The best of ABS East 2017

The $8B opportunity in private student loans

Pickup in aircraft lease ABS issuance creates 'virtuous circle'

PennyMac plans 'programmatic' MSR securitizaiton

Scarcity of CLO equity

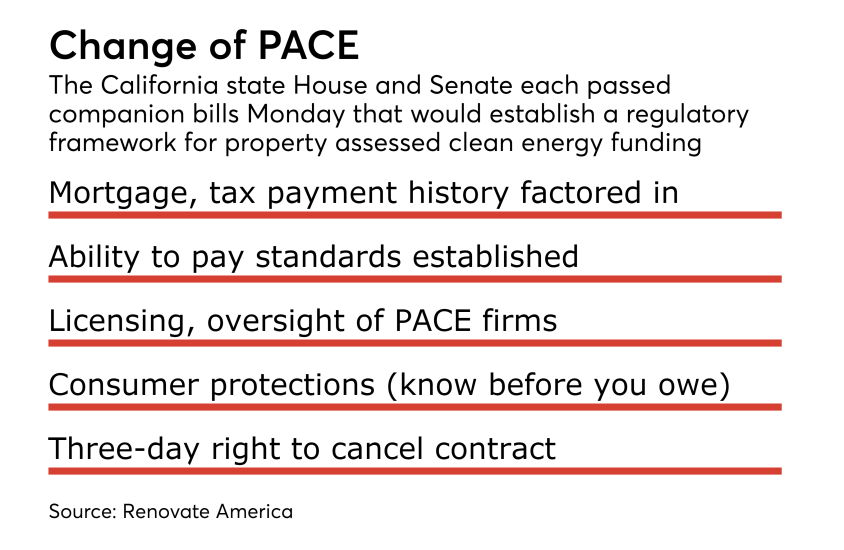

PACE lenders welcome increasing oversight

Appetite for whole biz ABS is growing

DId CLO managers err in lobbying for an exemption to risk retention?