The U.S. structured finance market has experienced numerous changes a decade after the financial crisis from changes to the broader economy, the emergence of new asset types and a regulatory environment that has shaped loan originations, collateral disclosure, and stronger alignment of interests in the sector. And it is by and large adapting to those changes.

As a result, Fitch’s outlook for U.S. structured finance ratings is predominantly stable for 2018. That said, given where we are in the credit cycle, Fitch is keeping a close watch on select asset types that could run into some issues over the next 12 months.

Entering 2018, Fitch has either Positive or Stable Outlook on over 90% of its rated securitized bonds. Helping matters is a supportive macro environment, low interest rates and solid structural enhancements. Outside pressures likely in the coming year remain either idiosyncratic or secular.

Risk Retention

Risk retention is now firmly ingrained into the fabric of the securitization markets (commercial mortgage bonds and collateralized loan obligations in particular) with a mix of three distinct structures being used in new deals — horizontal, vertical and L-shaped. CLOs had a bit of a head start by introducing risk retention structures into its new structures earlier in 2016, though CMBS appears to have also adapted to risk retention with surprising alacrity.

Perhaps the most notable change that has manifested from risk retention is the shrinking universe of originators bringing new securitizations to market. This is particularly notable in the universe of CMBS originators, which has shrunk from a high of roughly 40 to now less than 20 due to a combination of risk retention and Reg A/B.

Interest Rates

Like most other market sectors, a lingering question around securitization is what happens when interest rates start to rise more appreciably. Fitch’s longstanding opinion has been that structured finance can weather interest rate hikes so long as they do not happen too quickly or rise too dramatically.

ABS

Consumer asset-backeds ratings remain stable. The same holds true for asset performance, though it clearly has peaked with some weakening likely in 2018 (though still well within Fitch’s expectations). Prime auto and credit card losses will rise marginally off at or near record lows. Asset types likely to see more cracks in the armor are subprime auto and unsecured consumer loan (marketplace) ABS.

ABS deal performance remains largely in line with Fitch expectations and should continue to benefit from the solid macro environment and solid structural enhancements in place. Fitch has either a Positive or Stable Outlook on over 97% of its rated ABS bonds.

Competitive pressures, long in place for subprime autos, are escalating in a marketplace ABS environment that is struggling to find its footing by testing recent underwriting models, asset quality and, in some cases, business models. Delinquencies and chargeoffs of existing assets continue to increase as marginal borrowers increase their leverage. Not likely to help is the drive for growth among large marketplace lenders coupled with rising market pressure from competing banks like Goldman Sachs (Marcus), Discover and SunTrust. And unless originators tighten their credit policies with discipline, the strain will intensify.

CMBS

While ratings performance is stable, the outlook for asset performance is a bit murky. Pockets of concern heading into 2018 rest largely with CMBS 1.0 tail risk and technology-driven secular shifts, most glaringly in retail.

As the winding down of U.S. CMBS 1.0 continues, many of the remaining loans are adversely selected with approximately 40% of remaining loans delinquent. By contrast, CMBS 2.0 makes up well over 90% of U.S. CMBS and should be mostly stable with idiosyncratic risk being the biggest performance influence. Barbelling is also worth a close watch, as the trend of placing high percentages of credit opinion loans into deals continues.

Meanwhile, traditional brick and mortar retailers are struggling to keep up with the growth in online shopping, which will continue to place pressure on CMBS containing large amounts of Class B and C mall loans. Lower rated classes in deals with poorer performing regional malls may be subject to negative rating actions, many of which currently have Negative Rating Outlooks. Other secular shifts worth a closer look in 2018 will be with hotels with the advent of AirBnB and other alternative travel and offices as WeWork and other co-working alternatives gain ground.

RMBS

Both rating and asset performance of residential mortgage bonds are positive for next year. The sector will continue to benefit from excellent performance on RMBS that has come to market since 2010 and solid home price gains that are now sustainable throughout much of the country.

While the number of distressed mortgages is now back to pre-crisis levels, performance for post-crisis RMBS has been exemplary with losses near zero for prime jumbo RMBS.

Fitch expects home price growth to remain steady for most regions. The rate of price growth is still uneven nationally with prices in California, Arizona, Nevada and Washington up over 50% since 2012 and New York, New Jersey and Massachusetts home prices up less than half that figure over the same period. The country still has some overheated pockets such as Dallas, Phoenix, Riverside and Portland.

CLOs

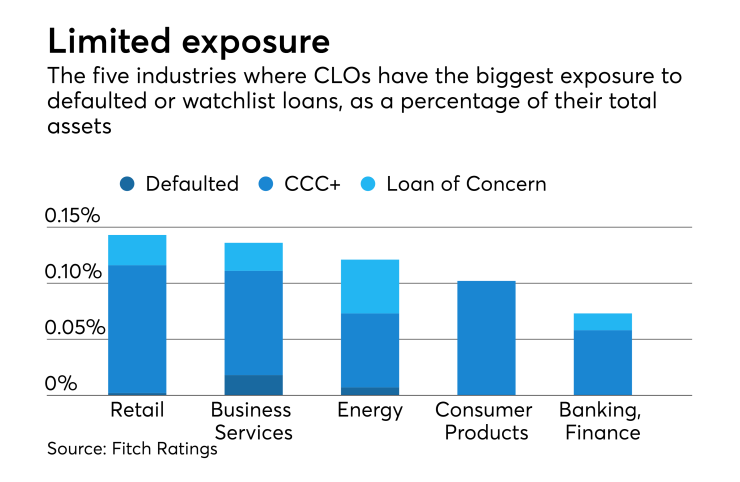

The outlook for both CLO rating and asset performance remains stable in 2018. Chief catalysts include a relatively modest high yield default environment and the success of managers in navigating retail and commodity sector shocks.

Strong credit protection in place for ‘AAA’ notes has not changed much at all over the last few years. That said, lingering concerns exist with leverage multiples on underlying loans on the rise documentation standards showing signs of weakening. Other key credit metrics like weighted average spread could also come into some pressure in the coming months.

CLO managers have been effectively weathering troubles in both the retail and commodity markets by curbing exposure to both sectors. In fact, troubled exposure in Fitch-rated U.S. CLOs has declined to its lowest point in over a year. Fitch’s most recent Leveraged Finance “Loans of Concern” list shows just under $10 billion in concerning among its rated CLO universe of over $167 billion, a manageable 6.2%.

In conclusion, 2018 looks to be another strong year. There’s positive momentum for RMBS and CLOs, though CMBS could see some marginal weakening in spots. Normalization is now in play for consumer ABS while asset performance risks should be largely contained to assets like marketplace and subprime auto ABS.

Rui Pereira is head of North American structured finance for Fitch Ratings.