Mariner Finance's rapid expansion in subprime consumer installment lending has not been pain-free.

The private lender, which is based in Baltimore, has stepped up origination in markets like Texas and Utah where it can charge higher interest rates than in its legacy East Coast base. But those higher-earning loans also brought higher annualized loss rates.

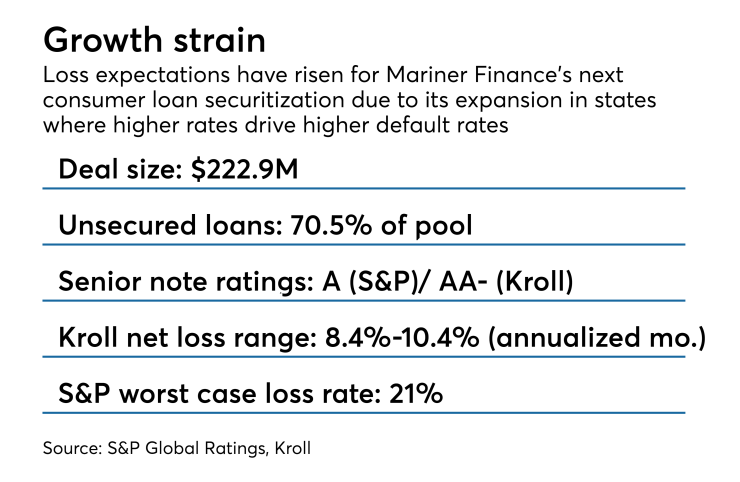

Both Kroll Bond Rating Agency and S&P Global Ratings have raised loss expectations for the $222.89 million Mariner Finance Issuance Trust 2018-A transaction. And in the case of Kroll, a one-notch penalty compared to Mariner’s previous asset-backed offering last December.

The transaction is secured by loans with a total balance of $247.66 million but the collateral will revolve over a two-year period as payments are put to work buying new loans. Four classes of notes will be issued. The $188.79 million tranche of Class A notes has split ratings of A from S&P and AA- from Kroll, and is supported by initial credit enhancement of 24.77%, which will build to a total credit enhancement of 42.13% (in line with the 42.03% in Mariner 2017-B).

The Kroll rating was below that of the AA rating it assigned to Mariner Finance Issuance Trust 2017-B.

The subordinate classes also contain split ratings: the $5.5 million Class B tranche is rated A- by S&P and A by Kroll; the $8.97 million Class C notes are considered triple-B by S&P and A- by Kroll; while the $19.63 million Class D trance is rated BB (S&P)/BBB- (Kroll).

Kroll’s expected annualized monthly net loss range on the deal is 8.4%-10.4%, up from 6.5%-8.5% for both of Mariner’s 2017 transactions.

Likewise, S&P has raised its worst-case net loss expectation (based on annualized net losses) to 21.01% from 18.77% in the 2017-B deal.

The pool contains 91,614 loans with an average balance of $2,704 with a weighted average coupon of 27.48% and FICO of 635. Unsecured loans make up 70.5% of the pool, a larger share than the 68.14% in Mariner 2017-B and the 62.2% in its inaugural ABS in February 2017.

The collateral consists of three types of personal consumer loans: direct (73.31%), indirect sale finance contracts (5.44%) and direct-mail loans (21.26%).

Mariner is owned by funds managed by private equity firm Warburg Pincus. With five acquisitions since 2013, it has grown into one of the largest branch-based installment loan networks in the country, with 438 branches in 22 states, according to S&P. As of June 30, the company had a portfolio of $1.37 billion in loans.

“Part of the company's business strategy involves growing its business in a non-organic manner through the selective acquisition of complementary companies, loan portfolios, or loan products,” S&P’s presale report states.

The transaction is being led by Citigroup and Wells Fargo.