-

Historically low interest rates, low unemployment and positive yet slowing economic growth will support stable U.S. structured finance asset performance in 2020.

By Rui PereiraJanuary 28 -

We are one year deeper into an already extended credit cycle, so it’s even more important to focus on market complacency.

By Rui PereiraNovember 20 -

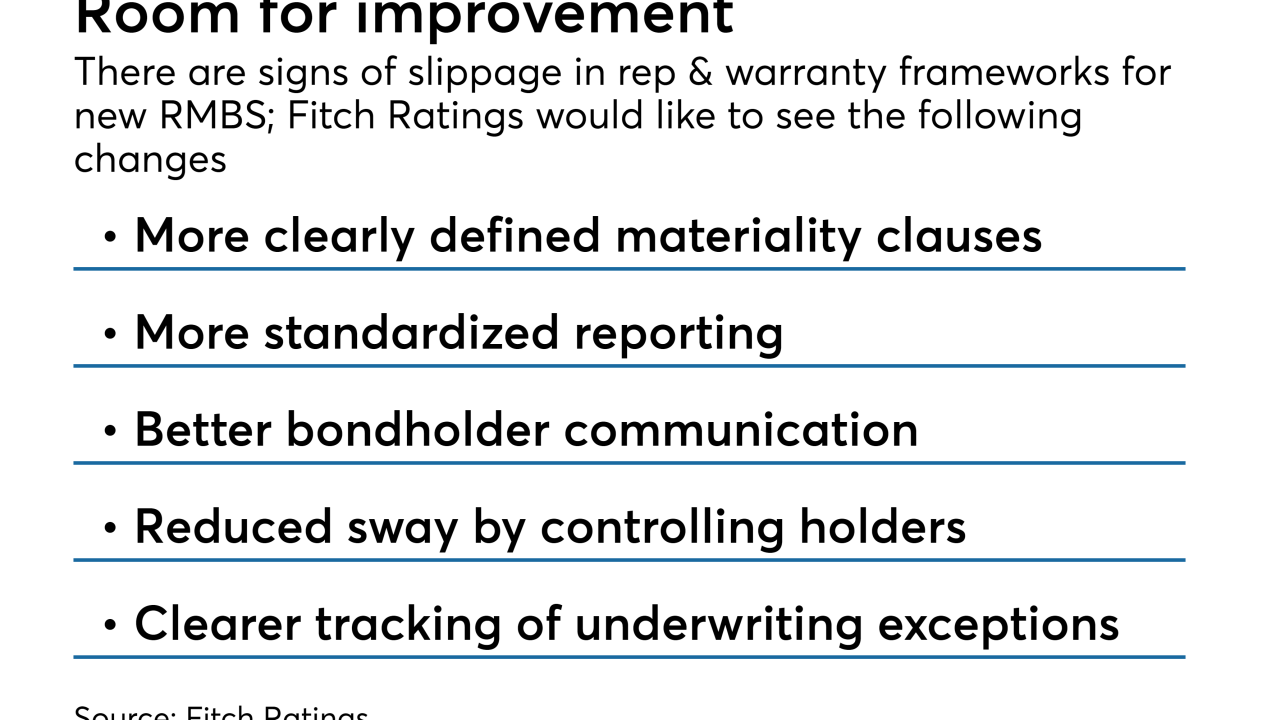

Frameworks have largely improved since the financial crisis, but there remains a lack of consistency and some recurring weaknesses that are keeping some traditional U.S. RMBS investors on the sidelines.

By Rui PereiraJuly 11 -

The securitization market is weathering risk retention and rising interest rates, though Fitch Ratings is keeping its eye on some consumer asset classes as the credit cycle lengthens.

By Rui PereiraNovember 15

Load More