-

Lendbuzz sells the notes as it juggles mixed performance results from 2023. Originations and revenues saw huge jumps, but so did operating expenses.

April 23 -

After several quarters of slumping investment banking and trading fees, the Charlotte, North Carolina-based company reported a big uptick from that division, which helped compensate for a large decline in net interest income.

April 22 -

The return of the higher-for-longer mantra is a headache for insurance companies and pension plans which, flush with cash, sent demand for bonds soaring this year.

April 22 -

Net charge-offs at the Charlotte, North Carolina-based bank increased by more than 80% in the first quarter compared with a year earlier. BofA executives say that the rising losses were in line with the bank's risk appetite.

April 16 -

Should the all-stock transaction close as planned later this year, Wintrust Financial in the Chicago area would gain about $2.7 billion of assets.

April 15 -

The current levels of credit enhancement are a reduction from levels of 58.0%, 48.7%, 35.9%, 22.5% and 17% on the classes A, B, C, D and E on the BLAST 2024-1 deal.

April 12 -

First-quarter results at the companies were promising for other banks looking to reel in fees from capital markets activities as deposit costs put pressure on net interest income.

April 12 -

The financing outlook improved from recent surveys on a macro basis, but expectations around commercial real estate helped cloud over the credit forecast.

April 12 -

A solid majority of decision-makers at these companies expect to expand their workforces again this year, a Citizens Financial survey found. Loan losses are normally low in eras of economic expansion.

April 9 -

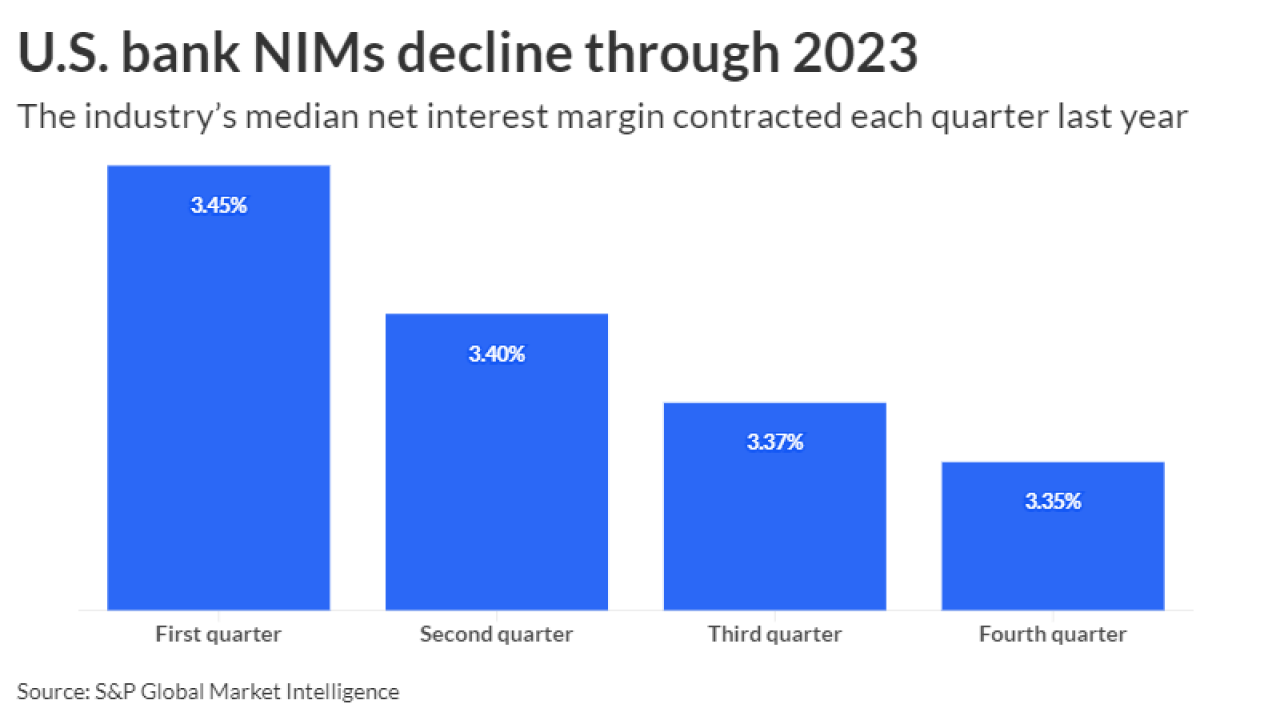

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Dean Wheeler will drive the firm's growth push in the U.S. and follows the London firm promoting Serenity Morley to COO, to drive growth globally.

April 2 -

A federal appeals court is putting the transfer of a lawsuit challenging the Consumer Financial Protection Bureau on hold pending the outcome of a hearing on the suit's appropriate venue.

April 1 -

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

March 27 -

First National has agreed to buy Touchstone Bankshares. The combined company would have more than $500 million each of deposits and loans.

March 26 -

The top three industries includes software, healthcare and software development, accounting for 18.45%, 7.89% and 5.12%, respectively.

March 22 -

Two tranches of class A and B notes will raise $80 million from investors, to support Kalamata's business financing small business loans and merchant cash advances.

March 21 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

March 15 -

The Long Island-based lender has released a number of new details about its reconfiguration following a $1 billion capital injection led by two former Trump administration officials.

March 12 -

In credit, a risk-taking ebullience has taken hold. The lowest-rated traded company debt is outgunning safer assets.

March 8 -

Former Trump administration officials Steven Mnuchin and Joseph Otting are headlining an investment group that's seeking to rescue the troubled Long Island lender. Otting is expected to serve as CEO, and Mnuchin will have a board seat.

March 6