-

Junk-rated firms pay little tax, and so won't benefit much from a lower corporate rate. And this benefit could be offset by a limit on the interest deduction.

December 4 -

The dramatic tightening in loan spreads this year made it difficult for the CLO manager to manage to various performance metrics of its deals, and this required building flexibility into deals being refinanced.

December 4 -

Carlyle Euro CLO 2017-3 is the latest under its new shelf managed by affiliate CELF Advisors, with a AAA coupon of just 75 basis points over three-month Euribor.

November 28 -

The deal will relaunch with a weighted average spread (4.22%) and excess spread (2.86%) well above the three-month industry average for issued U.S. CLOs.

November 22 -

CBAM Asset Management's $1B CBAM 2017-4 is not its largest deal among the four BSL portfolios it has issued in less than eight months; but the latest transaction is still almost double the average peer CLO deal size of $511 million since the third quarter.

November 17 -

The securitization market is weathering risk retention and rising interest rates, though Fitch Ratings is keeping its eye on some consumer asset classes as the credit cycle lengthens.

November 15 Fitch Ratings

Fitch Ratings -

Benefit Street Partners is securitizing 20 short-term commercial real estate loans it originated or acquired for transitional properties currently with unstable cash flow.

November 15 -

The aerospace components manufacturer, one of the largest-held obligors in U.S. CLOs, is consolidating loans and tightening coupon spreads from 300 to 275 basis points over Libor.

November 10 -

Deal volume of $95 billion through 10 months is at a pace that would make 2017 the second-busiest year for post-crisis CLO issuance; AAA spreads, meanwhile, have reached three-year tights.

November 7 -

The unwinding and rebuilding of the struggling portfolios of Fifth Street's business development companies could take two to three years, Oaktree management stated in an earnings call Thursday.

October 27 -

Neuberger Berman Loan Advisors CLO 26 builds the Dallas-based manager's assets under management to $5.5 billion.

October 25 -

Four new CLOs have been priced in the last week inside of 120 basis points over Libor, a rarely breached floor for most of 2017.

October 20 -

A wave of corporate loan refinancings is putting collateralized loan obligations afoul of a covenant designed to safeguard their own investors.

October 11 -

HPS Investment Partners is adding a new name to one of its legacy Highbridge CLOs, as well as piling on extensive changes to note structure, deal terms and restrictions on some higher-risk assets.

October 10 -

Just $7.6 billion of deals were refinanced or reset in September, bringing the total for the third quarter to $27.2 billion, far short of the pace of the first half, when approximately $138 billion was reworked.

October 9 -

A report released Friday calls risk retention "an imprecise mechanism" for encouraging the alignment of interest between sponsors and investors. It recommends creating loan-specific requirements under which managers would receive relief.

October 6 -

The $456.9 million LCCM 2017-FLI is secured by 19 commercial mortgages, the largest of them an amended and restated loan on Two Gateway, an office building in downtown Newark, New Jersey.

October 3 -

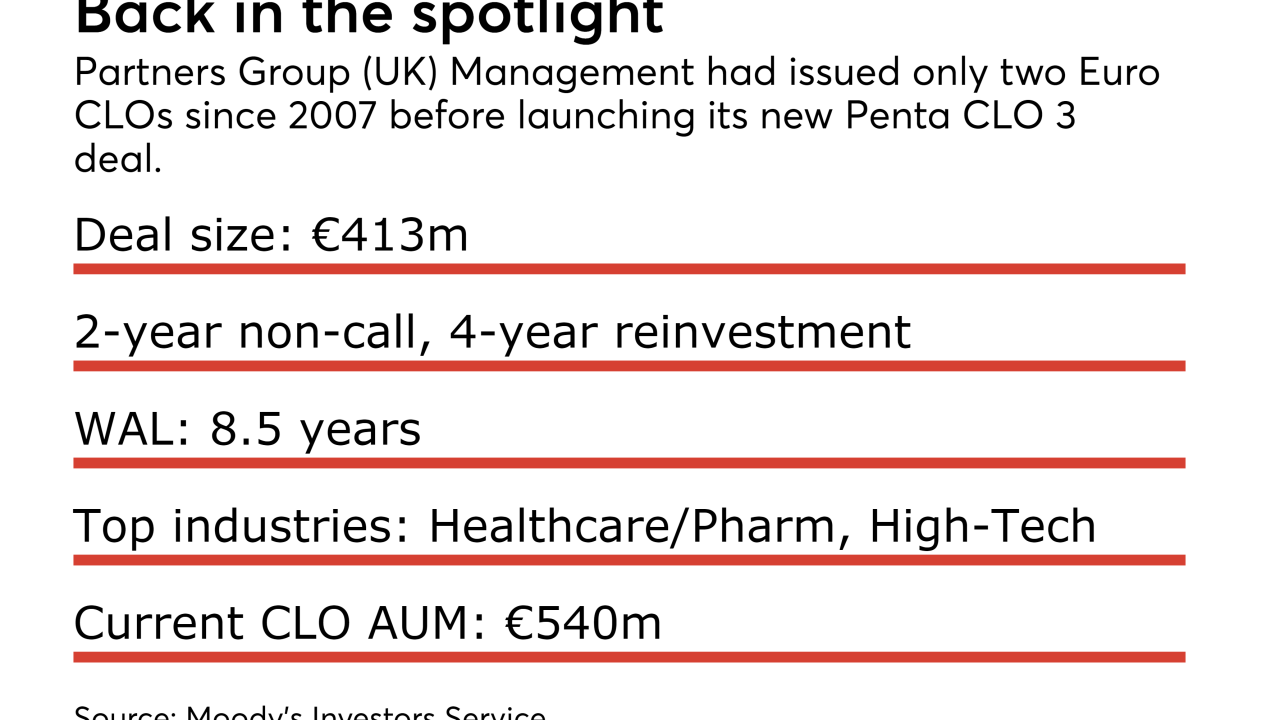

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2 -

Unlike the sponsor's previous transaction, which recycled collateral issued pre-crisis, this one includes newly issued securities intended to help small banks and insurance companies raise capital.

September 29 -

The legislation, sponsored by Rep. Andy Barr (R-Ky.) and Rep. David Scott (D-Ga.), is modeled on an exemption that allows sponsors of residential mortgage bonds to avoid holding risk in their deals.

September 25