EJF Capital is preparing a collateralized debt obligation backed by securities intended to help small banks and insurance companies raise capital.

The $353 million TruPS Financials Note Securitization 2017-2 is backed by $181.61 million of trust preferred securities (TruPS) and subordinated debt issued by U.S. community banks and their holding companies, and $171.4 million of TruPS, senior notes and surplus notes issued by insurance companies and their holding companies.

Typically, TruPS are non-amortizing, preferred stock securities with 30-year maturities and five- or 10-year non-call periods. They can defer interest for up to five years, without being considered in default. Surplus notes issued by insurance companies are a highly subordinated form of debt and have characteristics similar to insurance TruPS.

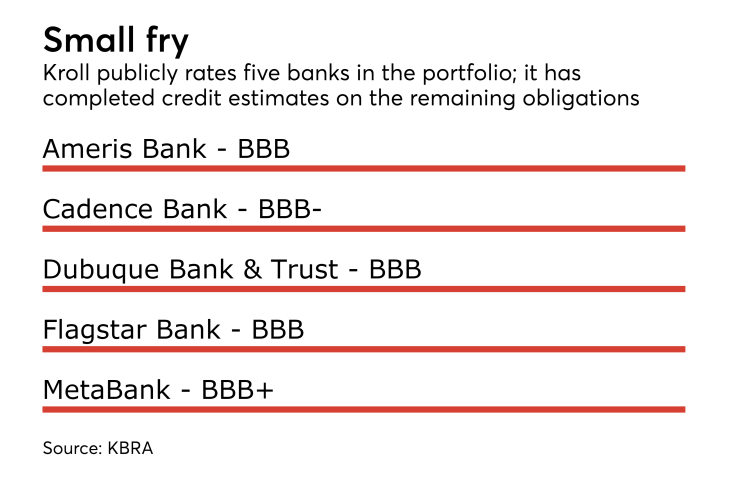

Most of the banks are community and small regional banks; only four have assets greater than $15 billion. The insurance companies consist of 19 property & casualty insurers and four life & health insurers. Approximately 97% of the portfolio is comprised of subordinated obligations.

Many of the assets were issued before the financial crisis and were acquired from FDIC or CDO auctions, or secondary market purchases; others are more recently issued, according to rating agency presale reports.

This is EJF Capital's fifth TruPs CDO.

Kroll Bond Rating Agency noted in its presale report that EJF Capital has developed a proprietary database for monitoring all companies in its portfolio. To support its commitment to the CDO management strategy, EJF Capital created a capitalized majority owned affiliate (C-MOA) earlier in 2017 to comply with U.S. risk retention rules and this The C-MOA is a consolidated entity on EJF Capital’s balance sheet and complies with the Dodd Frank Act.

The trust will issue three tranches of notes: two senior tranches carry preliminary ratings of Aa3/AA- from Moody’s Investors Service and Kroll: $205 million of fixed-rate notes and $35 million of floating-rate notes. There is also a $45.9 million subordinate tranche rated Ba2/BB-. EFJ Capital's majority-owned affiliate will retain the unrated $54.5 million of preferred shares to be issued.

Merrill Lynch, Pierce, Fenner & Smith is the intial purchaser of the notes.

The transaction is static, meaning that proceeds from interest and principal payments on the securities held as collateral cannot be put used to acquire additional securities. It cannot be called before March 2019.