Subprime mortgage bonds fueled the risky lending that inflated housing prices ahead of the financial crisis. Yet the mortgage industry got off relatively easy when financial regulations were enacted to discourage securitization of risky loans. Rules requiring sponsors to retain “skin in the game” of these transactions contain an important carve-out for “qualified mortgages” that meet certain criteria.

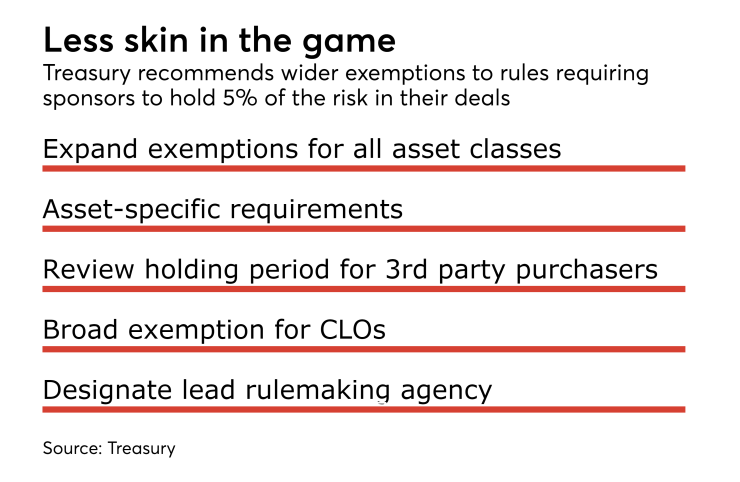

The Treasury Department’s report on capital markets recommends extensive revision to risk retention requirements that would provide relief for bonds backed by other kinds of assets as well, including commercial mortgages, auto loans, and below-investment grade corporate bonds.

In the report, released Friday, Treasury states that risk retention is an “imprecise mechanism” for encourage alignment of interest between sponsors and investors, though it could serve as a complement for other regulatory reforms, such as enhanced disclosure requirements and underwriting safeguards, to provide added confidence to investors in securitized products.

Instead of recommending an across-the-board repeal of the retention requirement, Treasury recommends that federal banking regulators expand qualifying risk retention exemptions across eligible asset classes based on the unique characteristics of each securitized asset class.

“Well-documented and conservatively underwritten loans and leases, regardless of asset class, should not require signaling, through retention, from the sponsor as to the creditworthiness of the underlying collateral,” the report states.

Rather, asset-specific disclosure requirements should provide investors with confidence that securitizations of assets that are deemed “qualified” are sound enough to warrant exemption. “This expanded exemption would reduce the cost to issue and could encourage additional funding through securitization,” the report states.

The agency explicitly called for a broad exemption for CLO risk retention, noting that sponsors of collateralized loan obligations are typically asset managers, and not lenders, and have little balance sheet of their own.

However the Treasury stopped short of recommending a statutory elimination of skin in the game for CLO managers, noting that they do have discretion in the quality of the loans they select for their vehicles.

Instead, the department recommends creating a set of loan-specific requirements under which managers would receive relief from being required to retain risk.

The Loan Syndications and Trading Association, an industry trade group, has long advocated for a carve-out for CLOs with high-quality loans.

There have been several unsuccessful attempts to legislate such a change. In September, a bipartisan bill that would create a category of qualified CLOs was reintroduced in the House by Rep. Andy Barr, R-Ky., and Rep. David Scott, D-Ga. It is modeled on the exemption for qualified mortgages.

The Treasury thinks that this could be done through notice-and-comment rulemaking. However, it recommends that Congress designate a single lead agency, from among the six that promulgated the risk retention rules, to be responsible for future actions. This would avoid the challenge of coordinating the agencies to issue interpretative guidance or exemptive relief.

Currently, the Securities and Exchange Commission, the Office of the Comptroller of the Currency, Federal Reserve Board, Federal Deposit Insurance Corp., Federal Housing Finance Agency, and Department of Housing and Urban Development jointly prescribe regulations.

“The LSTA is gratified to see that the Treasury report recognizes that CLOs are different from other forms of securitizations and recommends a form of risk retention better suited for CLOs,” the trade group said in a emailed statement.

While securitizations of commercial loans, commercial mortgages, and high-quality auto loans are also eligible for exemptive relief, the requirements have proven to be impractical.

Treasury concluded that banking regulators “do not appear to have undertaken a sufficiently robust economic analysis on the impact of the thresholds.”

For example, loans backing auto securitizations are required to have a minimum 10% down payment, among other standards, to qualify for exemption. But autos are typically financed with lower down payment requirements or none at all, rendering even well-underwritten collateral subject to issuer risk retention.