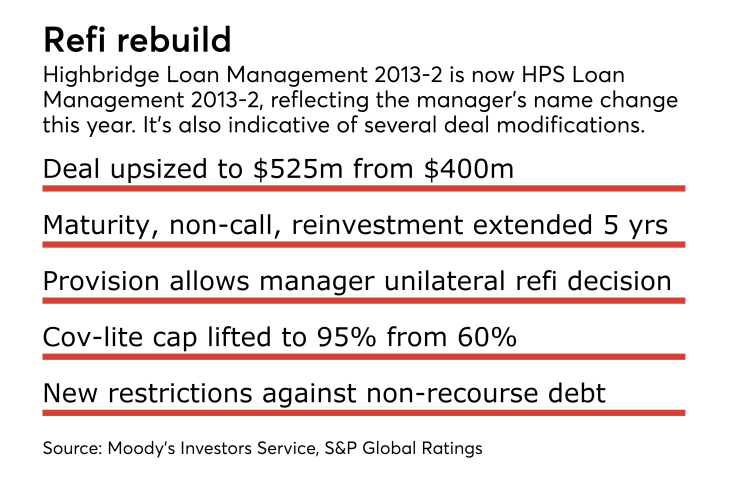

HPS Investment Partners, formerly Highbridge Principal Strategies, is renaming a 2013-vintage CLO to reflect the global asset management’s name change after its 2016 spinoff from JPMorgan.

But that’s not the only modification on the table for HPS Loan Management 2013-2, aka Highbridge Loan Management 2013-2, in a refinancing and extension being sought by HPS this month.

According to presale reports, HPS is seeking an extensive list of changes to the upsized $525 million portfolio’s capital stack structure, underlying asset allocation limits, and concentration levels. It is also seeking to install longer noncall and reinvestment extensions than those granted in a pair of 2014 and 2015 deals that HPS refinanced earlier in the summer, according to Moody's Investors Service and S&P Global Ratings.

HPS Loan Management 2013-2, which the deal will be called after its planned closing on Oct. 20, has a laundry list of new allowances and restrictions from the original deal which closed in September 2013. Among those is the addition of a Class X series of interest-only notes and $52 million in subordinate notes (for risk-retention purposes), plus a division of the original $260 million in Class A-1 notes into split floating- and fixed-rate tranche series.

HPS is also seeking to expand its cap on covenant-lite loans – or loans that lack typical commercial lender maintenance requirements – to a maximum 95% of the collateral pool, vs. the former restriction of 60%, according to the agencies' presale reports.

(The 95% restriction will be reduced based on how far above the portfolio exceeds a specific weighted average rating factor [WARF] as assets turn over. WARF is a Moody's measurement of the weight of lower-grade vs. upper-grade speculative debt in a CLO/CDO portfolio. A higher WARF means a portfolio contains more lower-rated, higher-risk loans from highly leveraged corporates.)

HPS also seeks a provision that would remove an industry concentration limit (the deal favors obligors from the software and media industries, according to S&P) and increases the maximum amount of discount obligations to 20% of the pool, up from the existing restriction of 15%. The manager also seeks a supplemental indenture to partake in a future refinancing without noteholder consent.

The manager also will build out the noncall period to October 2019 (four years beyond the original noncall expiration) well as the just-completed reinvestment period by five years to October 2022, according to Moody’s and S&P. HPS Loan Management 2014-2, which was refinanced and extended in July, received a 4.5-year reinvestment and 3.5-year noncall period extension, by comparison.

HPS is agreeing to tightened restrictions on distressed debt purchases (25%, down from 35%) and second-lien/unsecured loan exposure (decreasing to 4% from 7.5%). HPS also agreed to maintain a tightened weighted-average coupon rate of the underlying loans at 7% vs. 7.25%, and the deal will also add a prohibition on the purchase of nonrecourse obligations such as project finance or “high volatility" commercial real estate that lacks a Moody’s or S&P rating.

HPS Investment Partners CLO LLC is a majority-owned of affiliate of HPS, and manages nine U.S. and European CLOs totaling $5.1 billion. HPS itself has $44 billion in assets under management. Last December the independent firm