-

Both lenders are boosting originations to borrowers with near-prime loans, though the impact on the overall credit quality of the collateral for their deals is slight.

January 30 -

The collateral for the $550 million transaction is slightly weaker than that of its prior deal, but rating agencies expect cumulative net losses to be in the same range.

January 18 -

More than 45% of collateral for the $254.4 million CPSART 2019-A are either "preferred," "super alpha” or “alpha plus”; that's up from 42.4% of collateral for the prior deal.

January 10 -

The latest deal from the sponsor's DRIVE platform for deep subprime loans benefits from recent improvements in underwriting; both S&P and Moody's have lowered loss expectations.

January 9 -

It’s a trend that bears watching, particularly for holders of the riskiest securities issued in subprime auto securitizations, according to S&P Global Ratings.

December 3 -

The $175 million deal is backed by loans with an average balance of $2,365; fewer of them are "renewal loans" to existing borrowers who qualify to borrow more because of previous on-time payments.

November 28 -

The agency alleges the subprime auto lender violated consumer finance laws by misrepresenting the level of guaranteed insurance protection.

November 20 -

The rating agency is now considering lowering its BBB rating on the class B notes. The rating agency also downgraded the class C notes issued in the deal, for a second time, to CC from CCC+.

November 20 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Flagship, Santander Consumer USA and AmeriCredit are printing $2.3 billion in new notes backed by subprime auto-loan originations.

November 8 -

Both Kroll and S&P expect losses on collateral in the subprime consumer lender's latest deal to be higher than its 2017 deals; Kroll alone assigned a lower rating to the senior tranche.

November 5 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

October 31 -

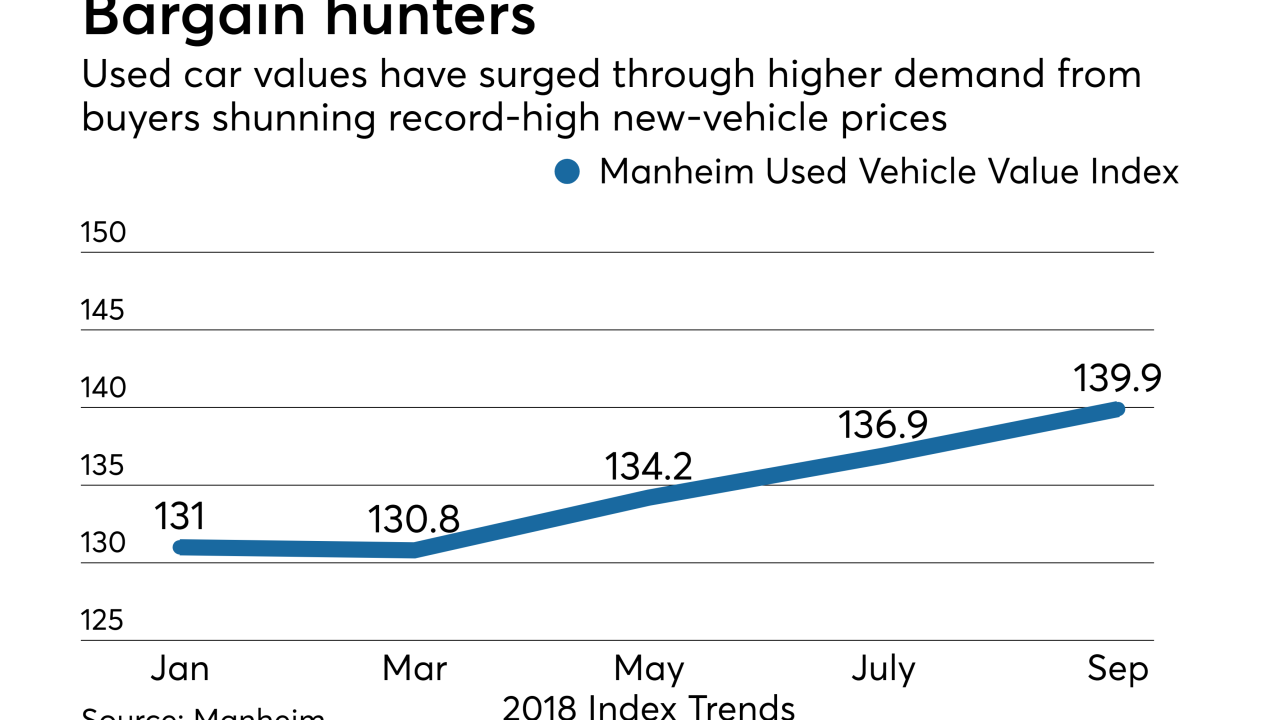

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

October 29 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Both S&P and Moody's have cut expected losses on $732 million deal, yet credit enhancement on the senior tranches is unchanged from the prior deal.

October 22 -

The credit quality of loans backing the Cailfornia-based lender's $183 million securitization is better than that of its inaugural deal, which was only rated 'A' by Kroll.

October 18 -

The California-based CDFI has a growing portfolio of renewal loans from prior borrowers eligible for higher credit limits.

October 11 -

The fifth SDART deal of the year benefits from the same improvement in credit quality as other recent transactions from the platform.

October 11 -

Consumer Portfolio Services' fourth auto-loan securitization of the year has a 3.97% share of loans previously assigned to CPS asset-backed portfolios, compared to an 11.97% share in its last transaction.

October 4 -

DriveTime is making less-risky loans under a $750 million contract purchase agreement with Ally Financial; it appears that the sponsor is also funding some of this lending through its own securitization platform.

October 4