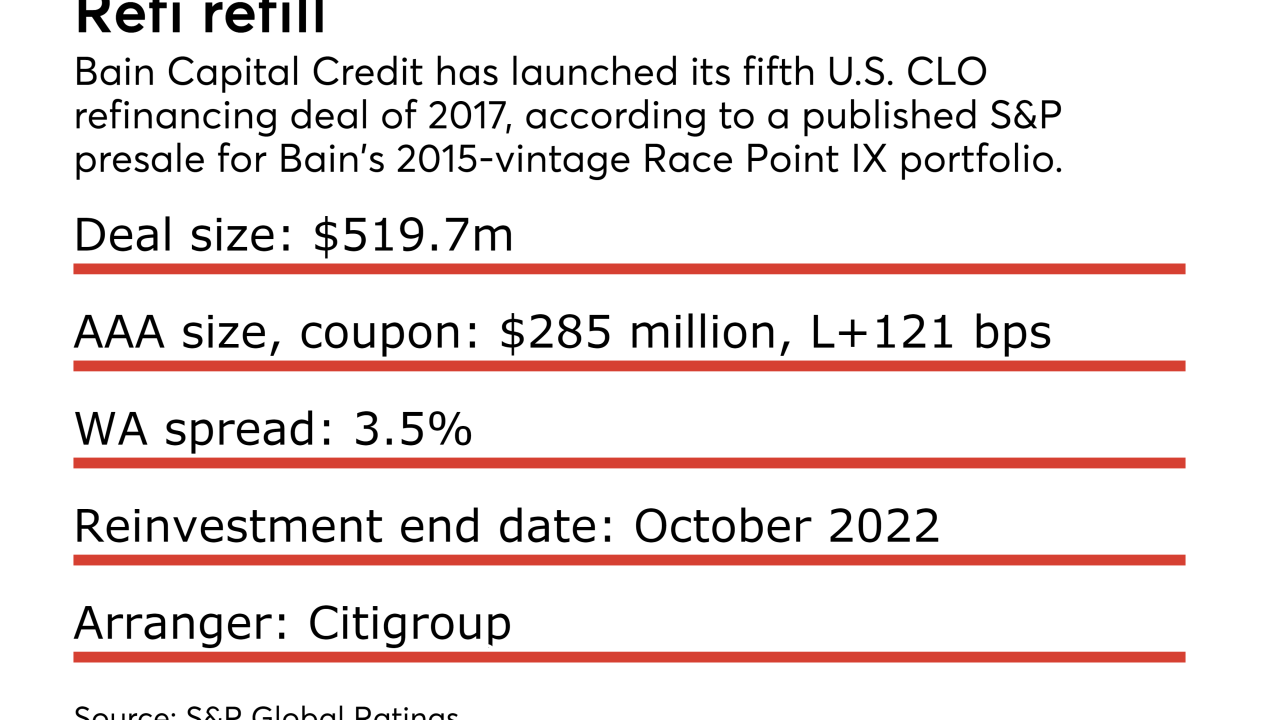

Race Point IX CLO, a 2015 vintage deal, follows four other refinancings that Bain has completed for its Race Point, Avery Point and former Cavalry issuance platforms; Bain has also refinanced a Euro CLO.

August 30